Question: I would like help on how to do the problem not just the answer. module%c - File Home Insert Draw Page Layout Formulas Data Review

I would like help on how to do the problem not just the answer.

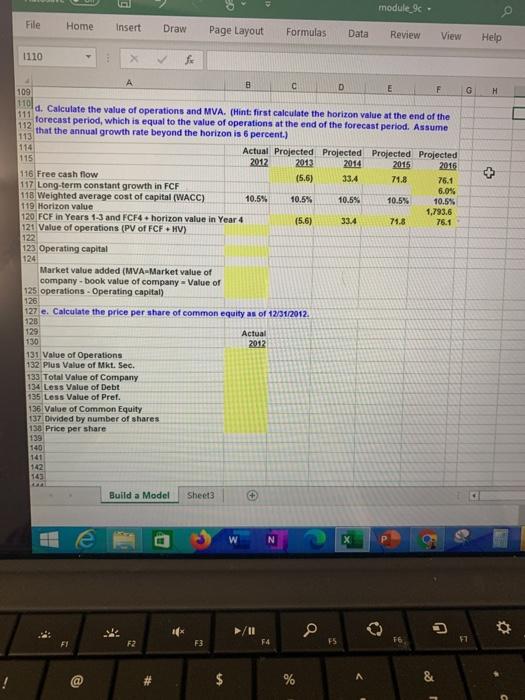

I would like help on how to do the problem not just the answer.module%c - File Home Insert Draw Page Layout Formulas Data Review View Help 1110 G H 113 8 c D 109 F 1101 d. Calculate the value of operations and MVA. (Hint: first calculate the horizon value at the end of the 111 forecast period, which is equal to the value of operations at the end of the forecast period. Assume 112 that the annual growth rate beyond the horizon is 6 percent.) 114 Actual Projected Projected Projected Projected 115 2012 2013 2014 2015 2016 116 Free cash flow (5.6) 33.4 71.8 76.1 117 Long-term constant growth in FCF 118 Weighted average cost of capital (WACC) 6.0% 10.5% 10.5% 10.5% 10.5% 10.5% 119 Horizon value 120 FCF in Years 1-3 and FCF4 horizon value in Year 4 1,793.6 (5.6) 33.4 71.8 76.1 121 Value of operations (PV of FCF HV) 122 123 Operating capital + 124 Market value added (MVA-Market value of company book value of company - Value of 125 operations - Operating capital) 126 127 e. Calculate the price per share of common equity as of 12/31/2012 128 129 Actual 130 2012 131 Value of Operations 132 Plus Value of Mkt. Sec. 133 Total Value of Company 134 Less Value of Debt 135 Less Value of Pref. 136 Value of Common Equity 137 Divided by number of shares 138 Price per share 139 140 141 142 Build a Model Sheet3 e N F3 F4 F5 TE 57 $ % & module%c - File Home Insert Draw Page Layout Formulas Data Review View Help 1110 G H 113 8 c D 109 F 1101 d. Calculate the value of operations and MVA. (Hint: first calculate the horizon value at the end of the 111 forecast period, which is equal to the value of operations at the end of the forecast period. Assume 112 that the annual growth rate beyond the horizon is 6 percent.) 114 Actual Projected Projected Projected Projected 115 2012 2013 2014 2015 2016 116 Free cash flow (5.6) 33.4 71.8 76.1 117 Long-term constant growth in FCF 118 Weighted average cost of capital (WACC) 6.0% 10.5% 10.5% 10.5% 10.5% 10.5% 119 Horizon value 120 FCF in Years 1-3 and FCF4 horizon value in Year 4 1,793.6 (5.6) 33.4 71.8 76.1 121 Value of operations (PV of FCF HV) 122 123 Operating capital + 124 Market value added (MVA-Market value of company book value of company - Value of 125 operations - Operating capital) 126 127 e. Calculate the price per share of common equity as of 12/31/2012 128 129 Actual 130 2012 131 Value of Operations 132 Plus Value of Mkt. Sec. 133 Total Value of Company 134 Less Value of Debt 135 Less Value of Pref. 136 Value of Common Equity 137 Divided by number of shares 138 Price per share 139 140 141 142 Build a Model Sheet3 e N F3 F4 F5 TE 57 $ % &

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts