Question: I would request you to please answer the part C and D specifically. You could include the answers for part A and B. Please include

I would request you to please answer the part C and D specifically. You could include the answers for part A and B.

Please include formula and all relevant working for these question.

Thanks you :)

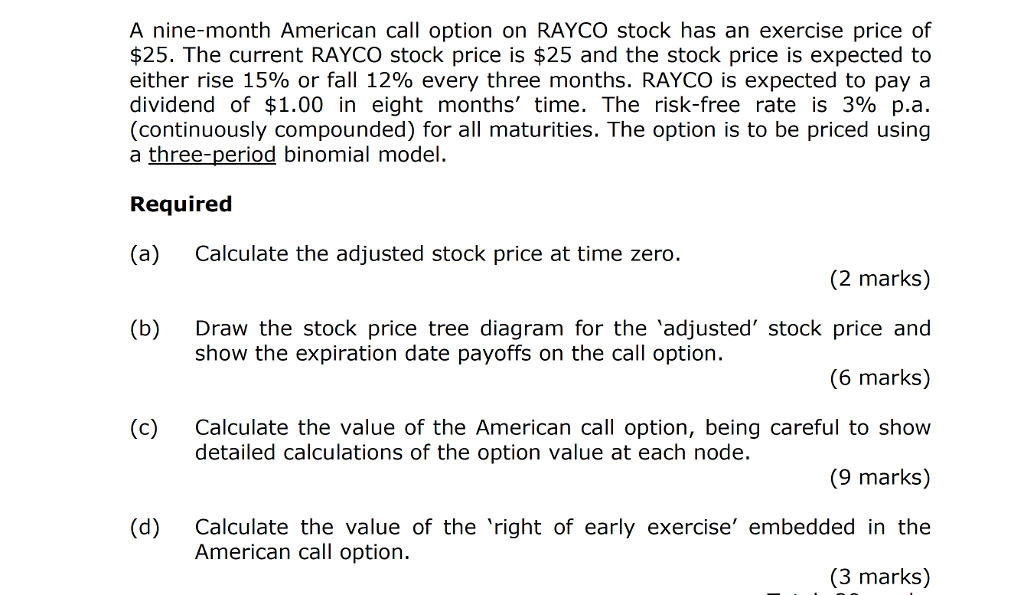

A nine-month American call option on RAYCO stock has an exercise price of $25. The current RAYCO stock price is $25 and the stock price is expected to either rise 15% or fall 12% every three months. RAYCO is expected to pay a dividend of $1.00 in eight months' time. The risk-free rate is 3% p.a. (continuously compounded) for all maturities. The option is to be priced using a three-period binomial model. Required (a) Calculate the adjusted stock price at time zero. (2 marks) (b) Draw the stock price tree diagram for the 'adjusted' stock pri show the expiration date payoffs on the call option. (6 marks) (c) Calculate the value of the American call option, being careful to show detailed calculations of the option value at each node. (9 marks) (d) Calculate the value of the right of early exercise' embedded in the American call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts