Question: i. Write a general expression for the yield on any debt security rd and define these terms: real risk-free rate of interest (r), inflation premium

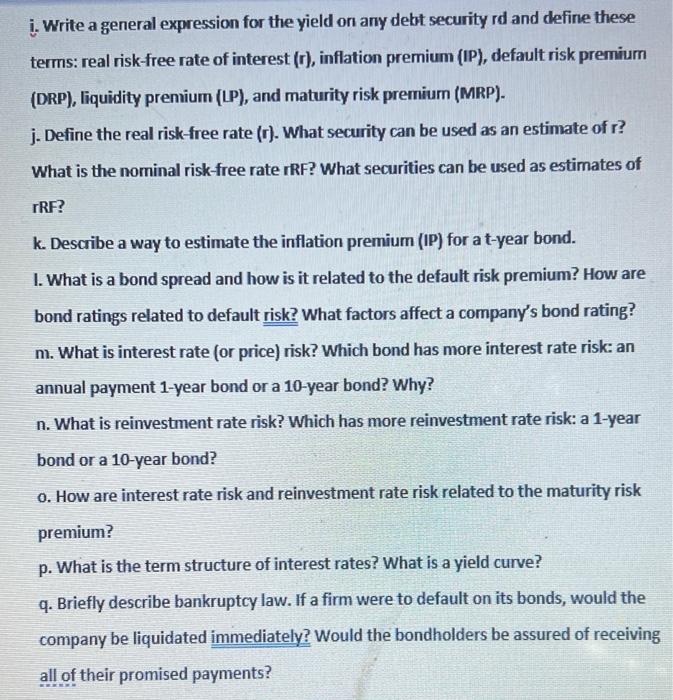

i. Write a general expression for the yield on any debt security rd and define these terms: real risk-free rate of interest (r), inflation premium (IP), default risk premium (DRP), liquidity premium (LP), and maturity risk premium (MRP). j. Define the real risk-free rate ( r ). What security can be used as an estimate of r ? What is the nominal risk-free rate rRF? What securities can be used as estimates of rRF? k. Describe a way to estimate the inflation premium (IP) for a t-year bond. I. What is a bond spread and how is it related to the default risk premium? How are bond ratings related to default risk? What factors affect a company's bond rating? m. What is interest rate (or price) risk? Which bond has more interest rate risk: an annual payment 1-year bond or a 10-year bond? Why? n. What is reinvestment rate risk? Which has more reinvestment rate risk: a 1-year bond or a 10-year bond? o. How are interest rate risk and reinvestment rate risk related to the maturity risk premium? p. What is the term structure of interest rates? What is a yield curve? q. Briefly describe bankruptcy law. If a firm were to default on its bonds, would the company be liquidated immediately? Would the bondholders be assured of receiving all of their promised payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts