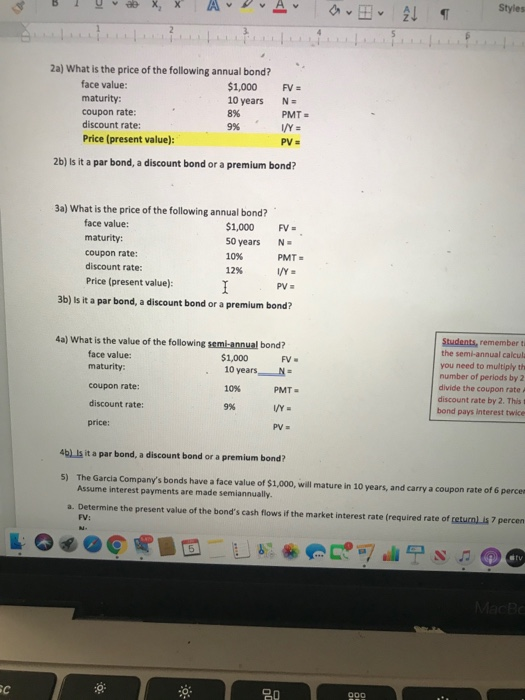

Question: ic X a 211 Styles 2 2a) What is the price of the following annual bond? face value: $1,000 FV = maturity: 10 years N=

ic X a 211 Styles 2 2a) What is the price of the following annual bond? face value: $1,000 FV = maturity: 10 years N= coupon rate: 8% PMT= discount rate: 9% IY Price (present value): PV = 2b) Is it a par bond, a discount bond or a premium bond? 3a) What is the price of the following annual bond? face value: $1,000 FV maturity: 50 years NE coupon rate: 10% PMT= discount rate: 12% VY Price (present value): PV = 3b) Is it a par bond, a discount bond or a premium bond? 1 4a) What is the value of the following semi-annual bond? face value: $1,000 FV- maturity: 10 years N- coupon rate: 10% PMT= discount rate: 9% V/Y Students, remember to the semi-annual calcula you need to multiply th number of periods by 2 divide the coupon rate discount rate by 2. This bond pays Interest twice price: PV- 4b) Is it a par bond, a discount bond or a premium bond? 5) The Garcia Company's bonds have a face value of $1,000, will mature in 10 years, and carry a coupon rate of 6 percen Assume interest payments are made semiannually. a. Determine the present value of the bond's cash flows if the market interest rate (required rate of return is 7 percen FV: N 5 tv MacBc :: BO 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts