Question: I would like help with problem 4c please. Thank you! B D G 7 A E H 1 CTA 8: Short Term & Capital Investment

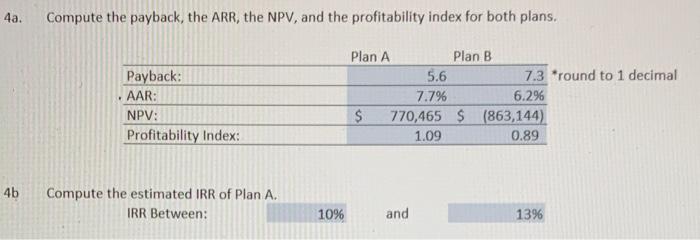

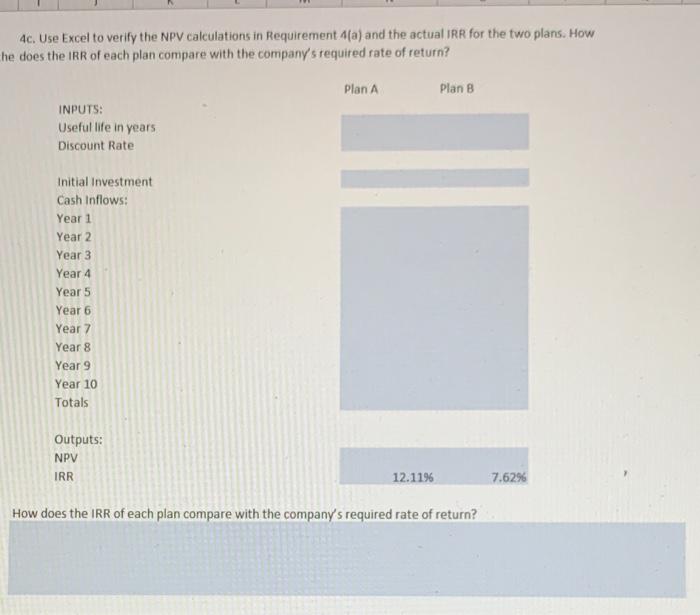

B D G 7 A E H 1 CTA 8: Short Term & Capital Investment Decisions 2 3 Cris Bonser, majority stockholder and president of Sudsy Soap Co., is working with her top managers on future 4 plans for the company. As the company's managerial accountant, you've been asked to analyze the following 5 situations and make recommendations to the management team. 6 4. Division D is considering two possible expansion plans. Plan A would expand a current product line at a cost 8 of $8,600,000. Expected annual net cash inflows are $1,525,000, with zero residual value at the end of 10 9 Under Plan B, Division D would begin producing a new product at a cost of $8,000,000. This plan is expected 10 to generate net cash inflows of $1,100,000 per year for 10 years, the estimated useful life of the product line. 11 Estimated residual value for Plan B is $980,000. Division D uses straight-line depreciation and requires an 12 annual return of 10%. 13 Compute the payback, the ARR, the NPV, and the profitability index for both plans. 5 b. Compute the estimated IRR of Plan A. 6. c. Use Excel to verify the NPV calculations in Requirement 4(a) and the actual IRR for the two plans. How 7 does the IRR of each plan compare with the company's required rate of return? 8 d. Division D must rank the plans and make a recommendation to Sudsy Soap's top management team for the best plan. Which expansion plan should Division D choose? Why? 4 a. 9 4a. Compute the payback, the ARR, the NPV, and the profitability index for both plans. 5.6 Payback: AAR: NPV: Profitability Index: Plan A Plan B 7.3 *round to 1 decimal 7.7% 6.296 $ 770,465 $ (863,144) 1.09 0.89 4b Compute the estimated IRR of Plan A. IRR Between: 10% and 1396 4c. Use Excel to verify the NPV calculations in Requirement 4(a) and the actual IRR for the two plans. How he does the IRR of each plan compare with the company's required rate of return? Plan A Plan B INPUTS: Useful life in years Discount Rate Initial Investment Cash Inflows: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Totals Outputs: NPV IRR 12.1196 7.6296 How does the IRR of each plan compare with the company's required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts