Question: i=0 i=1 i=2 A range bond is a structured security, which can be described as follows. It is like a standard fixed-rate coupon bond,

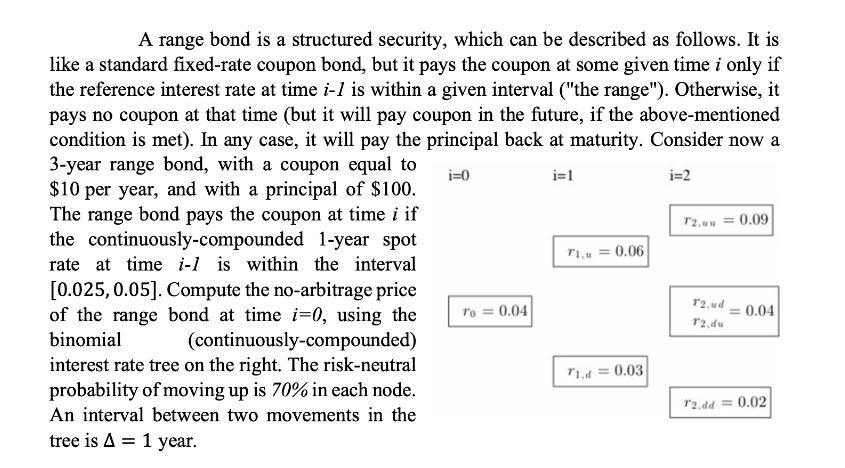

i=0 i=1 i=2 A range bond is a structured security, which can be described as follows. It is like a standard fixed-rate coupon bond, but it pays the coupon at some given time i only if the reference interest rate at time i-1 is within a given interval ("the range"). Otherwise, it pays no coupon at that time (but it will pay coupon in the future, if the above-mentioned condition is met). In any case, it will pay the principal back at maturity. Consider now a 3-year range bond, with a coupon equal to $10 per year, and with a principal of $100. The range bond pays the coupon at time i if the continuously-compounded 1-year spot rate at time i-1 is within the interval [0.025,0.05]. Compute the no-arbitrage price of the range bond at time i=0, using the binomial (continuously-compounded) interest rate tree on the right. The risk-neutral probability of moving up is 70% in each node. An interval between two movements in the tree is A 1 year. To = 0.04 71.= 0.06 71.d = 0.03 12. = 0.09 12,ud 12.du = 0.04 72.dd = 0.02

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Okay here are the steps to price the range bond using the binomial tree 1 At m... View full answer

Get step-by-step solutions from verified subject matter experts