Question: I would like to have step by step answer and calculation, thanks! Hawaii Travel, U.S based 100% privately owned travel company has signed an agreement

I would like to have step by step answer and calculation, thanks!

I would like to have step by step answer and calculation, thanks!

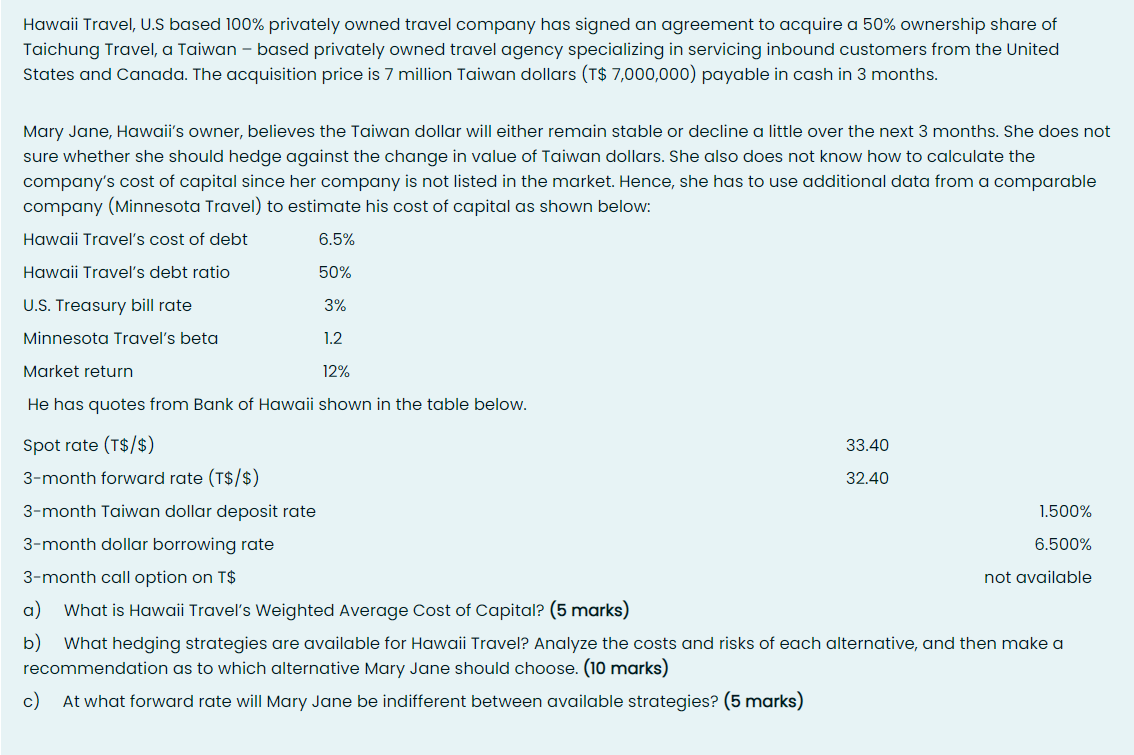

Hawaii Travel, U.S based 100% privately owned travel company has signed an agreement to acquire a 50% ownership share of Taichung Travel, a Taiwan - based privately owned travel agency specializing in servicing inbound customers from the United States and Canada. The acquisition price is 7 million Taiwan dollars (T$ 7,000,000) payable in cash in 3 months. Mary Jane, Hawaii's owner, believes the Taiwan dollar will either remain stable or decline a little over the next 3 months. She does not sure whether she should hedge against the change in value of Taiwan dollars. She also does not know how to calculate the company's cost of capital since her company is not listed in the market. Hence, she has to use additional data from a comparable company (Minnesota Travel) to estimate his cost of capital as shown below: Hawaii Travel's cost of debt 6.5% Hawaii Travel's debt ratio 50% U.S. Treasury bill rate 3% Minnesota Travel's beta 1.2 Market return 12% He has quotes from Bank of Hawaii shown in the table below. Spot rate (T$/$) 33.40 3-month forward rate (T$/$) 32.40 3-month Taiwan dollar deposit rate 1.500% 3-month dollar borrowing rate 6.500% 3-month call option on T$ not available a) What is Hawaii Travel's Weighted Average Cost of Capital? (5 marks) b) What hedging strategies are available for Hawaii Travel? Analyze the costs and risks of each alternative, and then make a recommendation as to which alternative Mary Jane should choose. (10 marks) c) At what forward rate will Mary Jane be indifferent between available strategies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts