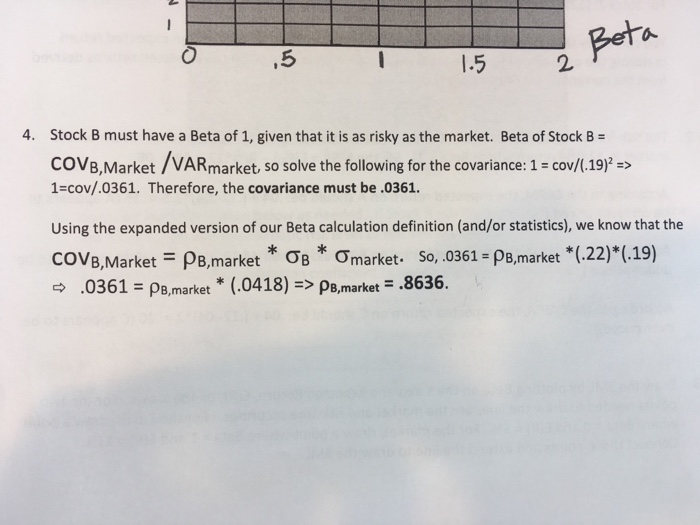

Question: I would like to know how the value in 4 b ( .0418) and how the final answer were figured please! **below are question and

I would like to know how the value in 4 b ( .0418) and how the final answer were figured please!

**below are question and answer files

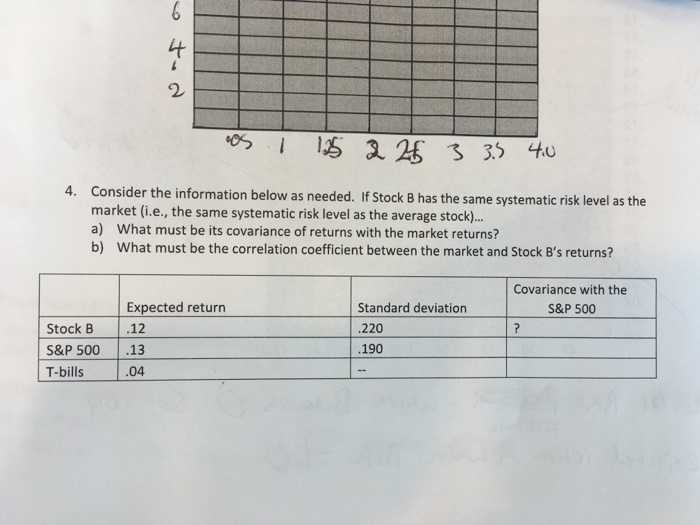

2 4. Consider the information below as needed. If Stock B has the same systematic risk level as the market (i.e, the same systematic risk level as the average stock). a) What must be its covariance of returns with the market returns? b) What must be the correlation coefficient between the market and Stock B's returns? Covariance with the S&P 500 Expected return Standard deviation 220 190 Stock B .12 S&P 500.13 T-bills 04

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock