Question: I would like help with figuring out how to solve this. Chapter 8 Financing East Coast Yachts Expansion Plans with a Bond Issue hutang Years

I would like help with figuring out how to solve this.

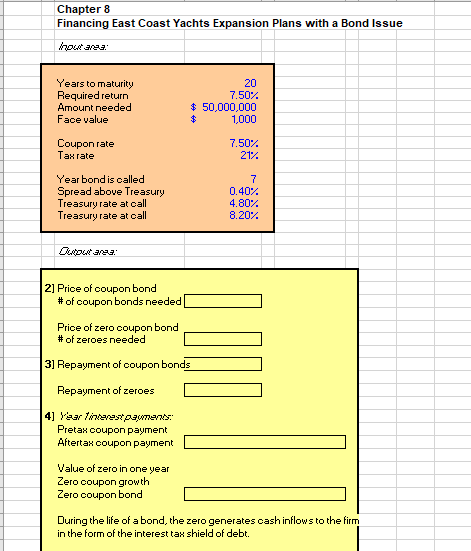

Chapter 8 Financing East Coast Yachts Expansion Plans with a Bond Issue hutang Years to maturity Required return Amount needed Face value 20 7.50% $ 50,000,000 $ 1,000 Coupon rate Taurate 7.50% 21% Year bond is called Spread above Treasury Treasury rate at call Treasury rate at call 7 0.40% 4.80% 8.20% U279 2] Price of coupon bond # of coupon bonds needed Price of zero coupon bond # of zeroes needed 3] Repayment of coupon bonds Repayment of zeroes 4] Yaar Test pameras Pretax coupon payment Aftertax coupon payment Value of zero in one year Zero coupon growth Zero coupon bond During the life of a bond, the zero generates cash inflows to the firm in the form of the interest tax shield of debt. Chapter 8 Financing East Coast Yachts Expansion Plans with a Bond Issue hutang Years to maturity Required return Amount needed Face value 20 7.50% $ 50,000,000 $ 1,000 Coupon rate Taurate 7.50% 21% Year bond is called Spread above Treasury Treasury rate at call Treasury rate at call 7 0.40% 4.80% 8.20% U279 2] Price of coupon bond # of coupon bonds needed Price of zero coupon bond # of zeroes needed 3] Repayment of coupon bonds Repayment of zeroes 4] Yaar Test pameras Pretax coupon payment Aftertax coupon payment Value of zero in one year Zero coupon growth Zero coupon bond During the life of a bond, the zero generates cash inflows to the firm in the form of the interest tax shield of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts