Question: I would like help on this hedging question please. Thank you! Money Market Hedge on Receivables Assume that Parker Company will receive 200,000 Canadian dollars

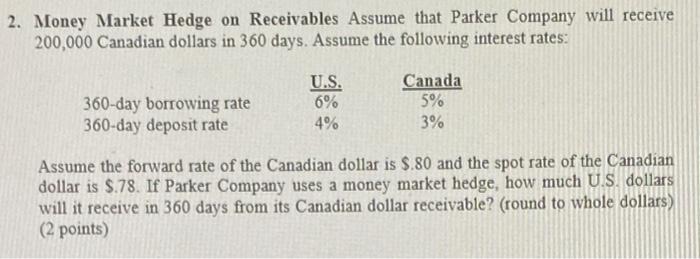

Money Market Hedge on Receivables Assume that Parker Company will receive 200,000 Canadian dollars in 360 days. Assume the following interest rates: Assume the forward rate of the Canadian dollar is $.80 and the spot rate of the Canadian dollar is \$.78. If Parker Company uses a money market hedge, how much U.S. dollars will it receive in 360 days from its Canadian dollar receivable? (round to whole dollars) (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts