Question: I would the answer to be on the labtop +all the calculations clear Pearl Co and Stone Co The following are the draft statement of

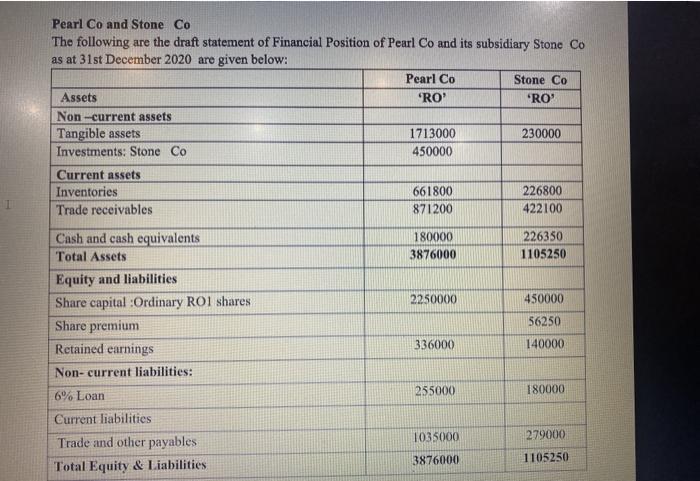

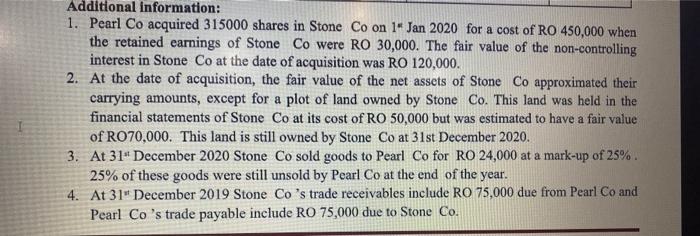

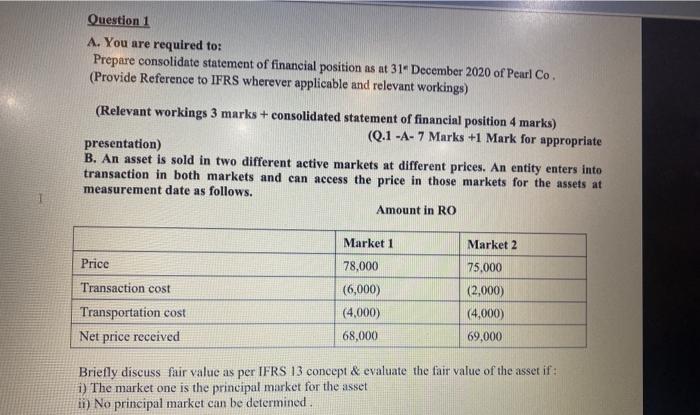

Pearl Co and Stone Co The following are the draft statement of Financial Position of Pearl Co and its subsidiary Stone Co as at 31st December 2020 are given below: Pearl Co Stone Co Assets "RO "RO Non-current assets Tangible assets 1713000 230000 Investments: Stone Co 450000 Current assets Inventories 661800 226800 Trade receivables 871200 422100 180000 3876000 226350 1105250 2250000 450000 56250 336000 140000 Cash and cash equivalents Total Assets Equity and liabilities Share capital Ordinary ROI shares Share premium Retained earnings Non-current liabilities: 6% Loan Current liabilities Trade and other payables Total Equity & Liabilities 255000 180000 279000 1035000 3876000 1105250 Additional information: 1. Pearl Co acquired 315000 shares in Stone Co on 14 Jan 2020 for a cost of RO 450,000 when the retained earnings of Stone Co were RO 30,000. The fair value of the non-controlling interest in Stone Co at the date of acquisition was RO 120,000. 2. At the date of acquisition, the fair value of the net assets of Stone Co approximated their carrying amounts, except for a plot of land owned by Stone Co. This land was held in the financial statements of Stone Co at its cost of RO 50,000 but was estimated to have a fair value of R070,000. This land is still owned by Stone Co at 31st December 2020. 3. At 31" December 2020 Stone Co sold goods to Pearl Co for RO 24,000 at a mark-up of 25%. 25% of these goods were still unsold by Pearl Co at the end of the year. 4. At 31 December 2019 Stone Co's trade receivables include RO 75,000 due from Pearl Co and Pearl Co's trade payable include RO 75,000 due to Stone Co. Question 1 A. You are required to: Prepare consolidate statement of financial position as at 31 December 2020 of Pearl Co. (Provide Reference to IFRS wherever applicable and relevant workings) (Relevant workings 3 marks + consolidated statement of financial position 4 marks) (Q.1 -A- 7 Marks +1 Mark for appropriate presentation) B. An asset is sold in two different active markets at different prices. An entity enters into transaction in both markets and can access the price in those markets for the assets at measurement date as follows. Amount in RO Market 1 Market 2 Price Transaction cost 78,000 (6,000) (4,000) 68,000 75,000 (2.000) (4,000) 69,000 Transportation cost Net price received Briefly discuss fair value as per IFRS 13 concept & evaluate the fair value of the asset if i) The market one is the principal market for the asset ii) No principal market can be determined. Pearl Co and Stone Co The following are the draft statement of Financial Position of Pearl Co and its subsidiary Stone Co as at 31st December 2020 are given below: Pearl Co Stone Co Assets "RO "RO Non-current assets Tangible assets 1713000 230000 Investments: Stone Co 450000 Current assets Inventories 661800 226800 Trade receivables 871200 422100 180000 3876000 226350 1105250 2250000 450000 56250 336000 140000 Cash and cash equivalents Total Assets Equity and liabilities Share capital Ordinary ROI shares Share premium Retained earnings Non-current liabilities: 6% Loan Current liabilities Trade and other payables Total Equity & Liabilities 255000 180000 279000 1035000 3876000 1105250 Additional information: 1. Pearl Co acquired 315000 shares in Stone Co on 14 Jan 2020 for a cost of RO 450,000 when the retained earnings of Stone Co were RO 30,000. The fair value of the non-controlling interest in Stone Co at the date of acquisition was RO 120,000. 2. At the date of acquisition, the fair value of the net assets of Stone Co approximated their carrying amounts, except for a plot of land owned by Stone Co. This land was held in the financial statements of Stone Co at its cost of RO 50,000 but was estimated to have a fair value of R070,000. This land is still owned by Stone Co at 31st December 2020. 3. At 31" December 2020 Stone Co sold goods to Pearl Co for RO 24,000 at a mark-up of 25%. 25% of these goods were still unsold by Pearl Co at the end of the year. 4. At 31 December 2019 Stone Co's trade receivables include RO 75,000 due from Pearl Co and Pearl Co's trade payable include RO 75,000 due to Stone Co. Question 1 A. You are required to: Prepare consolidate statement of financial position as at 31 December 2020 of Pearl Co. (Provide Reference to IFRS wherever applicable and relevant workings) (Relevant workings 3 marks + consolidated statement of financial position 4 marks) (Q.1 -A- 7 Marks +1 Mark for appropriate presentation) B. An asset is sold in two different active markets at different prices. An entity enters into transaction in both markets and can access the price in those markets for the assets at measurement date as follows. Amount in RO Market 1 Market 2 Price Transaction cost 78,000 (6,000) (4,000) 68,000 75,000 (2.000) (4,000) 69,000 Transportation cost Net price received Briefly discuss fair value as per IFRS 13 concept & evaluate the fair value of the asset if i) The market one is the principal market for the asset ii) No principal market can be determined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts