Question: I would like to know how you get the answer. 6. When Pheasant Corporation was formed under s 351, Kristen transferred property (basis of $26,000

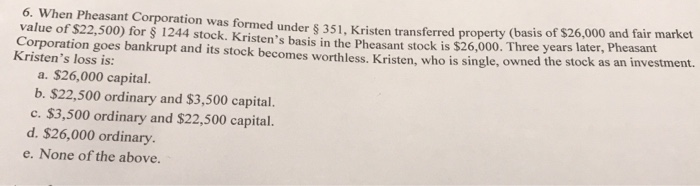

6. When Pheasant Corporation was formed under s 351, Kristen transferred property (basis of $26,000 and fair market value of $22,500) for 1244 stock. Kristen's basis in the Pheasant stockis S26 000. Three y ears later, Pheasant Corporation goes bankrupt and its stock becomes worthless. Kristen, who is single, owned the stock as an investment. Kristen's loss is: a. $26,000 capital. b. $22,500 ordinary and $3,500 capital. c. $3,500 ordinary and $22,500 capital. d. $26,000 ordinary e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts