Question: I would really like some help solving this problem for my accounting course at Uni. We have to prepare three sections: Statement of owners equity,

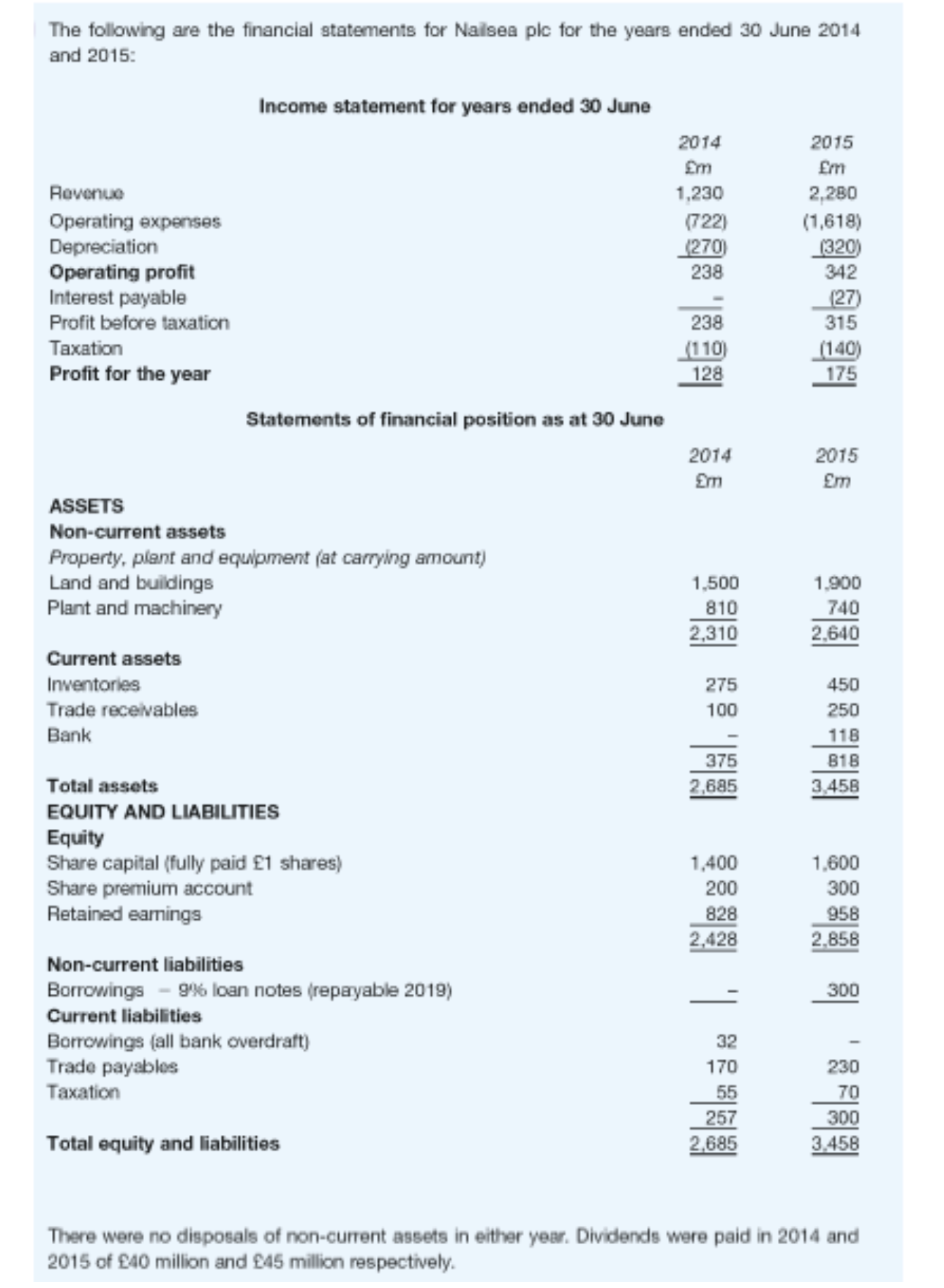

I would really like some help solving this problem for my accounting course at Uni. We have to prepare three sections: Statement of owners equity, net cash flow statement to finally the cash flow statement. I understand it in theory but just applying the correct numbers in the right areas any calculations I need help with. Many thanks! The following are the financial statements for Nalsea ple for the years ended June and :

Noncurrent liabilities

Borrowings loan notes repayable

There were no disposals of noncurrent assets in either year. Dividends were paid in and of million and million respectively. Start by developing the Statement of Owner's Equity for the year using the following format if you do not understand what some of the entries entail, then research the topics in the textbook or in other sources Not all the elements will necessarily apply to the example: Then develop the net cash flows from operating activities using the following framework:

Also, develop the net cash flows from investing and financing activities using the following framework:

Based on the above and other details if necessary prepare an overall Cash Flow Statement using the template on the following page and, if appropriate, add brief notes in the relevant rows to explain how the statement correlates with the Profit and Loss Statement, Statement of Cash Flow, Balance Sheet, or Statement of Owner's Equity and, where necessary, how the other three statements correlate with each other.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock