Question: I would like to get answer to this question. thanks $5,500 $6,500 Mark for follow up Question 12 of 30. Ben (48) and Lisa (49)

I would like to get answer to this question. thanks

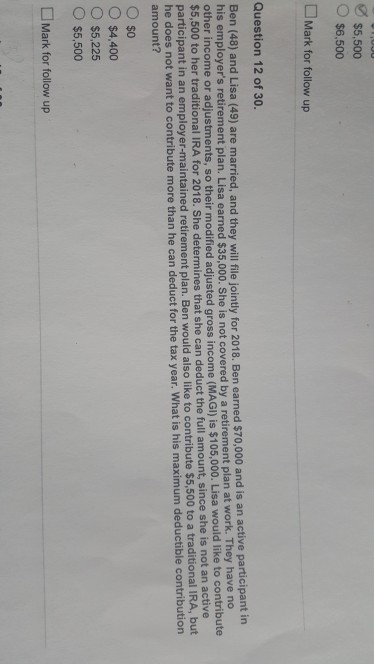

$5,500 $6,500 Mark for follow up Question 12 of 30. Ben (48) and Lisa (49) are married, and they will file jointly for 2018. Ben earned $70,000 and is an active participant in his employer's retirement plan. Lisa earned $35,000. She is not covered by a retirement plan at work. They have no other income or adjustments, so their modified adjusted gross income (MAGI) is $105,000. Lisa would like to contribute $5,500 to her traditional IRA for 2018. She determines that she can deduct the full amount, since she is not an active participant in an employer-maintained retirement plan. Ben would also like to contribute $5,500 to a traditional IRA, but he does not want to contribute more than he can deduct for the tax year. What is his maximum deductible contribution amount? $0 $4,400 $5,225 $5,500 Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts