Question: I would like it if you could explain why the answer is right, and what the key words are that make the answer right. Also

I would like it if you could explain why the answer is right, and what the key words are that make the answer right. Also any additional information you think that is important in answering this question would be great. Thanks.

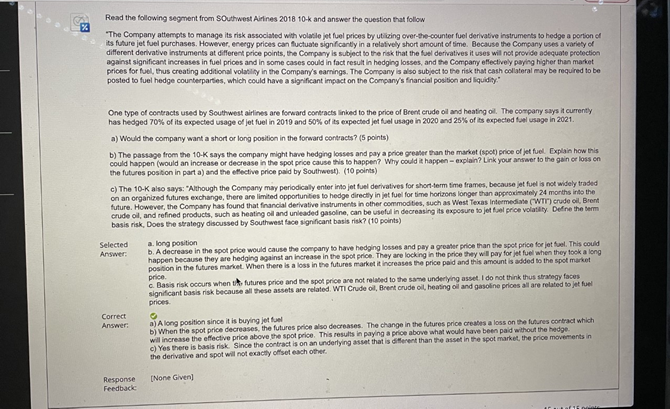

Read the following segment from southwest Airlines 2018 10-k and answer the question that follow "The Company attempts to manage its risk associated with volatile jet fuel prices by utilizing over-the-counter fuel derivative instruments to hedge a portion of its future jet fuel purchases. However, energy prices can fluctuate significantly in a relatively short amount of time. Because the Company uses a variety of different derivative Instruments at different price points, the Company is subject to the risk that the fuel derivatives it uses will not provide adequate protection against significant increases in fuel prices and in some cases could in fact result in hedging losses, and the Company effectively paying higher than market prices for fuel, thus creating additional volatility in the Company's earnings. The Company is also subject to the risk that cash collateral may be required to be posted to fuel hedge counterparties, which could have a significant impact on the Company's financial position and liquidity One type of contracts used by Southwest airlines are forward contracts linked to the price of Brent crude oil and heating oil. The company says it currently has hedged 70% of its expected usage of jet fuel in 2019 and 50% of its expected jet fuel usage in 2020 and 25% of its expected for usage in 2021 a) Would the company want a short or long position in the forward contracts? (5 points) b) The passage from the 10-K says the company might have hedging losses and pay a price greater than the market (spot) price of jet fuel Explain how this could happen (would an increase or decrease in the spot price cause this to happen? Why could it happen-explain? Link your answer to the gain or loss on the futures position in part a) and the effective price paid by Southwest) (10 points) c) The 10-K also says: "Although the Company may periodically enter into jet fuel derivatives for short-term time frames, because jet fuel is not widely traded on an organized futures exchange, there are limited opportunities to hedge directly in jet fuel for time horizons longer than approximately 24 months into the future. However, the Company has found that financial derivative instruments in other commodities, such as West Texas Intermediate (WTI) crude oil, Brent crude oil, and refined products, such as heating and unleaded gasoline, can be useful in decreasing its exposure to je fal price volatility Define the term basis risk, Does the strategy discussed by Southwest face significant basis risk? (10 points) Selected a. long position Answer: b. A decrease in the spot price would cause the company to have hedging losses and pay a greater price than the spot price for jet fuel. This could happen because they are hedging against an increase in the spot price. They are looking in the price they will pay for jet fuel when they took a long position in the futures market. When there is a loss in the futures market it increases the price paid and this amount is added to the spot market price C. Basis risk occurs when the futures price and the spot price are not related to the same underlying asset. I do not think thus strategy faces significant basis risk because all these assets are related. WTI Crude oil, Brent crude oil, hearing oil and gasoline prices all are related to jet fuel prices Correct Answer: a) Along position since it is buying jet fuel b) When the spot price decreases the futures price also decreases. The change in the futures price creates a loss on the futures contract which will increase the effective price above the spotprice. This results in paying a price above what would have been paid without the hedge c) Yes there is basis risk. Since the contract is on an underlying asset that is different than the asset in the spot market, the price movements in the derivative and spot will not exactly offset each other [None Given Response Feedback uli

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts