Question: I would like to see what you get please? Exercise 11.3 Computing employer's payroll taxes. LO 11-2,11-6 At the end of the weekly payroll period

I would like to see what you get please?

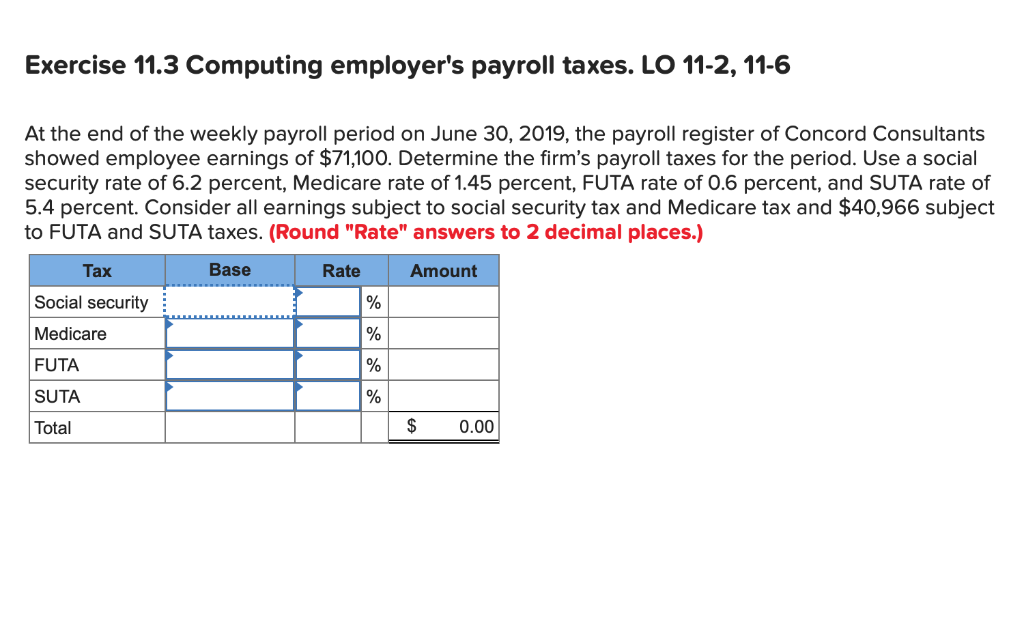

Exercise 11.3 Computing employer's payroll taxes. LO 11-2,11-6 At the end of the weekly payroll period on June 30, 2019, the payroll register of Concord Consultants showed employee earnings of $71,100. Determine the firm's payroll taxes for the period. Use a social security rate of 6.2 percent, Medicare rate of 1.45 percent, FUTA rate of 0.6 percent, and SUTA rate of 5.4 percent. Consider all earnings subject to social security tax and Medicare tax and $40,966 subject to FUTA and SUTA taxes. (Round "Rate" answers to 2 decimal places.) Base Tax Rate Amount Social security Medicare % FUTA SUTA % $ 0.00 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts