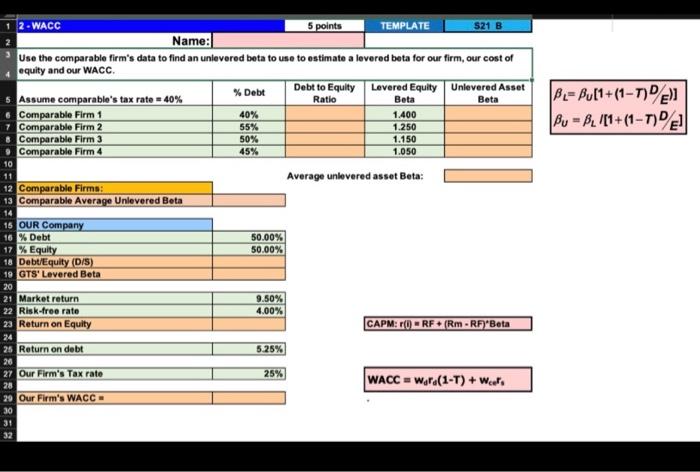

Question: i would like this problem worked in excel along with the formula B.= Bu[1+(1-791 Bu = B_ /[1+(1-7) 12-WACC 5 points TEMPLATE 521 B Name:

B.= Bu[1+(1-791 Bu = B_ /[1+(1-7) 12-WACC 5 points TEMPLATE 521 B Name: Use the comparable firm's data to find an unlevered bota to use to estimate a lovered beta for our firm, our cost of equity and our WACC % Debt Debt to Equity Levered Equity Unlevered Asset Assume comparable's tax rate = 40% Ratio Beta Beta Comparable Firm 1 40% 1.400 Comparable Firm 2 55% 1.250 Comparable Firm 3 50% 1.150 Comparable Firm 4 45% 1.050 10 Average unlevered asset Beta: 12 Comparable Firma: 13 Comparable Average Unlevered Beta 14 18 OUR Company 16 % Debt 50.00% 17 % Equity 50.00% 18 Debt/Equity (D/S) 19 GTS' Levered Beta 20 21 Market return 9.50% 22 Risk-free rate 4.00% 23 Return on Equity CAPM: P(1) - RF+ (RM-RF)*Beta 24 25 Return on debt 5.25% 20 27 Our Firm's Tax rate 25% 28 WACC = wir(1-T) + Weet Our Firm's WACC = B.= Bu[1+(1-791 Bu = B_ /[1+(1-7) 12-WACC 5 points TEMPLATE 521 B Name: Use the comparable firm's data to find an unlevered bota to use to estimate a lovered beta for our firm, our cost of equity and our WACC % Debt Debt to Equity Levered Equity Unlevered Asset Assume comparable's tax rate = 40% Ratio Beta Beta Comparable Firm 1 40% 1.400 Comparable Firm 2 55% 1.250 Comparable Firm 3 50% 1.150 Comparable Firm 4 45% 1.050 10 Average unlevered asset Beta: 12 Comparable Firma: 13 Comparable Average Unlevered Beta 14 18 OUR Company 16 % Debt 50.00% 17 % Equity 50.00% 18 Debt/Equity (D/S) 19 GTS' Levered Beta 20 21 Market return 9.50% 22 Risk-free rate 4.00% 23 Return on Equity CAPM: P(1) - RF+ (RM-RF)*Beta 24 25 Return on debt 5.25% 20 27 Our Firm's Tax rate 25% 28 WACC = wir(1-T) + Weet Our Firm's WACC =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts