Question: I would like the part G, H, J. please do not answer it if you are not quite sure Problem 19-1 Use the financial statements

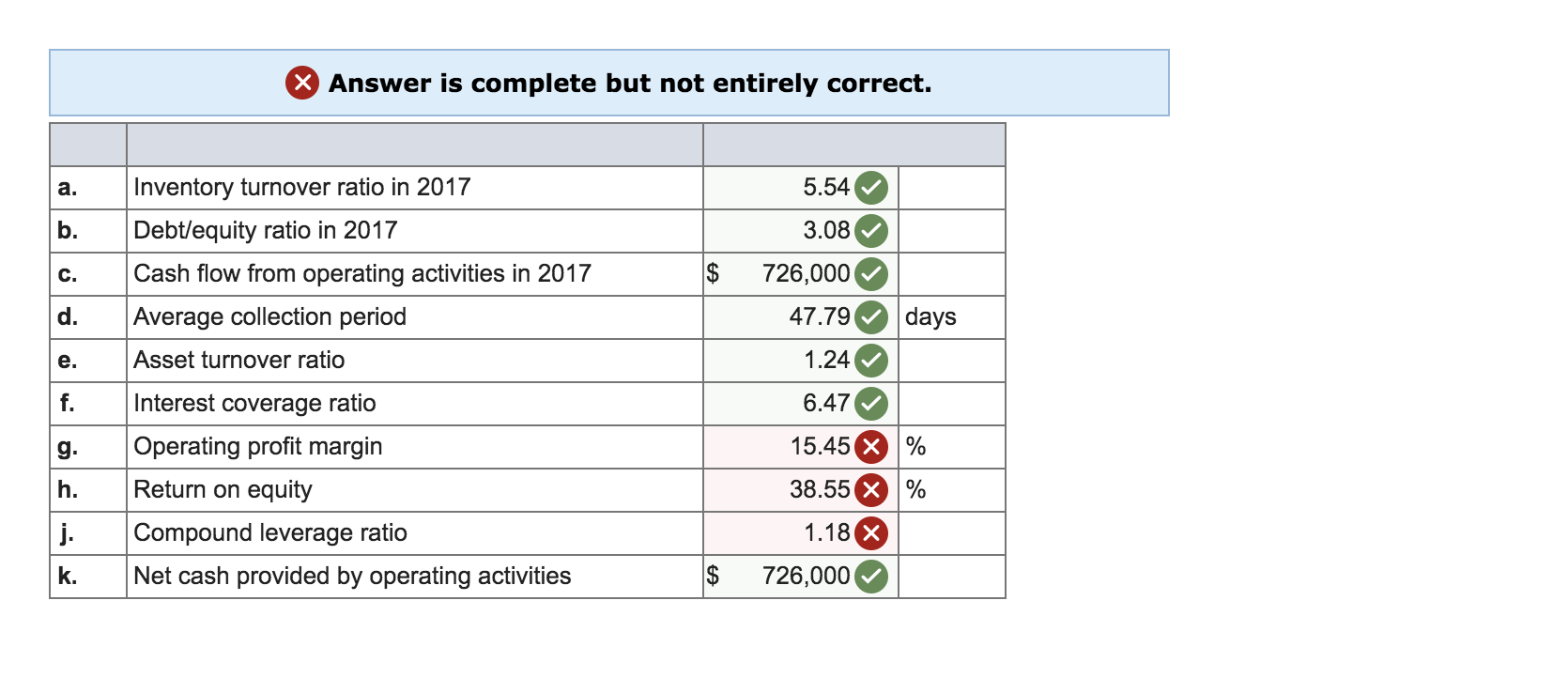

I would like the part G, H, J. please do not answer it if you are not quite sure

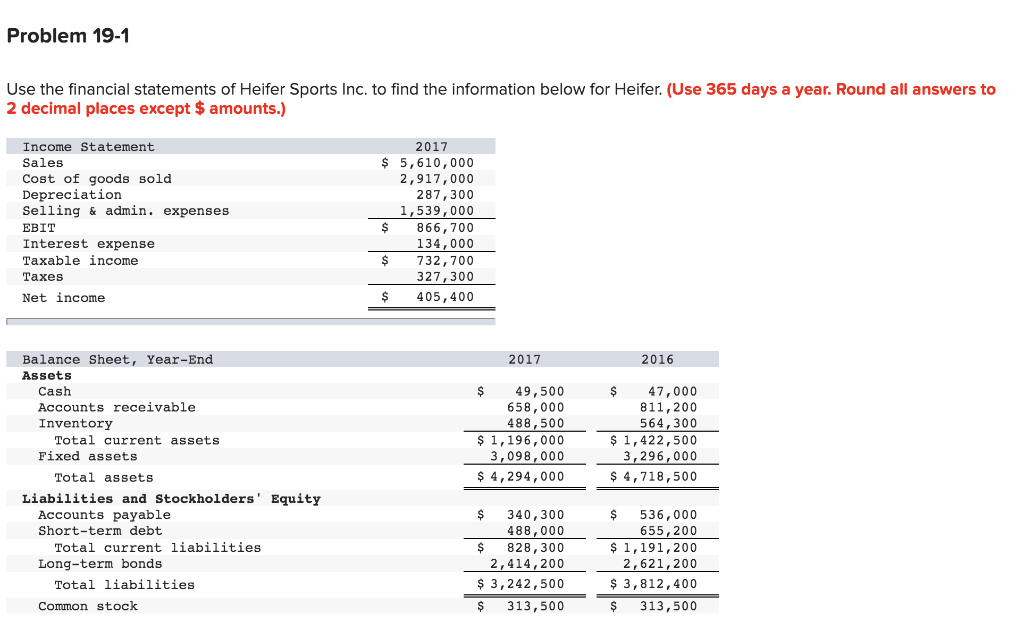

Problem 19-1 Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 days a year. Round all answers to 2 decimal places except $ amounts.) Income Statement Sales Cost of goods sold Depreciation Selling & admin. expenses EBIT Interest expense Taxable income Taxes Net income 2017 $ 5,610,000 2,917,000 287,300 1,539,000 $ 866, 700 134,000 $ 732,700 327,300 $ 405,400 2017 2016 Balance Sheet, Year-End Assets Cash Accounts receivable Inventory Total current assets Fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Short-term debt Total current liabilities Long-term bonds Total liabilities $ 49,500 658,000 488,500 $ 1,196,000 3,098,000 $ 4,294,000 $ 47,000 811,200 564,300 $ 1,422,500 3,296,000 $ 4,718,500 $ 340,300 488,000 $ 828,300 2,414,200 $ 3, 242,500 $ 313,500 $ 536,000 655,200 $ 1,191,200 2,621,200 $ 3,812,400 $ 313,500 Common stock X Answer is complete but not entirely correct. a. 5.54 b. 3.08 Inventory turnover ratio in 2017 Debt/equity ratio in 2017 Cash flow from operating activities in 2017 Average collection period C. $ 726,000 d. 47.79 days e. Asset turnover ratio 1.24 f. 6.47 g. 15.45 X % h. Interest coverage ratio Operating profit margin Return on equity Compound leverage ratio Net cash provided by operating activities 38.55 X % j. 1.18 x k. $ 726,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts