Question: i would really appreciated please answer quickly this question with details i dont want to excell solution thank you A four-year software development project has

i would really appreciated please answer quickly this question with details i dont want to excell solution thank you

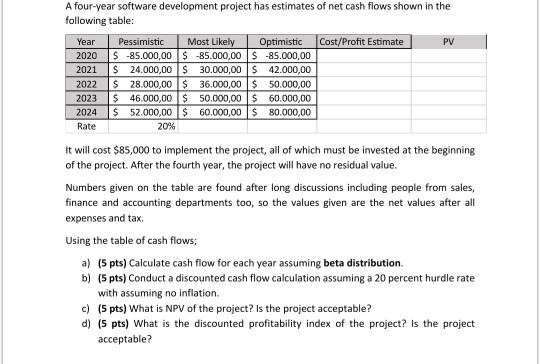

A four-year software development project has estimates of net cash flows shown in the following table: Year Pessimistic Most Likely Optimistic Cost/Profit Estimate PV 2020 $ -85.000,00 $ -85.000,00 S -85.000,00 2021 $ 24.000,00 $ 30.000,00 $ 42.000,00 2022 $ 28.000,00 $ 36.000,00 $ 50.000,00 2023 $ 46.000,00 $ 50.000,00 $ 60.000,00 2024 $ 52.000,00 $ 60.000,00 $ 80.000,00 Rate 20% it will cost $85,000 to implement the project, all of which must be invested at the beginning of the project. After the fourth year, the project will have no residual value. Numbers given on the table are found after long discussions including people from sales, finance and accounting departments too, so the values given are the net values after all expenses and tax Using the table of cash flows; a) (5 pts) Calculate cash flow for each year assuming beta distribution b) (5 pts) Conduct a discounted cash flow calculation assuming a 20 percent hurdle rate with assuming no inflation. c) (5 pts) What is NPV of the project? Is the project acceptable? d) (5 pts) What is the discounted profitability index of the project? Is the project acceptable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts