Icebreaker Company (a U.S.-based company) purchases materials from a foreign supplier on December 1, 2020, with...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

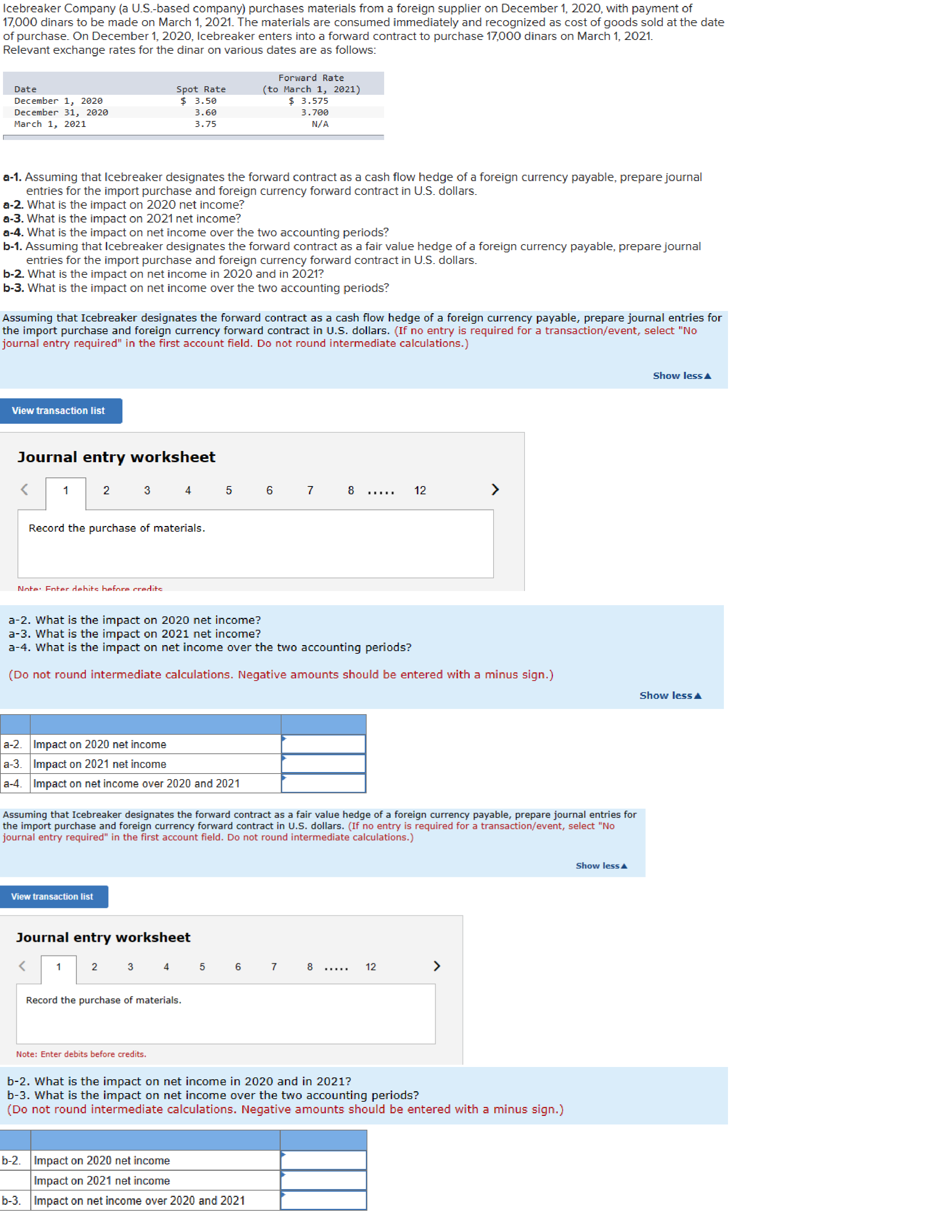

Icebreaker Company (a U.S.-based company) purchases materials from a foreign supplier on December 1, 2020, with payment of 17,000 dinars to be made on March 1, 2021. The materials are consumed immediately and recognized as cost of goods sold at the date of purchase. On December 1, 2020, Icebreaker enters into a forward contract to purchase 17,000 dinars on March 1, 2021. Relevant exchange rates for the dinar on various dates are as follows: Date December 1, 2020 December 31, 2020 March 1, 2021 Spot Rate $ 3.50 Forward Rate (to March 1, 2021) $ 3.575 3.60 3.75 3.700 N/A a-1. Assuming that Icebreaker designates the forward contract as a cash flow hedge of a foreign currency payable, prepare journal entries for the import purchase and foreign currency forward contract in U.S. dollars. a-2. What is the impact on 2020 net income? a-3. What is the impact on 2021 net income? a-4. What is the impact on net income over the two accounting periods? b-1. Assuming that Icebreaker designates the forward contract as a fair value hedge of a foreign currency payable, prepare journal entries for the import purchase and foreign currency forward contract in U.S. dollars. b-2. What is the impact on net income in 2020 and in 2021? b-3. What is the impact on net income over the two accounting periods? Assuming that Icebreaker designates the forward contract as a cash flow hedge of a foreign currency payable, prepare journal entries for the import purchase and foreign currency forward contract in U.S. dollars. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet < 1 2 3 Record the purchase of materials. Note: Foter debits before credite 567 8 12 ---- a-2. What is the impact on 2020 net income? a-3. What is the impact on 2021 net income? a-4. What is the impact on net income over the two accounting periods? (Do not round intermediate calculations. Negative amounts should be entered with a minus sign.) a-2. Impact on 2020 net income a-3. Impact on 2021 net income a-4. Impact on net income over 2020 and 2021 Assuming that Icebreaker designates the forward contract as a fair value hedge of a foreign currency payable, prepare journal entries for the import purchase and foreign currency forward contract in U.S. dollars. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet < 1 2 3 4 5 6 7 8 12 > Record the purchase of materials. Note: Enter debits before credits. b-2. What is the impact on net income in 2020 and in 2021? b-3. What is the impact on net income over the two accounting periods? (Do not round intermediate calculations. Negative amounts should be entered with a minus sign.) b-2. Impact on 2020 net income Impact on 2021 net income b-3. Impact on net income over 2020 and 2021 Show less Show less Show less A Icebreaker Company (a U.S.-based company) purchases materials from a foreign supplier on December 1, 2020, with payment of 17,000 dinars to be made on March 1, 2021. The materials are consumed immediately and recognized as cost of goods sold at the date of purchase. On December 1, 2020, Icebreaker enters into a forward contract to purchase 17,000 dinars on March 1, 2021. Relevant exchange rates for the dinar on various dates are as follows: Date December 1, 2020 December 31, 2020 March 1, 2021 Spot Rate $ 3.50 Forward Rate (to March 1, 2021) $ 3.575 3.60 3.75 3.700 N/A a-1. Assuming that Icebreaker designates the forward contract as a cash flow hedge of a foreign currency payable, prepare journal entries for the import purchase and foreign currency forward contract in U.S. dollars. a-2. What is the impact on 2020 net income? a-3. What is the impact on 2021 net income? a-4. What is the impact on net income over the two accounting periods? b-1. Assuming that Icebreaker designates the forward contract as a fair value hedge of a foreign currency payable, prepare journal entries for the import purchase and foreign currency forward contract in U.S. dollars. b-2. What is the impact on net income in 2020 and in 2021? b-3. What is the impact on net income over the two accounting periods? Assuming that Icebreaker designates the forward contract as a cash flow hedge of a foreign currency payable, prepare journal entries for the import purchase and foreign currency forward contract in U.S. dollars. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet < 1 2 3 Record the purchase of materials. Note: Foter debits before credite 567 8 12 ---- a-2. What is the impact on 2020 net income? a-3. What is the impact on 2021 net income? a-4. What is the impact on net income over the two accounting periods? (Do not round intermediate calculations. Negative amounts should be entered with a minus sign.) a-2. Impact on 2020 net income a-3. Impact on 2021 net income a-4. Impact on net income over 2020 and 2021 Assuming that Icebreaker designates the forward contract as a fair value hedge of a foreign currency payable, prepare journal entries for the import purchase and foreign currency forward contract in U.S. dollars. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet < 1 2 3 4 5 6 7 8 12 > Record the purchase of materials. Note: Enter debits before credits. b-2. What is the impact on net income in 2020 and in 2021? b-3. What is the impact on net income over the two accounting periods? (Do not round intermediate calculations. Negative amounts should be entered with a minus sign.) b-2. Impact on 2020 net income Impact on 2021 net income b-3. Impact on net income over 2020 and 2021 Show less Show less Show less A

Expert Answer:

Related Book For

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

Posted Date:

Students also viewed these accounting questions

-

Icebreaker Company (a U.S.-based company) purchases materials from a foreign supplier on December 1, 2020, with payment of 22,000 dinars to be made on March 1, 2021. The materials are consumed...

-

Icebreaker Company (a U.S.-based company) purchases materials from a foreign supplier on December 1, 2020, with payment of 22,000 dinars to be made on March 1, 2021. The materials are consumed...

-

An abc-sequence balanced three-phase wye-connected source supplies power to a balanced wye-connected load. The line impedance per phase is 1 + j10, and the load impedance per phase is 20 + j20. If...

-

Which accounts appear in a company's after-closing trial balance? How do these accounts differ from those reported in an adjusted trial balance?

-

Use the graph of the function f to make a table of values for the given points. Then make a second table that can be used to find f -1 and sketch the graph of f -1 . To print an enlarged copy of...

-

In a 1975 contract, Eureka was given the exclusive right to sell spring water and other products under the Ozarka trade name in 60 Oklahoma counties in exchange for \($9,000\) paid to Arrowhead,...

-

Assuming the cost of an associate leaving within 90 days is $3,000, what will be your facility's approximate cost of early turnover for this year? Year-to-Date Turnover Avg. Head- count Total < 90...

-

$28.95- charged for it yesterday!" said Shana, the Dining Room manager at Chez Paul's restaurant. "It's even more than our highest priced steak! that's almost ten dollars more than we on to control...

-

Consider the electrochemical cell given by the cell notation below: Hg(t)| Hg,Ce(s), Kce(aq, satd) || Fe2*(aq), Fe**(aq) | Pt(s) Calculate the electromotive force of the above electrochemical cell if...

-

In a mixed market economy, property owned by the government O can be used by many citizens. O can cause economic inequality. can help promote personal wealth. can be used for private businesses.

-

You decide you want to overclock the processors on your system. What is the first step in the process? O a. Boot Windows as Administrator, go to Control Panel, set the BIOS/UEFI flag, then restart O...

-

1. A) With the following data decide which country has comparative advantage for which good. Show your math. Good X Country A 75 Country B 60 B) Using the data above prove both countries can be...

-

What is the primary focus of normative decision theory? a Studying biases and heuristics b Maximizing expected utility c Describing decision - making processes d Analyzing the emotional aspects of...

-

A consumer is maximizing her utility with a particular money income when: A. the total utility derived from each product consumed is the same. B. MU/P=MUP-MudPc=..=MU P C. MUMUMU= ... = MU www D. Pa...

-

Imagine that you must collect and assess the quality and appropriateness of data held by a large, multi-national organization. What steps you would take? Include how you would address network,...

-

Perform the indicated operations. In designing a cam for a fire engine pump, the expression is used. Simplify this expression. (3) (3 4 32

-

Figure P2.4 shows a graph of position versus frame number from a video clip of a moving object. Describe this motion from beginning to end, and state any assumptions you make. Data from Figure P2.4...

-

What minimum information must be extracted from a video clip of a moving object in order to quantify the object's motion?

-

The sequence in Figure P2.3 represents a ball that is initially held above the ground. In the first frame the ball is released. In subsequent frames the ball falls, bounces on the ground, rises, and...

Study smarter with the SolutionInn App