Question: I would like to ask do we have a quick formula to find out cross bid and ask rates? Usually there will be American and

I would like to ask do we have a quick formula to find out cross bid and ask rates? Usually there will be American and European quotations on the table. So I hope the formula can be written in American or European quotation, thank you

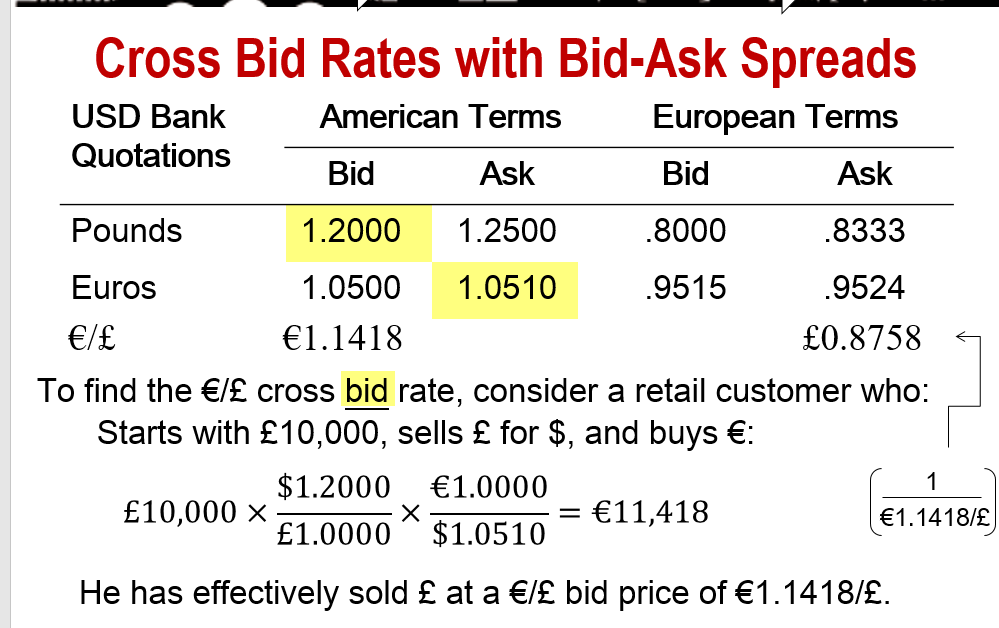

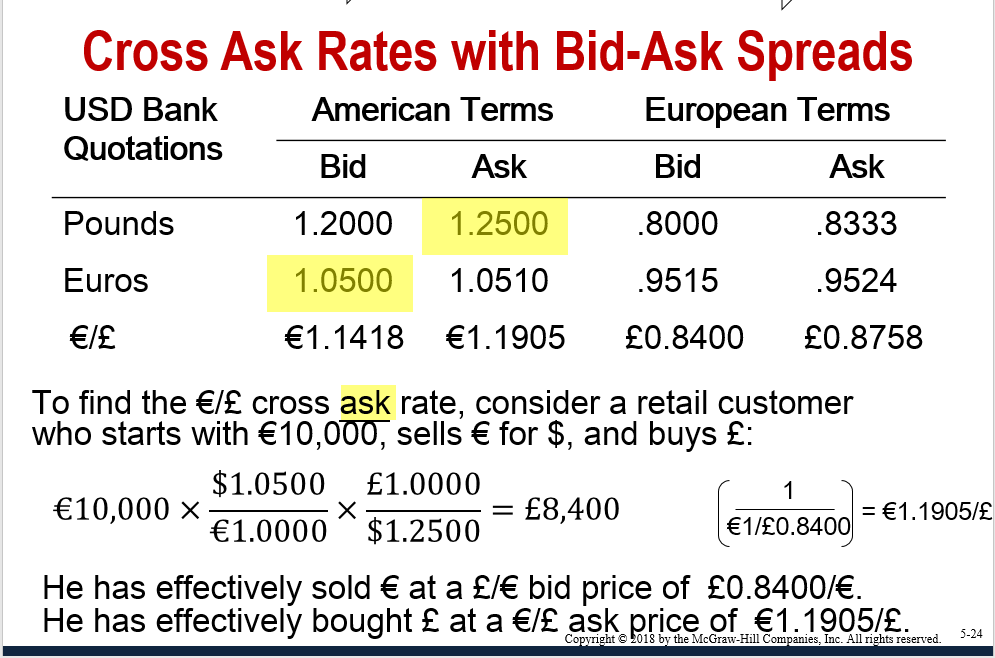

Cross Bid Rates with Bid-Ask Spreads USD Bank American Terms European Terms Quotations Bid Ask Bid Ask Pounds 1.2000 1.2500 .8000 .8333 Euros 1.0500 1.0510 .9515 .9524 / 1.1418 0.8758 To find the / cross bid rate, consider a retail customer who: Starts with 10,000, sells for $, and buys : $1.2000 1.0000 1 10,000 x = 11,418 1.1418/ 1.0000 $1.0510 He has effectively sold at a / bid price of 1.1418/. Cross Ask Rates with Bid-Ask Spreads European Terms American Terms USD Bank Quotations Bid Ask Bid Ask Pounds 1.2000 1.2500 .8000 .8333 Euros 1.0500 1.0510 .9515 .9524 / 1.1418 1.1905 0.8400 0.8758 To find the / cross ask rate, consider a retail customer who starts with 10,000, sells for $, and buys : $1.0500 1.0000 1 10,000 x = 8,400 = 1.1905/ 1.0000 $1.2500 1/0.8400 He has effectively sold at a / bid price of 0.8400/. He has effectively bought at a / ask price of 1.1905/. 5-24 Copyright 2018 by the McGraw-Hill Companies, Inc. All rights reserved. Cross Bid Rates with Bid-Ask Spreads USD Bank American Terms European Terms Quotations Bid Ask Bid Ask Pounds 1.2000 1.2500 .8000 .8333 Euros 1.0500 1.0510 .9515 .9524 / 1.1418 0.8758 To find the / cross bid rate, consider a retail customer who: Starts with 10,000, sells for $, and buys : $1.2000 1.0000 1 10,000 x = 11,418 1.1418/ 1.0000 $1.0510 He has effectively sold at a / bid price of 1.1418/. Cross Ask Rates with Bid-Ask Spreads European Terms American Terms USD Bank Quotations Bid Ask Bid Ask Pounds 1.2000 1.2500 .8000 .8333 Euros 1.0500 1.0510 .9515 .9524 / 1.1418 1.1905 0.8400 0.8758 To find the / cross ask rate, consider a retail customer who starts with 10,000, sells for $, and buys : $1.0500 1.0000 1 10,000 x = 8,400 = 1.1905/ 1.0000 $1.2500 1/0.8400 He has effectively sold at a / bid price of 0.8400/. He has effectively bought at a / ask price of 1.1905/. 5-24 Copyright 2018 by the McGraw-Hill Companies, Inc. All rights reserved

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts