Question: I would love some help solving this please Sweet Acacia Limited constructed a buliding at a cost of ( $ 3.4 ) million and has

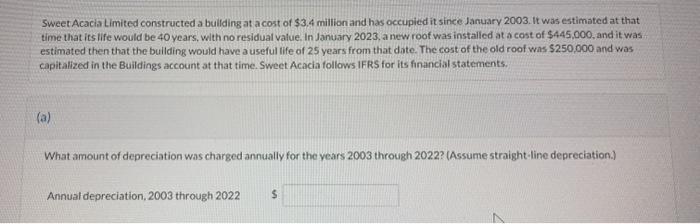

Sweet Acacia Limited constructed a buliding at a cost of \\( \\$ 3.4 \\) million and has occupied it since January 2003 . It was estimated at that time that its life would be 40 years, with no residual value. In January 2023, a new roof was installed at a cost of \\( \\$ 445,000 \\), and it was. estimated then that the building would have a useful life of 25 years from that date. The cost of the old roof wiss \\( \\$ 2.50,000 \\) and was capitalized in the Buildings account at that time. Sweet Acacia follows IFRS for its financial statements. (a) What amount of depreciation was charged annually for the vears 2003 through 2022? (Assume straight-line depreciation.) Annual depreciation, 2003 through 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts