Question: ICB is a cosmetics company which doesnt support tests on sensitive intelligent animals. The financial manager is trying to improve the companys working capital management

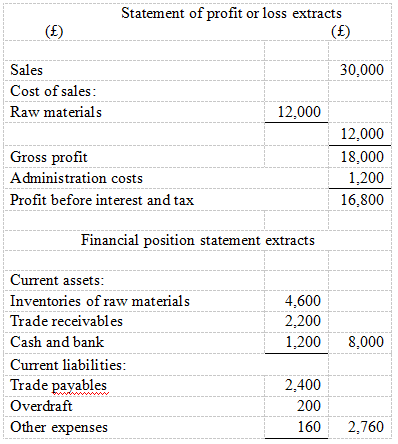

ICB is a cosmetics company which doesnt support tests on sensitive intelligent animals. The financial manager is trying to improve the companys working capital management for the year to end December 2019. As for the end of December 2018, the company has the following opening accounts: inventories of raw materials of 10,000, trade receivables 3,300, and trade payables, 1,500. The following information has been extracted from its closing financial statements for the year to the end of December 2019.

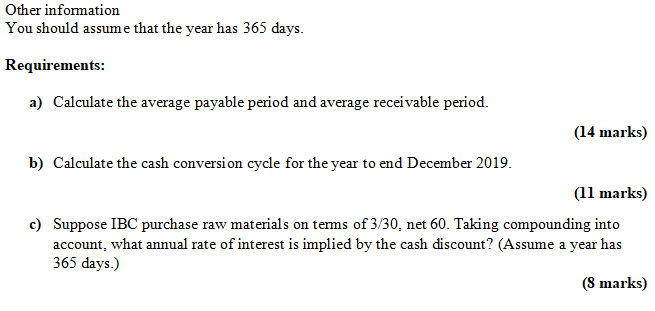

Statement of profit or loss extracts () th 30,000 Sales Cost of sales: Raw materials 12,000 Gross profit Administration costs Profit before interest and tax 12,000 18,000 1,200 16.800 Financial position statement extracts 4.600 2.200 1.200 8,000 Current assets: Inventories of raw materials Trade receivables Cash and bank Current liabilities: Trade payables Overdraft Other expenses 2,400 200 160 2.760 Other information You should assume that the year has 365 days. Requirements: a) Calculate the average payable period and average receivable period. (14 marks) b) Calculate the cash conversion cycle for the year to end December 2019. (11 marks) c) Suppose IBC purchase raw materials on terms of 3/30. net 60. Taking compounding into account, what annual rate of interest is implied by the cash discount? (Assume a year has 365 days.) (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts