Question: I would like you to explain please the steps to solve these exercises. Please, I see that in these exercises there are some formulas that

I would like you to explain please the steps to solve these exercises. Please, I see that in these exercises there are some formulas that recur very often and apply to similar scenarios. Would you please highlight/describe/generalize the formulae that are used (perhaps put those in an algebraic notation) so I am able to do these exercises regardless of the numbers put in the description of the exercise? Thank you very much.

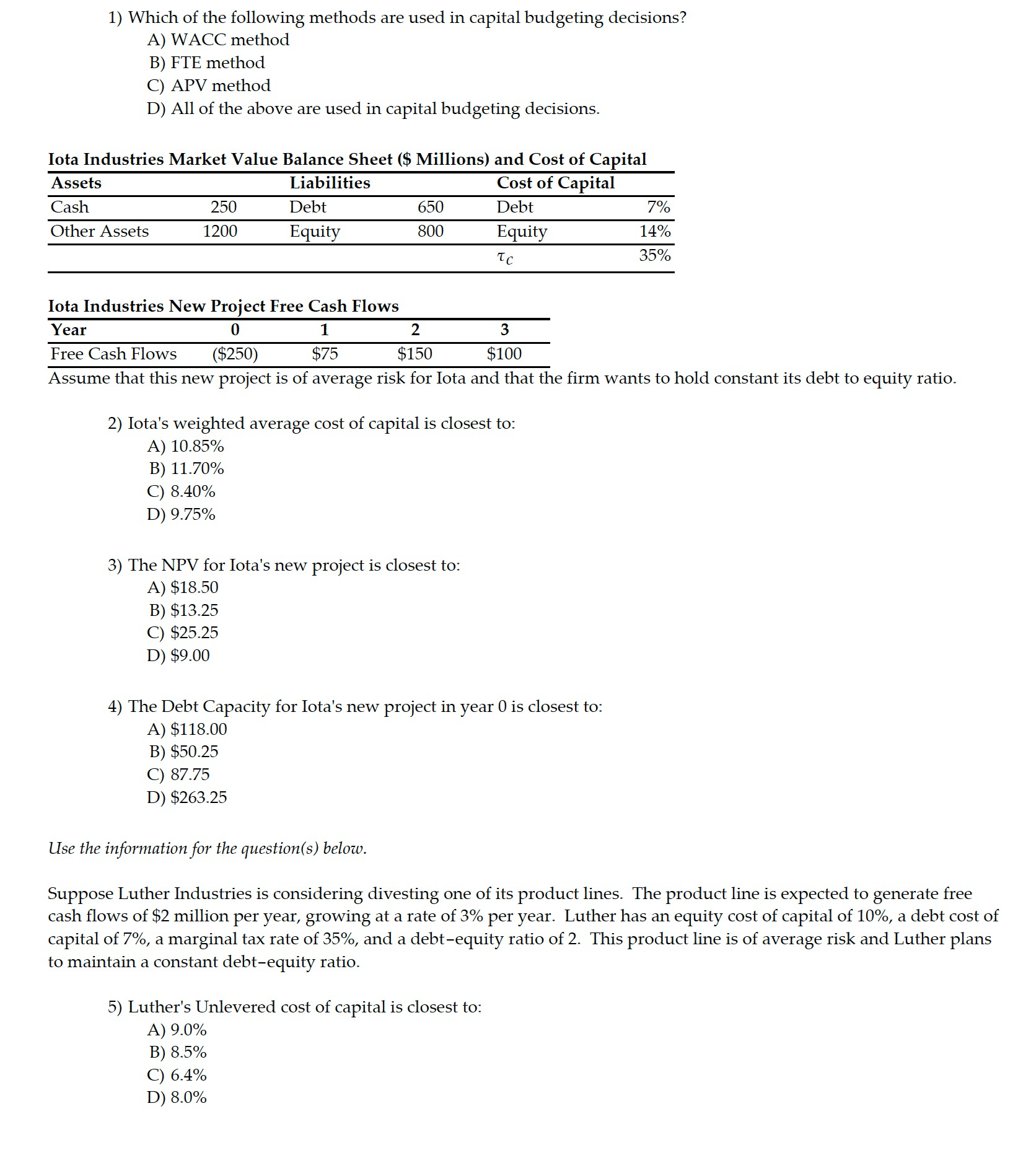

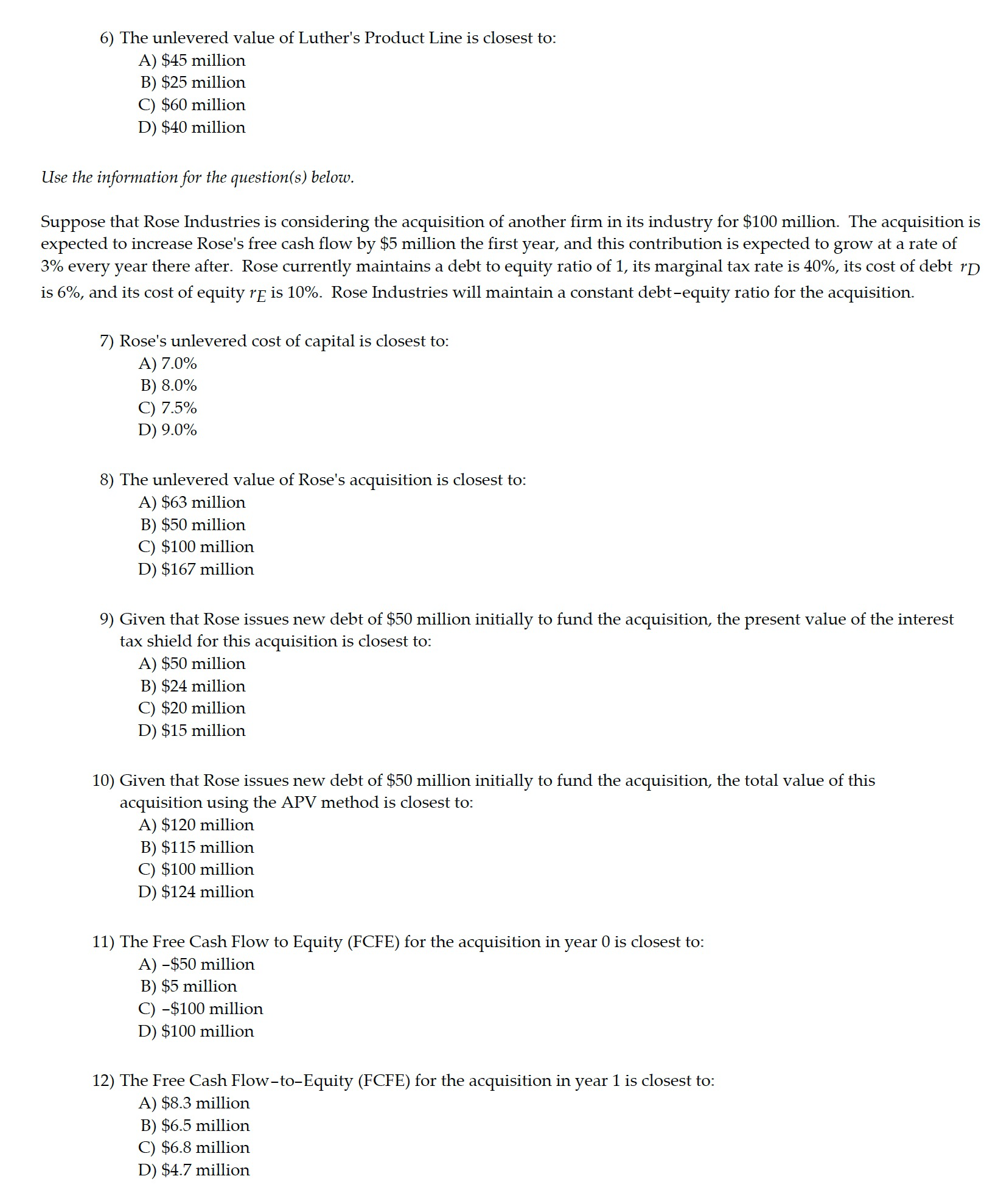

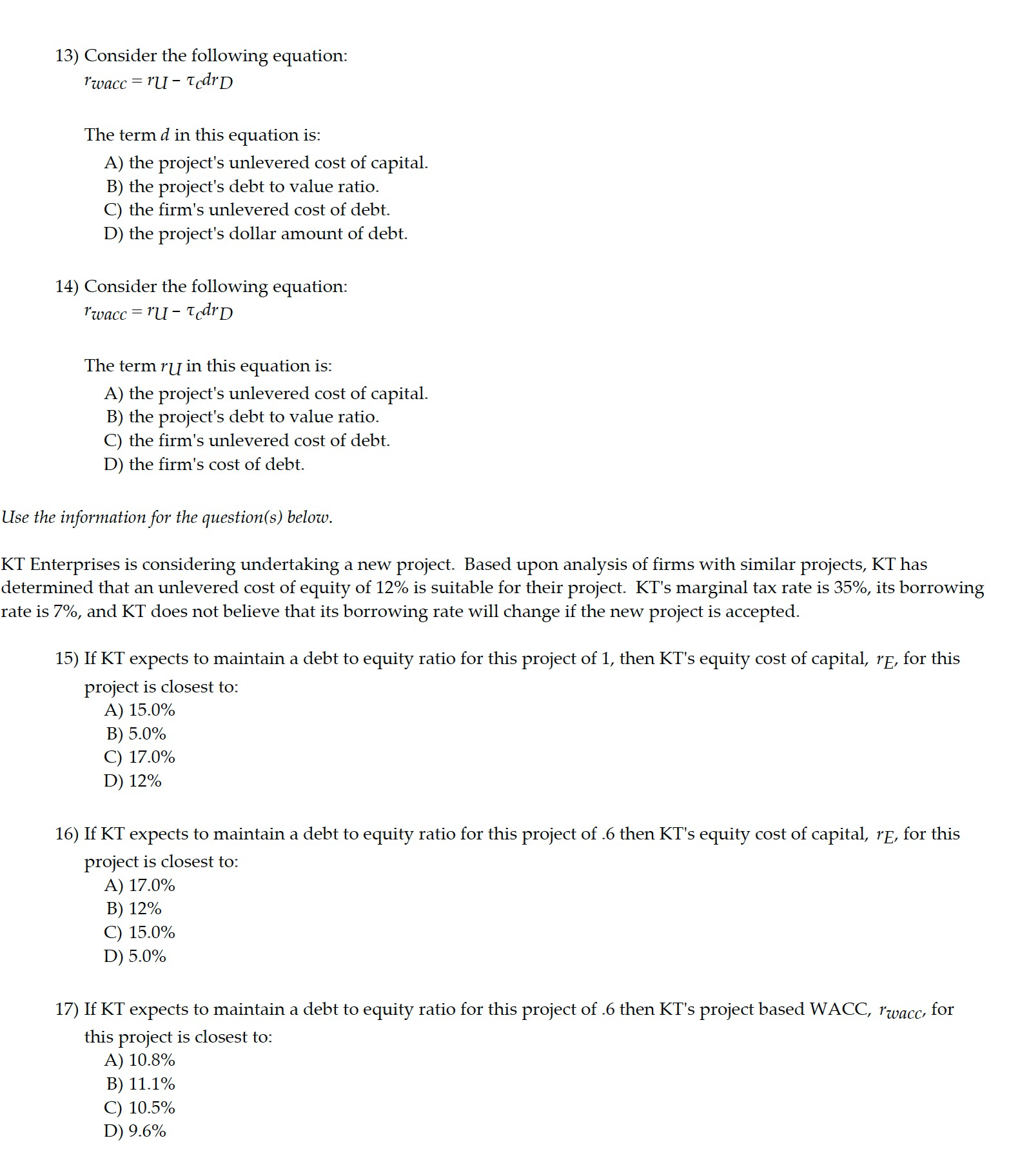

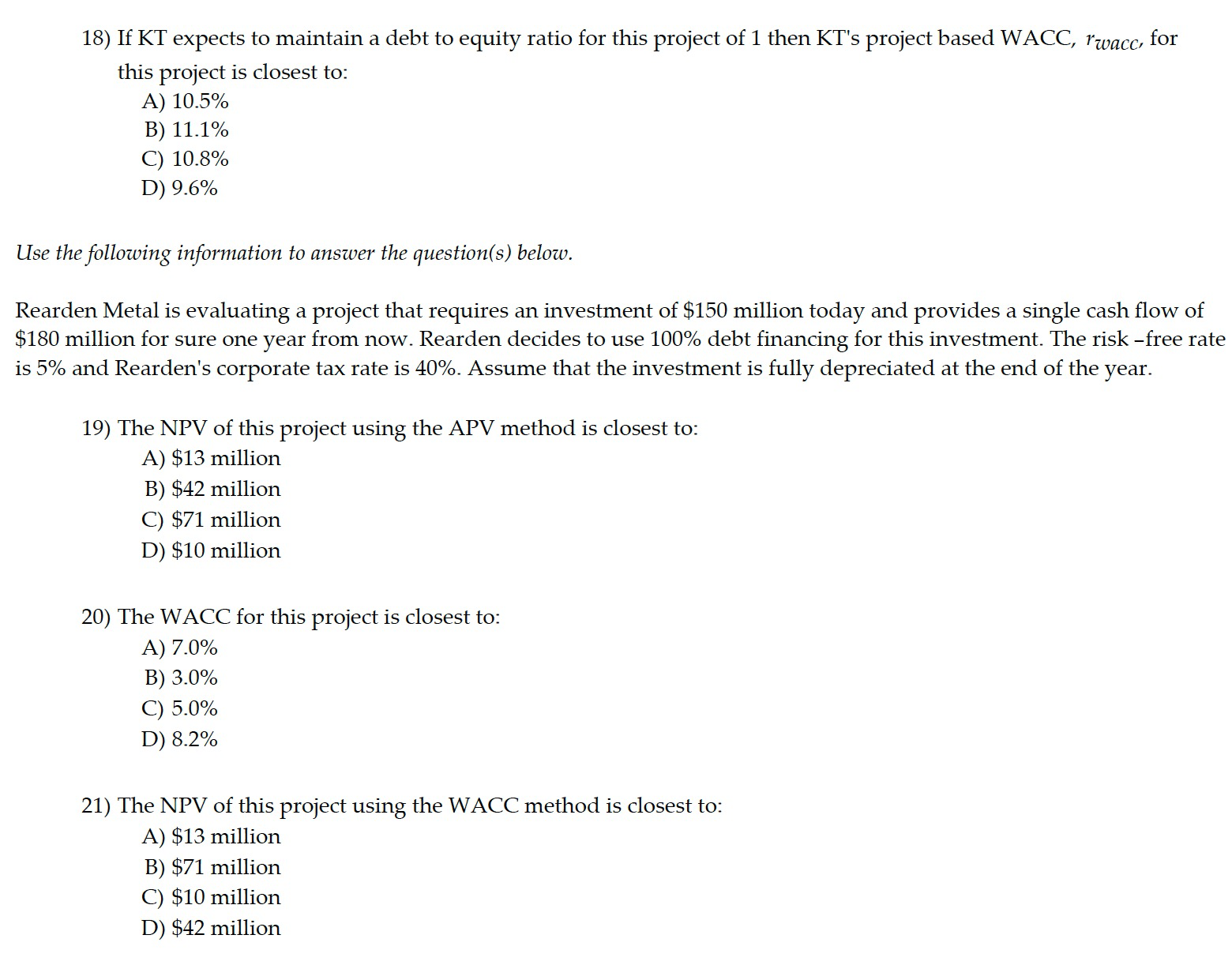

1) Which of the following methods are used in capital budgeting decisions? A) WACC method B) FTE method C) APV method D) All of the above are used in capital budgeting decisions. Iota Industries Market Value Balance Sheet ($ Millions) and Cost of Capital Assets Liabilities Cost of Capital Cash 250 Debt 650 Debt 7% Other Assets 1200 Equity 800 Equity 14% Tc 35% Iota Industries New Project Free Cash Flows Year 0 1 2 3 Free Cash Flows ($250) $75 $150 $100 Assume that this new project is of average risk for Iota and that the firm wants to hold constant its debt to equity ratio. 2) Iota's weighted average cost of capital is closest to: A) 10.85% B) 11.70% C) 8.40% D) 9.75% 3) The NPV for Iota's new project is closest to: A) $18.50 B) $13.25 C) $25.25 D) $9.00 4) The Debt Capacity for Iota's new project in year 0 is closest to: A) $118.00 B) $50.25 C) 87.75 D) $263.25 Use the information for the questi0n(s) below. Suppose Luther Industries is considering divesting one of its product lines. The product line is expected to generate free cash flows of $2 million per year, growing at a rate of 3% per year. Luther has an equity cost of capital of 10%, a debt cost of capital of 7%, a marginal tax rate of 35%, and a debtequity ratio of 2. This product line is of average risk and Luther plans to maintain a constant debtequity ratio. 5) Luther's Unlevered cost of capital is closest to: A) 9.0% B) 8.5% C) 6.4% D) 8.0% 6) The unlevered value of Luther's Product Line is closest to: A) $45 million B) $25 million C) $60 million D) $40 million Use the information for the question(s) below. Suppose that Rose Industries is considering the acquisition of another finn in its industry for $100 million. The acquisition is expected to increase Rose's free cash ow by $5 million the first year, and this contribution is expected to grow at a rate of 3% every year there after. Rose currently maintains a debt to equity ratio of 1, its marginal tax rate is 40%, its cost of debt no is 6%, and its cost of equity rE is 10%. Rose Industries will maintain a constant debtequity ratio for the acquisition. 7) Rose's unlevered cost of capital is closest to: A) 7.0% B) 8.0% C) 7.5% D) 9.0% 8) The unlevered value of Rose's acquisition is closest to: A) $63 million B) $50 million C) $100 million D) $167 million 9) Given that Rose issues new debt of $50 million initially to fund the acquisition, the present value of the interest tax shield for this acquisition is closest to: A) $50 million B) $24 million C) $20 million D) $15 million 10) Given that Rose issues new debt of $50 million initially to fund the acquisition, the total value of this acquisition using the APV method is closest to: A) $120 million B) $115 million C) $100 million D) $124 million 11) The Free Cash Flow to Equity (FCFE) for the acquisition in year 0 is closest to: A) $50 million B) $5 million C) $100 million D) $100 million 12) The Free Cash FlowtoEquity (FCFE) for the acquisition in year 1 is closest to: A) $8.3 million B) $6.5 million C) $6.8 million D) $4.7 million 13) Consider the following equation: T\"walec : 1'\"U' "5(er The term at in this equation is: A) the project's unlevered cost of capital. B) the project's debt to value ratio. C) the rm's unlevered cost of debt. D) the project's dollar amount of debt. 14) Consider the following equation: T'wacc : 7'11 ' 17er The term ru in this equation is: A) the project's unlevered cost of capital. B) the project's debt to value ratio. C) the rm's unlevered cost of debt. D) the firm's cost of debt. Use the informationfor the question(s) below. KT Enterprises is considering undertaking a new project. Based upon analysis of firms with similar projects, KT has determined that an unlevered cost of equity of 12% is suitable for their project. KT's marginal tax rate is 35%, its borrowing rate is 7%, and KT does not believe that its borrowing rate will change if the new project is accepted. 15) If KT expects to maintain a debt to equity ratio for this project of 1, then KT's equity cost of capital, mg, for this project is closest to: A) 15.0% B) 5.0% C) 17.0% D) 12% 16) If KT expects to maintain a debt to equity ratio for this project of .6 then KT's equity cost of capital, r13, for this project is closest to: A) 17.0% B) 12% C) 15.0% D) 5.0% 17) If KT expects to maintain a debt to equity ratio for this project of .6 then KT's project based WACC, rwcc, for this project is closest to: A) 10.8% B) 11.1% C) 10.5% D) 9.6% 18) If KT expects to maintain a debt to equity ratio for this project of 1 then KT's project based WACC, Twacc: for this project is closest to: A) 10.5% B) 11.1% C) 10.8% D) 9.6% Use the following information to answer the questions) below. Rearden Metal is evaluating a project that requires an investment of $150 million today and provides a single cash ow of $180 million for sure one year from now. Rearden decides to use 100% debt financing for this investment. The risk free rate is 5% and Rearden's corporate tax rate is 40%. Assume that the investment is fully depreciated at the end of the year. 19) The NPV of this project using the APV method is closest to: A) $13 million B) $42 million C) $71 million D) $10 million 20) The WACC for this project is closest to: A) 7.0% B) 3.0% C) 5.0% D) 8.2% 21) The NPV of this project using the WACC method is closest to: A) $13 million B) $71 million C) $10 million D) $42 million