Question: I would like to know the answer by step by step. and detail explanation QUESTION 4 (25 marks) (A) In 180 days, your company will

I would like to know the answer by step by step. and detail explanation

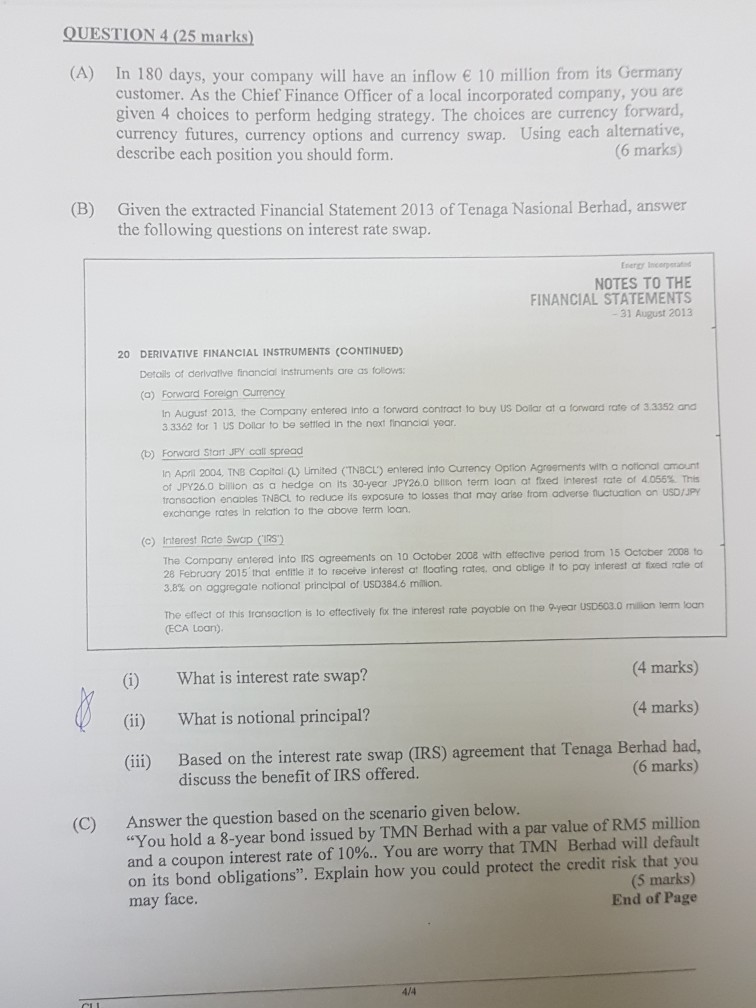

QUESTION 4 (25 marks) (A) In 180 days, your company will have an inflow 10 million from its Germany customer. As the Chief Finance Officer of a local incorporated company, you are given 4 choices to perform hedging strategy. The choices are currency forward, currency futures, currency options and currency swap. Using each alternative, describe each position you should form. (6 marks) (B) Given the extracted Financial Statement 2013 of Tenaga Nasional Berhad, answer the following questions on interest rate swap. Energy Incerperatod NOTES TO THE FINANCIAL STATEMENTS 31 August 2013 20 DERIVATIVE FINANCIAL INSTRUMENTS (CONTINUED) Detcils of derivatlve financial instruments are as follows (a) Forward Foreign Currency In August 2013, the Company entered into a forward contract to buy US Doilar at a forward rate of 3.3352 and 3 3362 for 1 US Dollar to be settied in the next financial year (b) Forward Start JPY call spread in Apri 2004. TNE Copital ) Limited CTNBCL) entered into Currency Option Agreements wih a notional amournt of JPY26.0 billion as a hedge on its 30-year JPY26.0 bliton term loan at fixed interest rate of 4.056% This transaction enaples TNBCl to reduce its exposure to losses that may arlee from adverse fuctuation on USD/IPY exchange rates in relation to the above term loan. (c) Interest Rate Swap (IRS) The Company entered into IRS agreements on 10 October 2008 with eftective penod trom 15 Octcber 2008 to February 2015 that entitle it to receive interest at tloating rates, and oblige it to pay interest at tixed rate ot 3.8% on oggregate notional principal of USD384.6 rnaon. The effect of this transaction is to ettectively fox the interest rate payable on the 9ayear (ECA Loan). USD503.0 million temm loan (4 marks) (4 marks) (ii) Based on the interest rate swap (IRS) agreement that Tenaga Berhad had, (i) What is interest rate swap? (ii) What is notional principal? discuss the benefit of IRS offered. (6 marks) Answer the question based on the scenario given below "You hold a 8-year bond issued by TMN Berhad with a par value of RM5 million and a coupon interest rate of 10%.. You are worry that TMN Berhad will default on its bond obligations". Explain how you could protect the credit risk that you may face. (C) (5 marks) End of Page 4/4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts