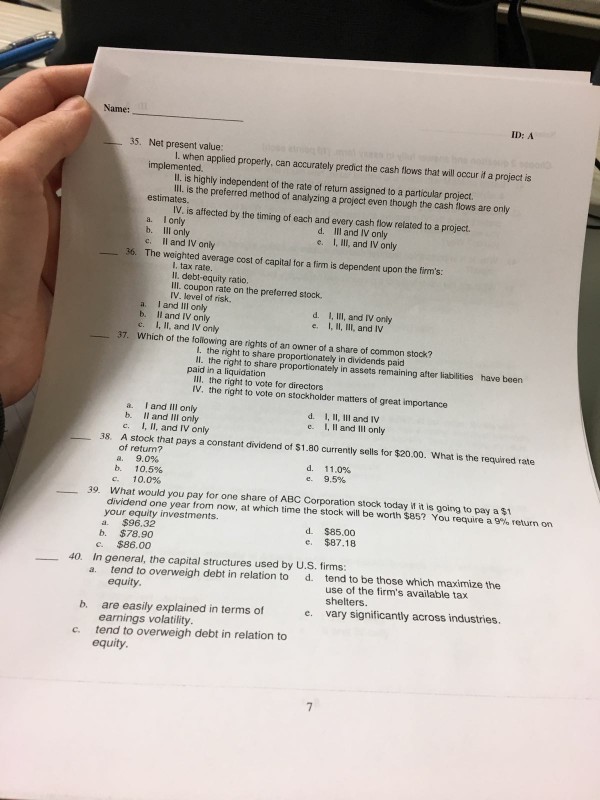

Question: ID: A 35. Net present value: implemented. applied properly, can accurately predict the cashflows that will occur if a project is is highly independent the

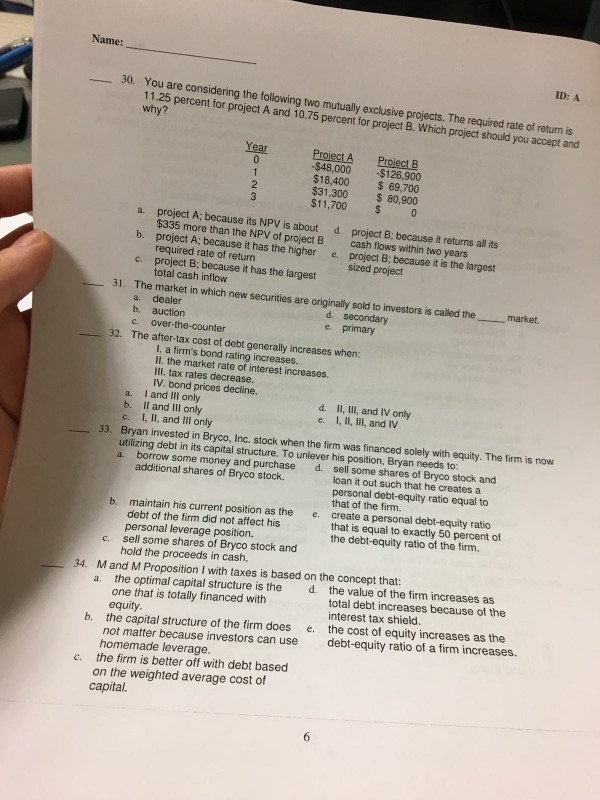

ID: A 35. Net present value: implemented. applied properly, can accurately predict the cashflows that will occur if a project is is highly independent the rate of re wo a project. Ill. is the preferred method a project even though the cash flows are only estimates. IV. is affected by the timing of each and every cash flow related to a project. only only and I only c, ll and only e. I, Ill, and IV only 36 The weighted average cost capital a firm is dependent upon the firm's rate of for I. ratio, Ill., coupon rate on the preferred stock. IV. level of risk. I and III only ll and IV only d. I, III, and IV only c. I, II, and IV only e, I, II, III, and IV Which of the following are rights of the to share proportionately stock? paid in a right share in dividends paid liquidation proportionately in assets remaining after liabilities have been Ill, the to vote for directors IV. the right to vote on stockholder matters of great importance a. I and Ill only b. II and III only and IV 38. c. I, II, and IV only e- i, ll and Ill only A stock that pays a constant dividend of s1.80 currently sells for $20.00. What is the required rate 10,5% 11.0% 10.0% 39. What would you pay for one share of ABC Corporation stock today if it is going to pay a$1 dividend one year from now, at which time the stock will be worth $85? You require a 9% on your equity investments. a. $96.32 return d- $85.00 b. $78.90 ee. $87.18 c. $86.00 40. In general, the capital structures used by U.S. firms: a. tend to overweigh debt in relation to d. tend to be those which maximize the equity. use of the firm's available tax shelters b. are easily explained in terms of e. vary significantly across industries earnings volatility. c tend to overweigh debt in relation to equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts