Question: IChapter 2 Problems PR 2-2A journal entries and trial balance Wk 1, 2, 3, 4 On August 1, 2016, Bill Hudson established Heritage Realty, which

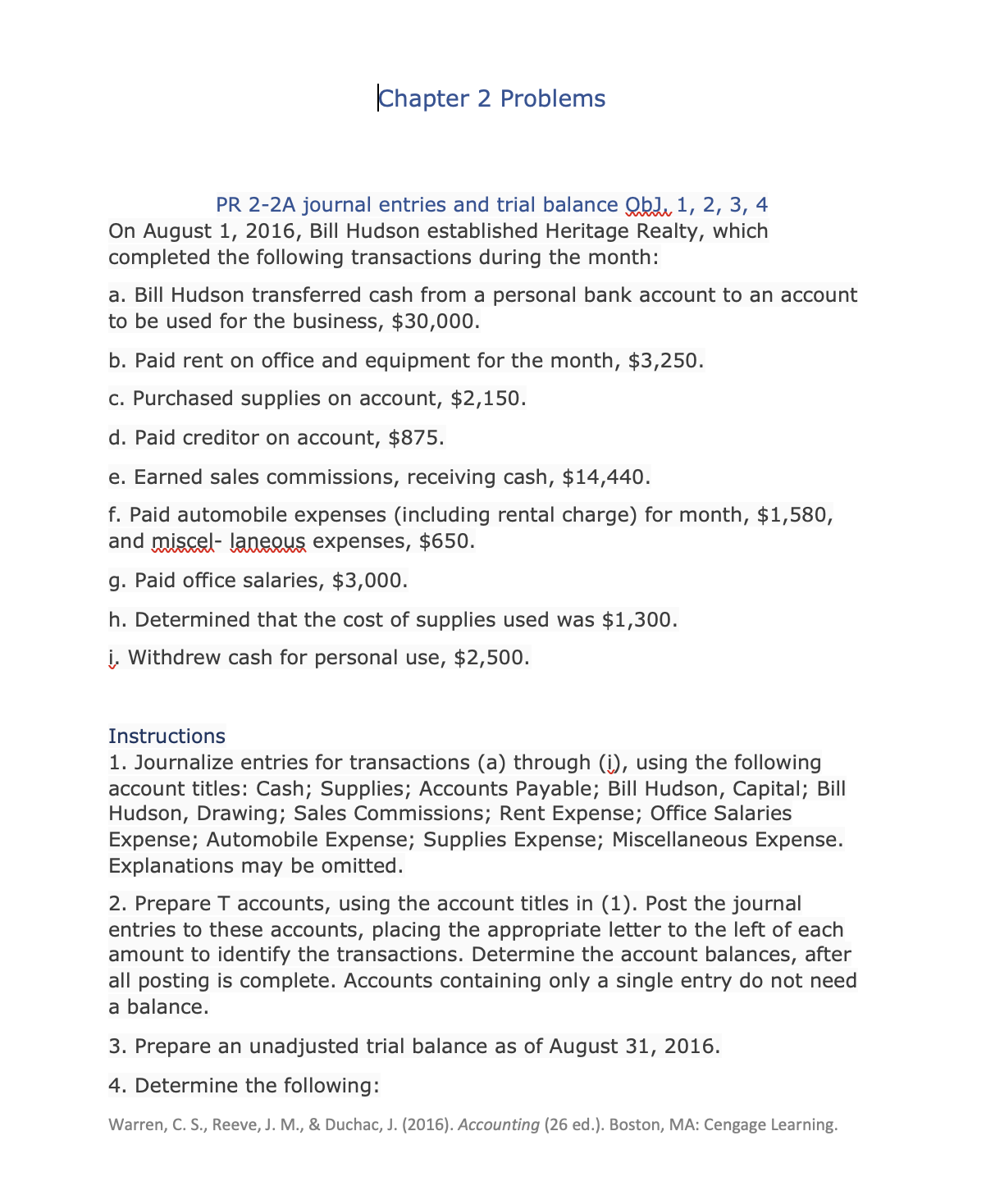

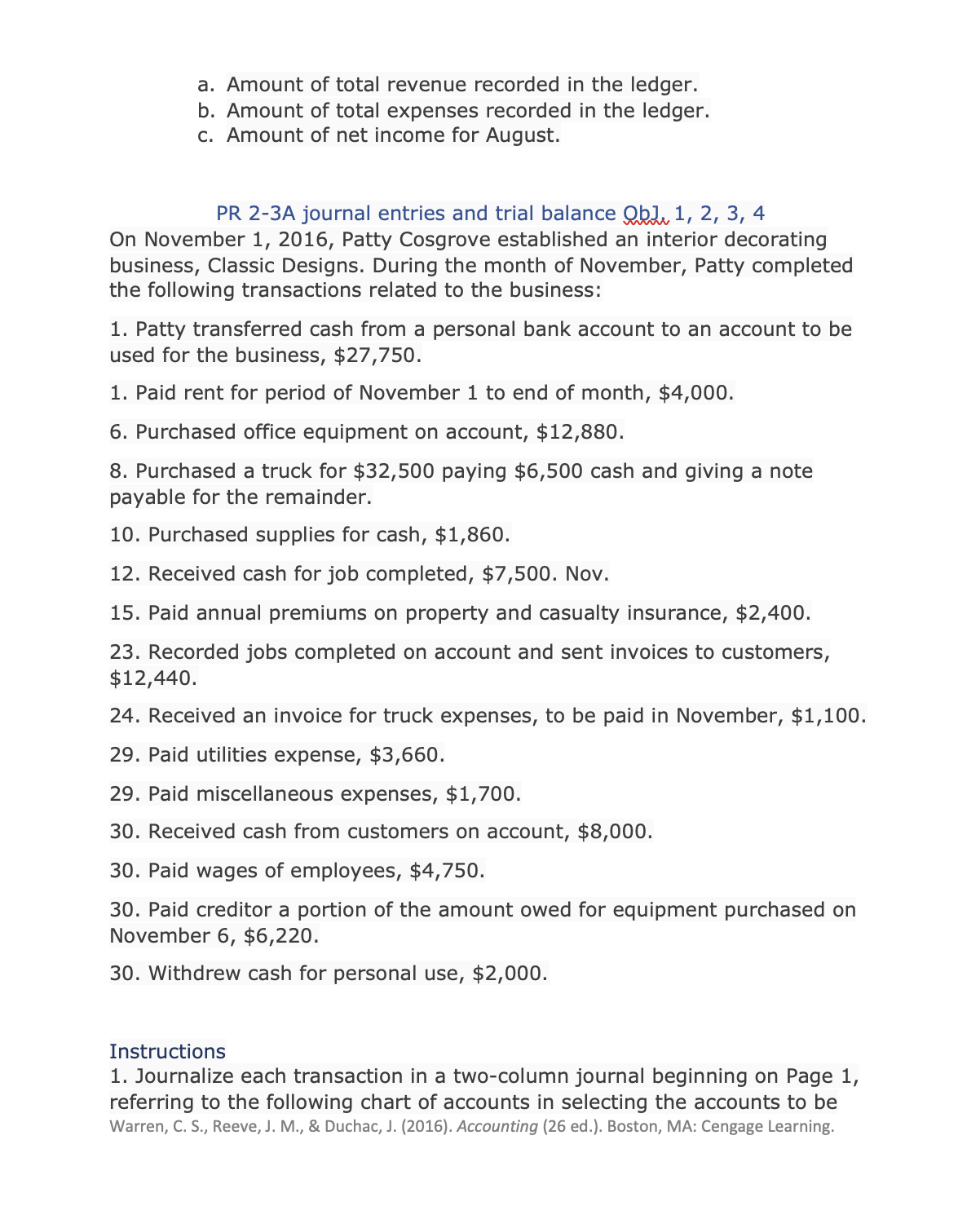

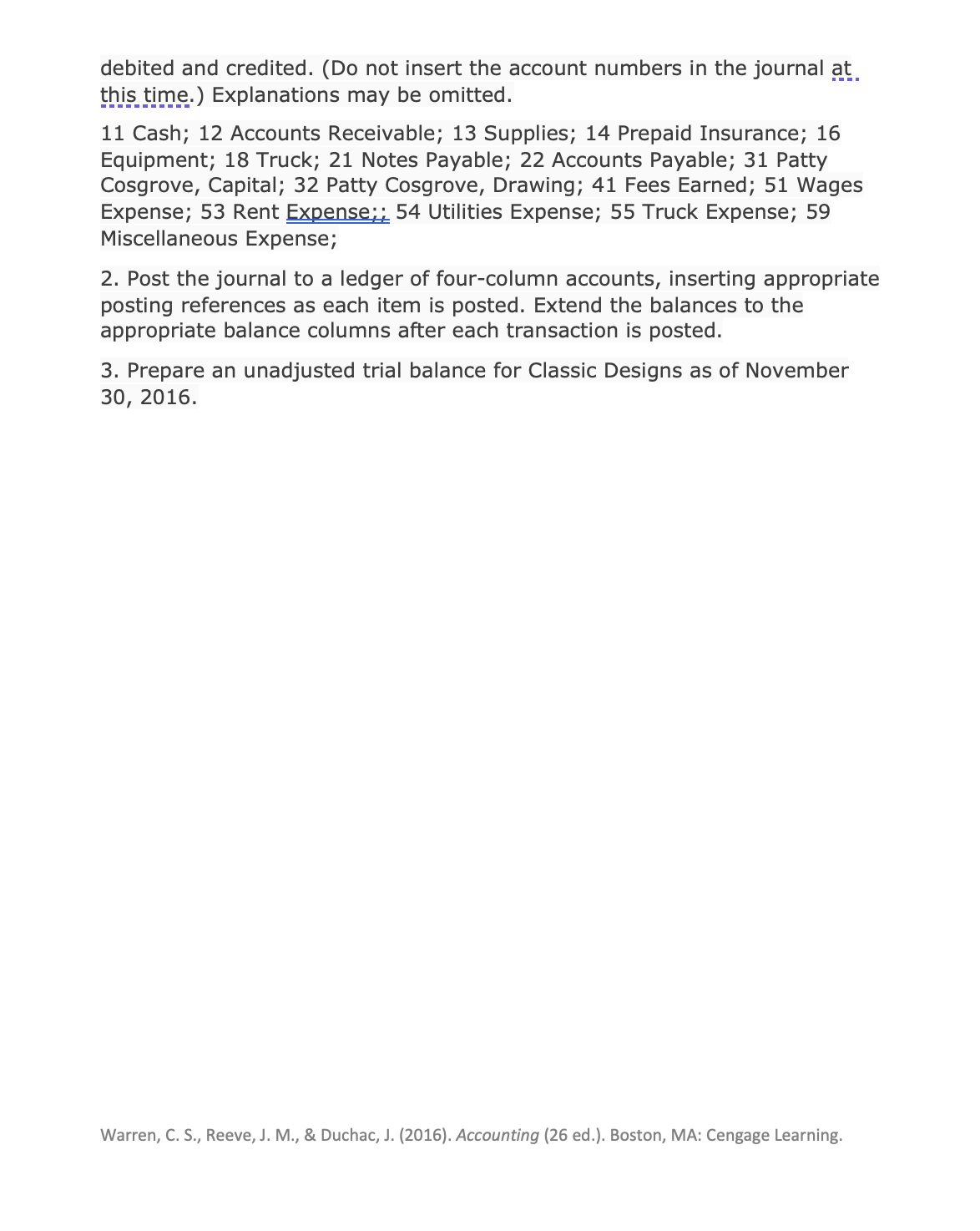

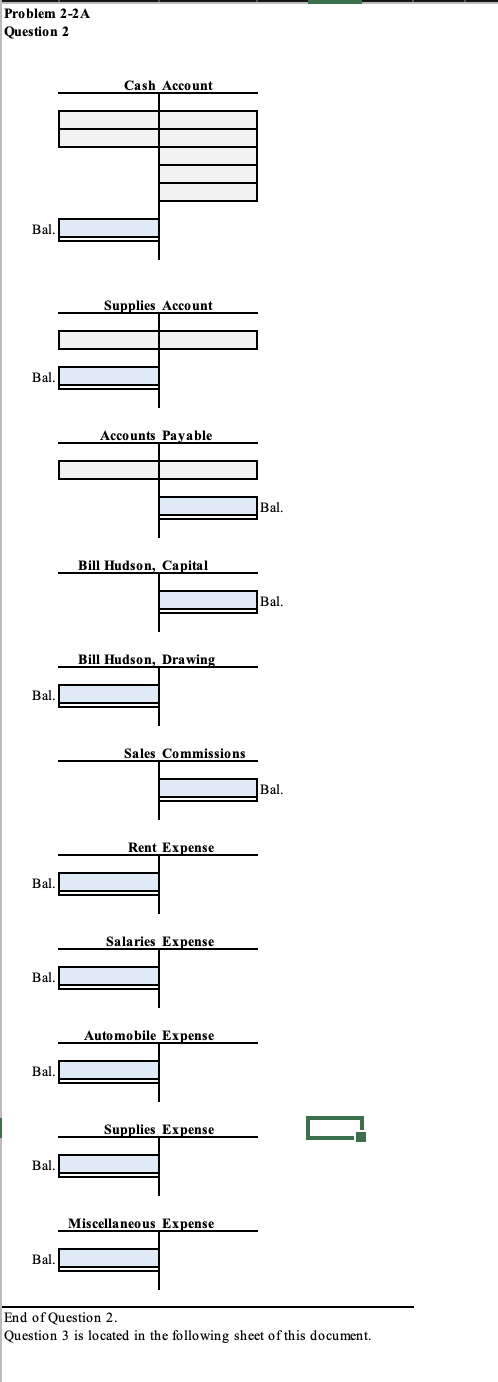

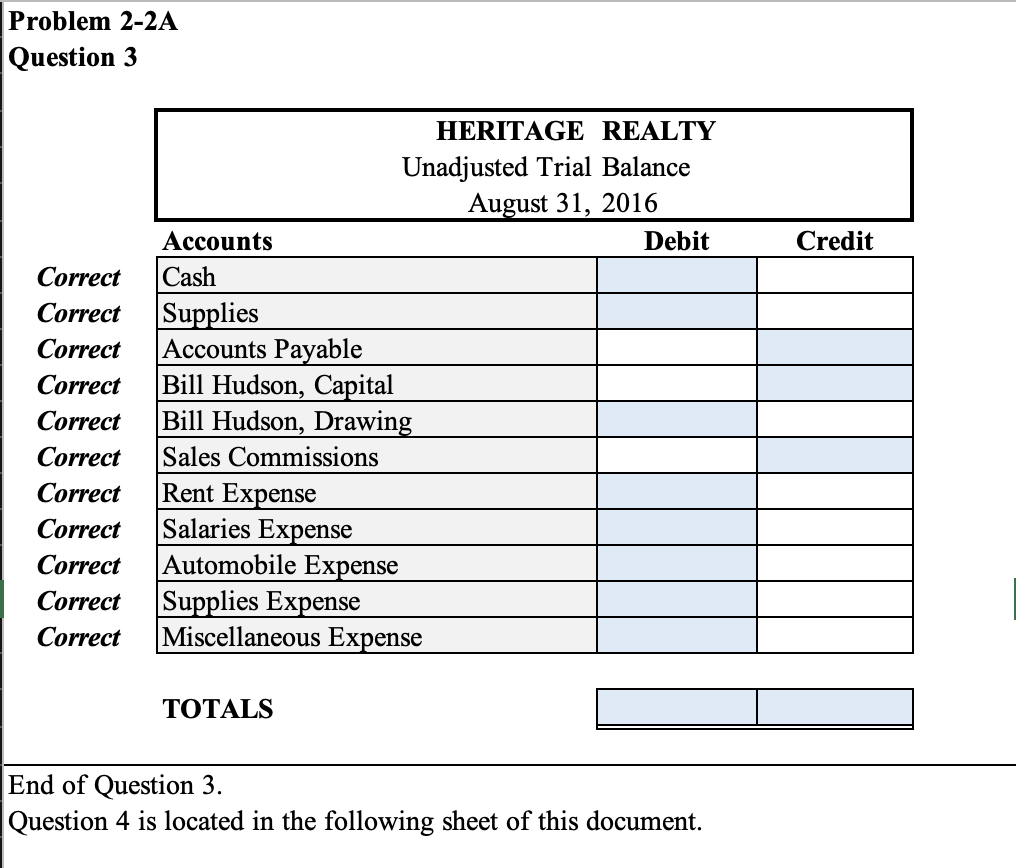

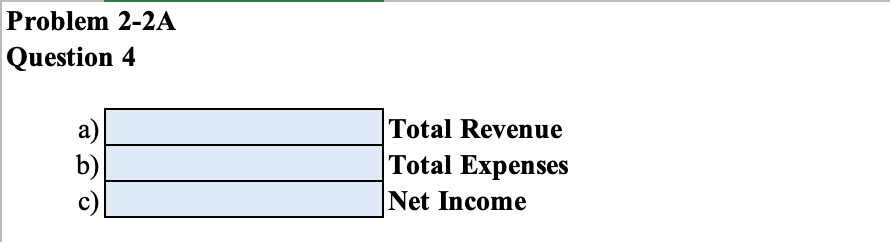

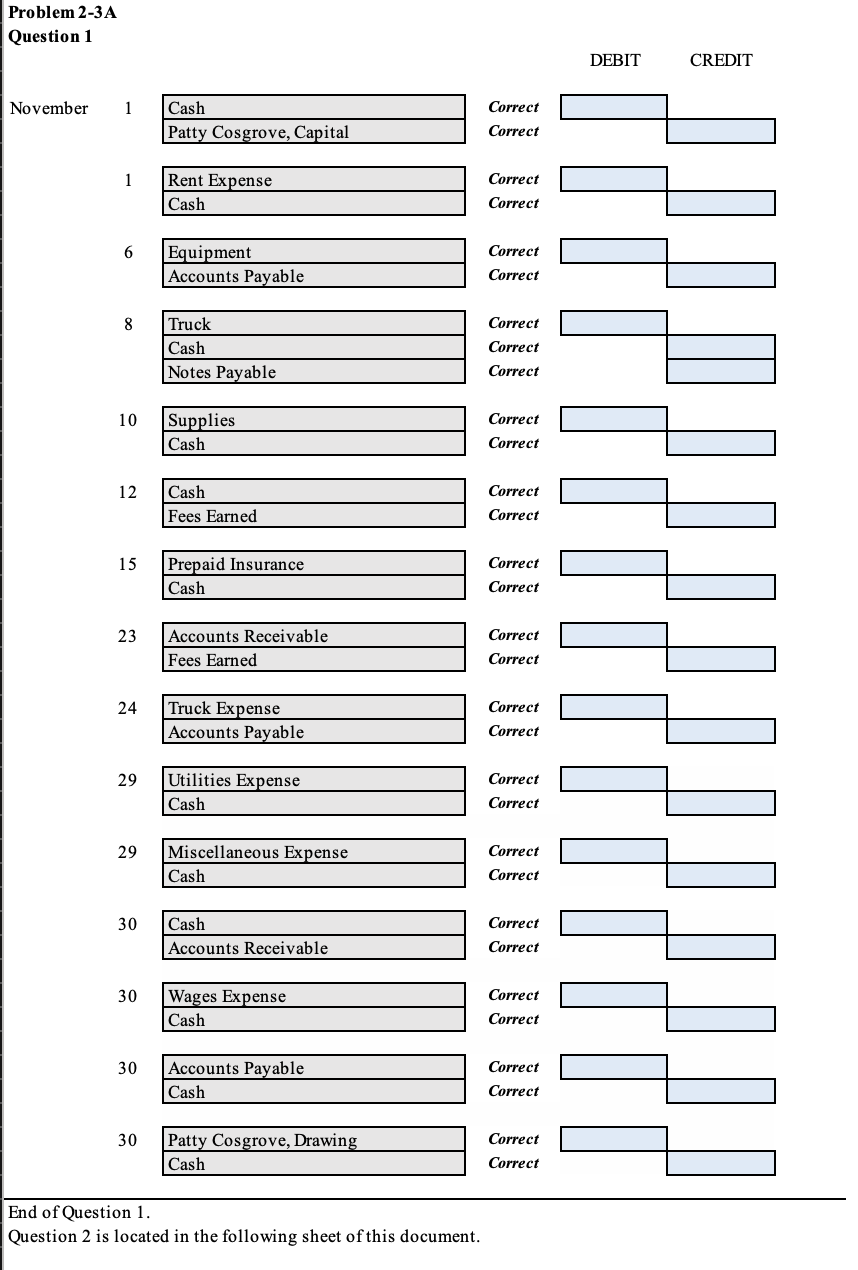

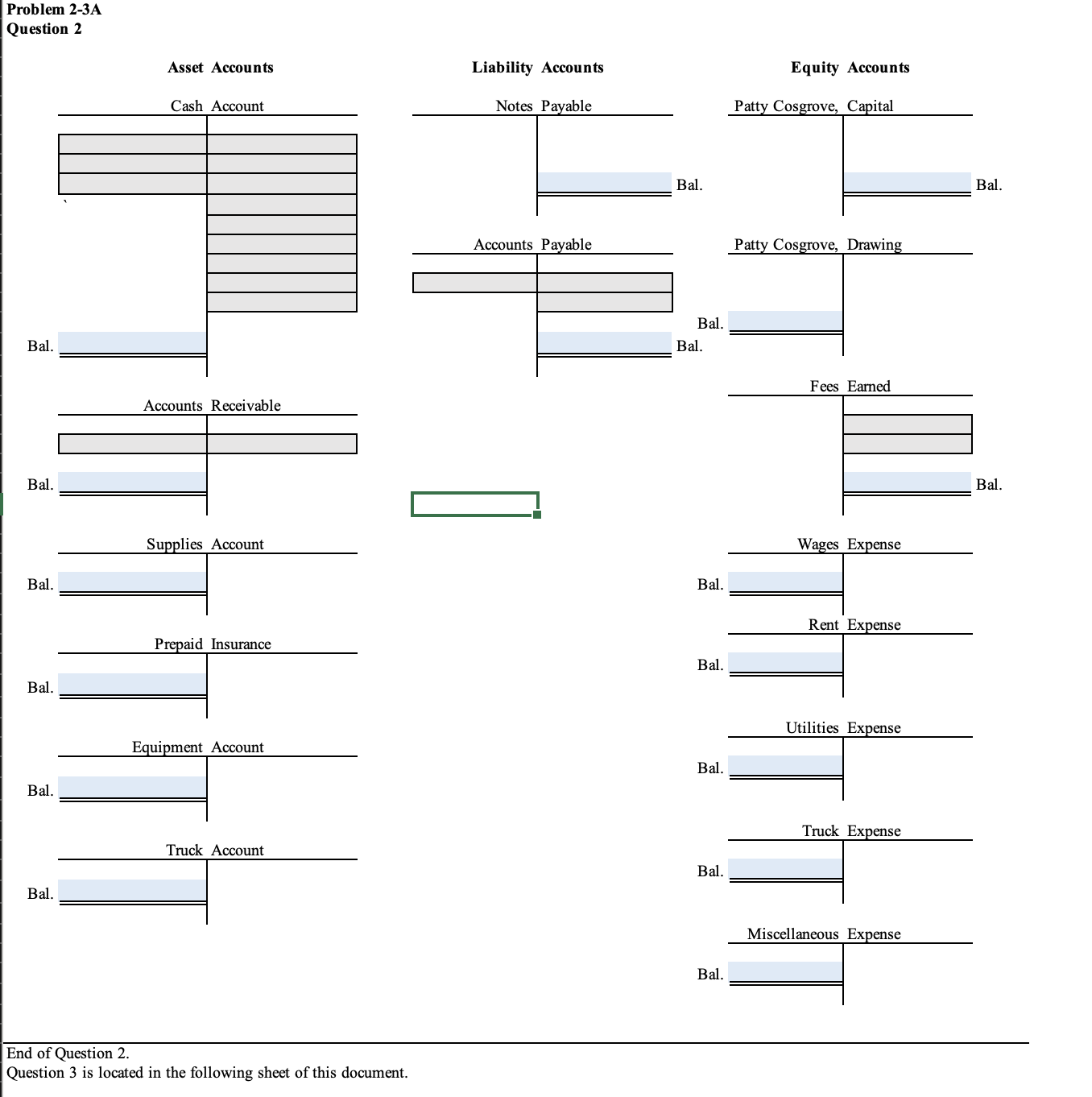

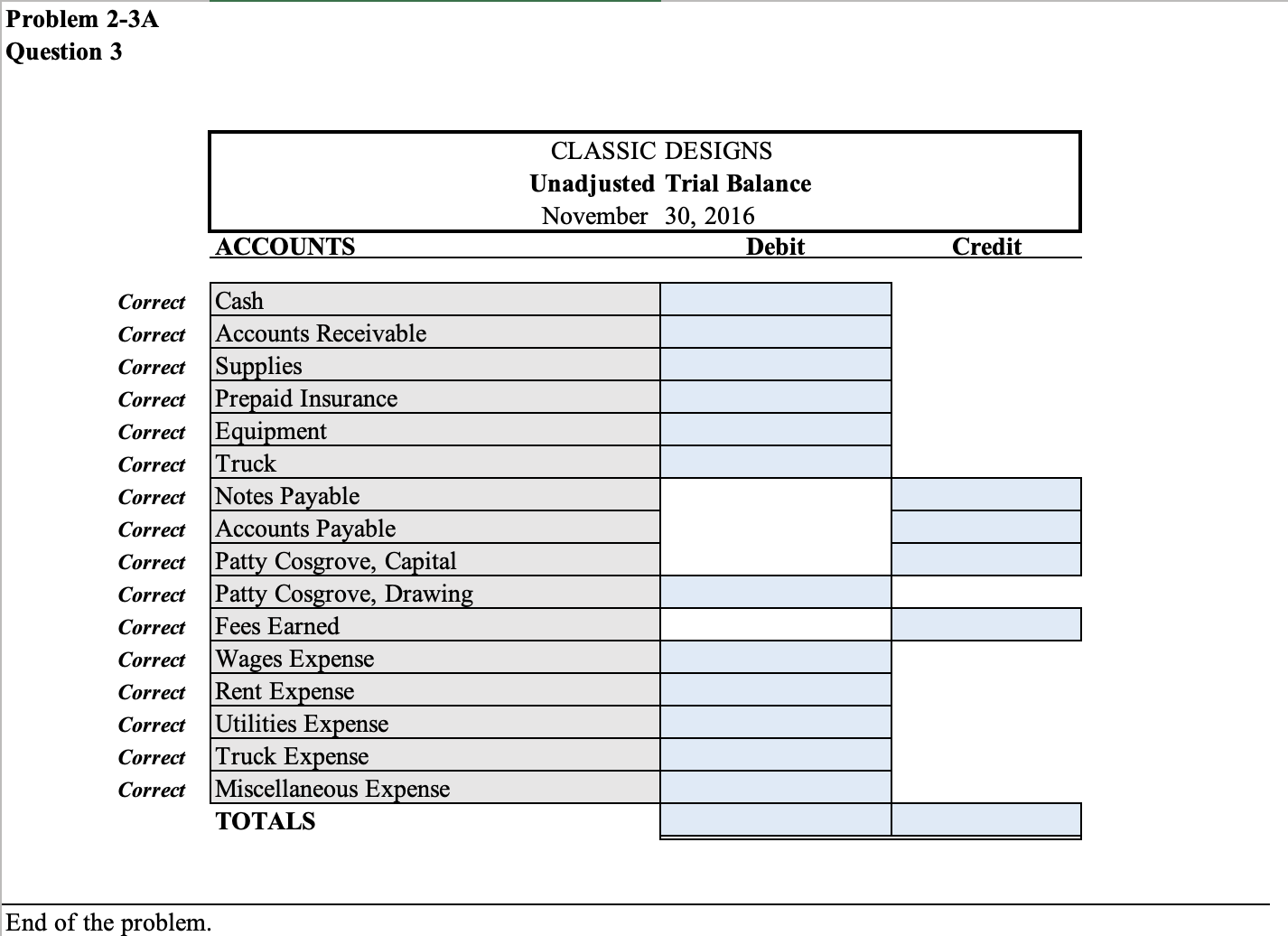

IChapter 2 Problems PR 2-2A journal entries and trial balance Wk 1, 2, 3, 4 On August 1, 2016, Bill Hudson established Heritage Realty, which completed the following transactions during the month: a. Bill Hudson transferred cash from a personal bank account to an account to be used for the business, $30,000. b. Paid rent on office and equipment for the month, $3,250. c. Purchased supplies on account, $2,150. d. Paid creditor on account, $875. e. Earned sales commissions, receiving cash, $14,440. f. Paid automobile expenses (including rental charge) for month, $1,580, and misgek W expenses, $650. g. Paid office salaries, $3,000. h. Determined that the cost of supplies used was $1,300. j, Withdrew cash for personal use, $2,500. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash; Supplies; Accounts Payable; Bill Hudson, Capital; Bill Hudson, Drawing; Sales Commissions; Rent Expense; Office Salaries Expense; Automobile Expense; Supplies Expense; Miscellaneous Expense. Explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 2016. 4. Determine the following: Warren, C. 5., Reeve, J. M., 8: Duchac, J. {2016). Accounting (26 ed.}. Boston, MA: Cengage Learning. a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. PR 2-3A journal entries and trial balance QQJW 1, 2, 3, 4 On November 1, 2016, Patty Cosgrove established an interior decorating business, Classic Designs. During the month of November, Patty completed the following transactions related to the business: 1. Patty transferred cash from a personal bank account to an account to be used for the business, $27,750. 1. Paid rent for period of November 1 to end of month, $4,000. 6. Purchased office equipment on account, $12,880. 8. Purchased a truck for $32,500 paying $6,500 cash and giving a note payable for the remainder. 10. Purchased supplies for cash, $1,860. 12. Received cash for job completed, $7,500. Nov. 15. Paid annual premiums on property and casualty insurance, $2,400. 23. Recorded jobs completed on account and sent invoices to customers, $12,440. 24. Received an invoice for truck expenses, to be paid in November, $1,100. 29. Paid utilities expense, $3,660. 29. Paid miscellaneous expenses, $1,700. 30. Received cash from customers on account, $8,000. 30. Paid wages of employees, $4,750. 30. Paid creditor a portion of the amount owed for equipment purchased on November 6, $6,220. 30. Withdrew cash for personal use, $2,000. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be Warren, C. 5., Reeve, J. M., & Duchac, J. {2016). Accounting (26 ed}. Boston, MA: Cengage Learning. debited and credited. (Do not insert the account numbers in the journal a_t__ th_is__tjr_n_e.) Explanations may be omitted. 11 Cash; 12 Accounts Receivable; 13 Supplies; 14 Prepaid Insurance; 16 Equipment; 18 Truck; 21 Notes Payable; 22 Accounts Payable; 31 Patty Cosgrove, Capital; 32 Patty Cosgrove, Drawing; 41 Fees Earned; 51 Wages Expense; 53 Rent Mg: 54 Utilities Expense; 55 Truck Expense; 59 Miscellaneous Expense; 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Classic Designs as of November 30, 2016. Warren, C. 5., Reeve, J. M., 81 Duchac, J. {2016). Accounting (26 ed.}. Boston, MA: Cengage Learning. Problem 2-2A Question 1 DEBIT CREDIT a) Cash Correct Bill Hudson, Capital Correct b) Rent Expense Correct Cash Correct c) Supplies Correct Accounts Payable Correct d) Accounts Payable Correct Cash Correct e) Cash Correct Sales Commissions Correct f) Automobile Expense Correct Miscellaneous Expense Correct Cash Correct g) Salaries Expense Correct Cash Correct h) Supplies Expense Correct Supplies Correct i) Bill Hudson, Drawing Correct Cash Correct End of Question 1. Question 2 is located in the following sheet of this document.Problem 2-2A Question 2 Cash Account Bal. Supplies Account Bal Accounts Payable Bal. Bill Hudson, Capital Bal. Bill Hudson, Drawing Bal Sales Commissions Bal. Rent Expense Bal. Salaries Expense Bal. Automobile Expense Bal Supplies Expense Bal Miscellaneous Expense Bal. End of Question 2. Question 3 is located in the following sheet of this document.Problem 2-2A Question 3 HERITAGE REALTY Unadjusted Trial Balance Au_ st31, 2016 Accounts Debit Credit Correct Cash Correct ___ Correct Correct Correct ___ Correct ___ Correct ___ Correct ___ Correct ___ Correct ___ Correct ___ TOTALs L;;;;;;;1;;;;;;;1 End of Question 3. Question 4 is located in the following sheet of this document. Problem 2-2A Question 4 Total Revenue Qge Total Expenses Net IncomeProblem 2-3A Question 1 DEBIT CREDIT November Cash Correct Patty Cosgrove, Capital Correct Rent Expense Correct Cash Correct 6 Equipment Correct Accounts Payable Correct 8 Truck Correct Cash Correct Notes Payable Correct 10 Supplies Correct Cash Correct 12 Cash Correct Fees Earned Correct 15 Prepaid Insurance Correct Cash Correct 23 Accounts Receivable Correct Fees Earned Correct 24 Truck Expense Correct Accounts Payable Correct 29 Utilities Expense Correct Cash Correct 29 Miscellaneous Expense Correct Cash Correct 30 Cash Correct Accounts Receivable Correct 30 Wages Expense Correct Cash Correct 30 Accounts Payable Correct Cash Correct 30 Patty Cosgrove, Drawing Correct Cash Correct End of Question 1. Question 2 is located in the following sheet of this document.Problem 2-3A Question 2 Asset Accounts Liability Accounts Equity Accounts Cash Account Notes Payable Patty Cosgrove, Capital Bal Bal. Accounts Payable Patty Cosgrove, Drawing Bal Bal. Bal. Fees Earned Accounts Receivable Bal. Bal. Supplies Account Wages Expense Bal Bal. Rent Expense Prepaid Insurance Bal. Bal. Utilities Expense Equipment Account Bal. Bal. Truck Expense Truck Account Bal. Bal. Miscellaneous Expense Bal End of Question 2. Question 3 is located in the following sheet of this document.Problem 2-3A Question 3 CLASSIC DESIGNS Unadjusted Trial Balance November 30, 2016 ACCOUNTS Debit Credit Correct Cash Correct Accounts Receivable Correct Supplies Correct Prepaid Insurance Correct Equipment Correct Truck Correct Notes Payable Correct Accounts Payable Correct Patty Cosgrove, Capital Correct Patty Cosgrove, Drawing Correct Fees Earned Correct Wages Expense Correct Rent Expense Correct Utilities Expense Correct Truck Expense Correct Miscellaneous Expense TOTALS End of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts