Question: IBM sold a mainframe computer to its customer for 60 monthly payments of $92,082.61, which totals $5,524,956.60. IBM also agreed to provide installation and

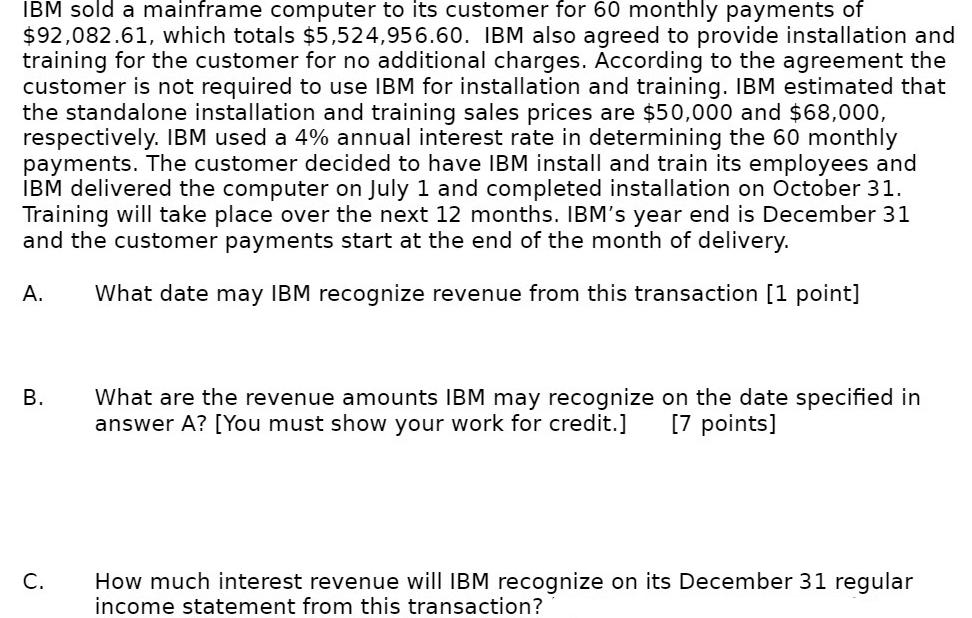

IBM sold a mainframe computer to its customer for 60 monthly payments of $92,082.61, which totals $5,524,956.60. IBM also agreed to provide installation and training for the customer for no additional charges. According to the agreement the customer is not required to use IBM for installation and training. IBM estimated that the standalone installation and training sales prices are $50,000 and $68,000, respectively. IBM used a 4% annual interest rate in determining the 60 monthly payments. The customer decided to have IBM install and train its employees and IBM delivered the computer on July 1 and completed installation on October 31. Training will take place over the next 12 months. IBM's year end is December 31 and the customer payments start at the end of the month of delivery. What date may IBM recognize revenue from this transaction [1 point] A. B. C. What are the revenue amounts IBM may recognize on the date specified in answer A? [You must show your work for credit.] [7 points] How much interest revenue will IBM recognize on its December 31 regular income statement from this transaction?

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

A IBM may recognize revenue from this transaction on July 1 the date when they delivered the compute... View full answer

Get step-by-step solutions from verified subject matter experts