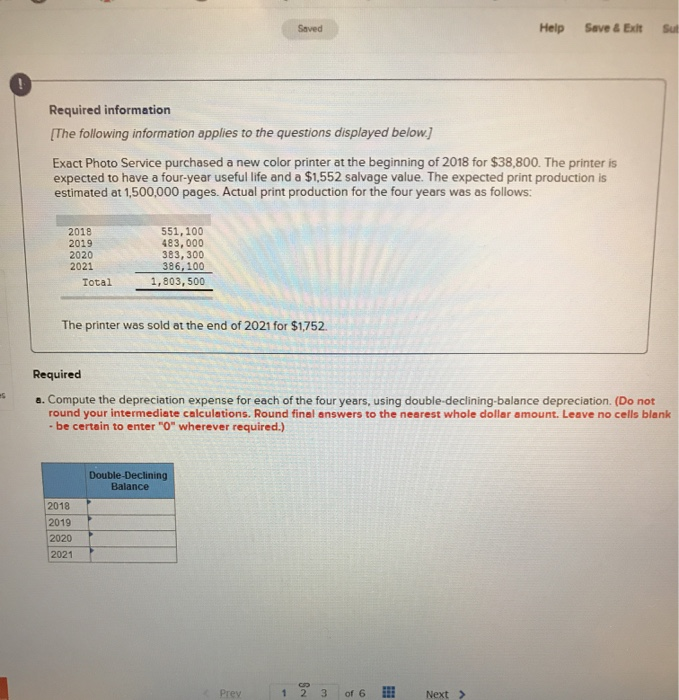

Question: i'd appreciate some help! Save & Exit Help Su Saved Required information [The following information applies to the questions displayed below Exact Photo Service purchased

i'd appreciate some help!

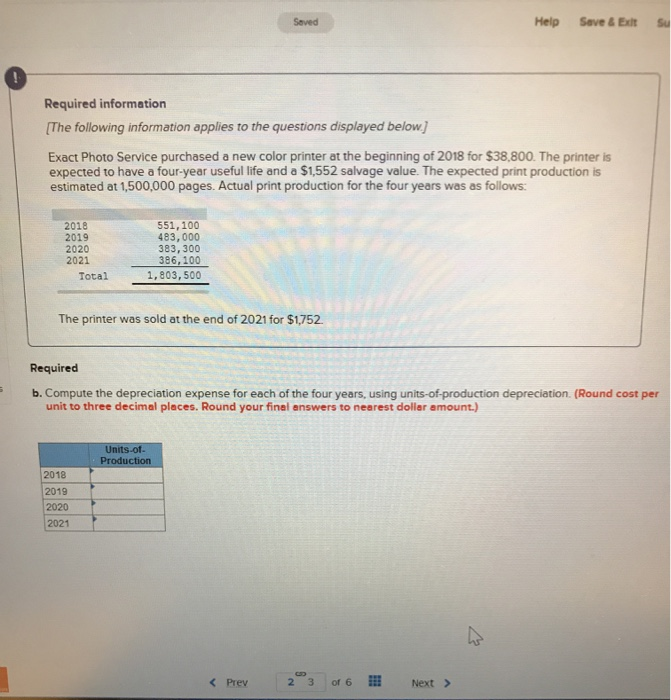

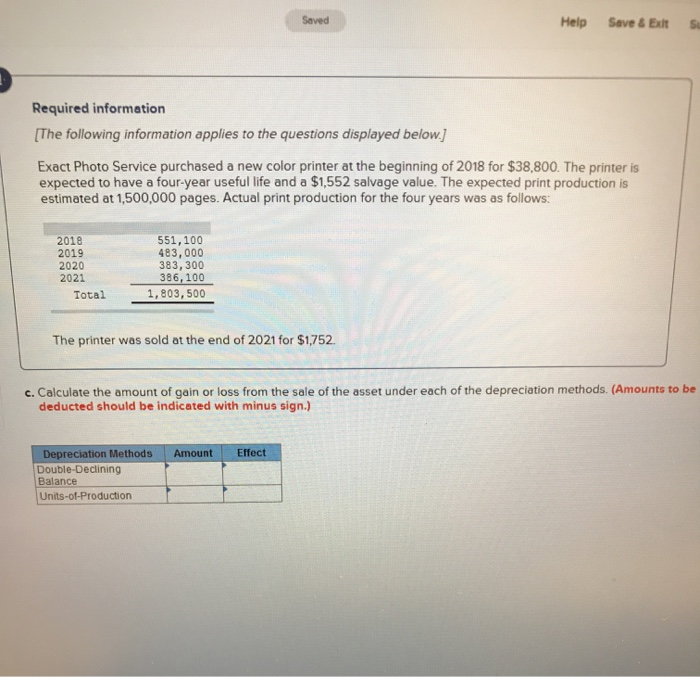

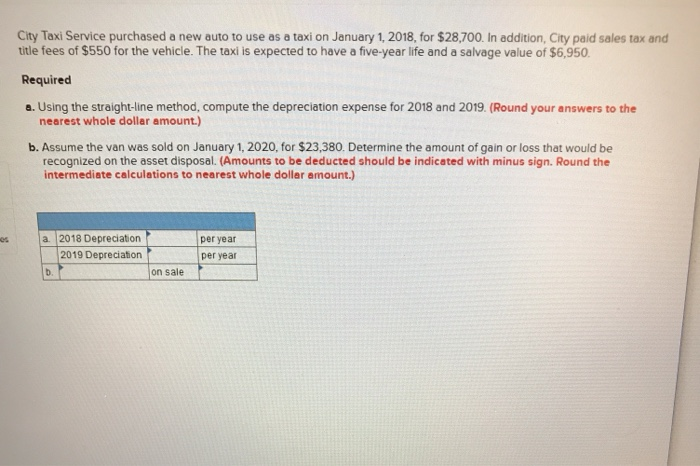

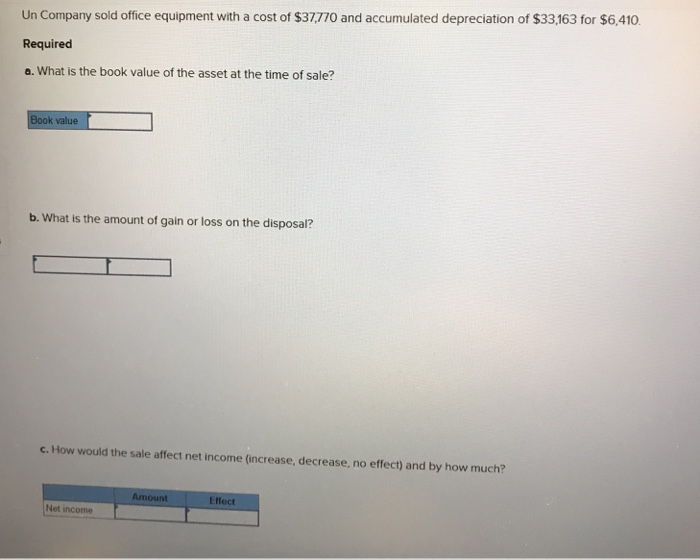

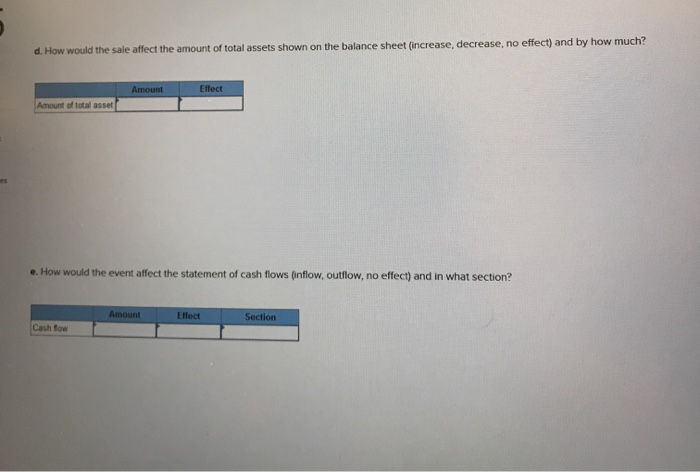

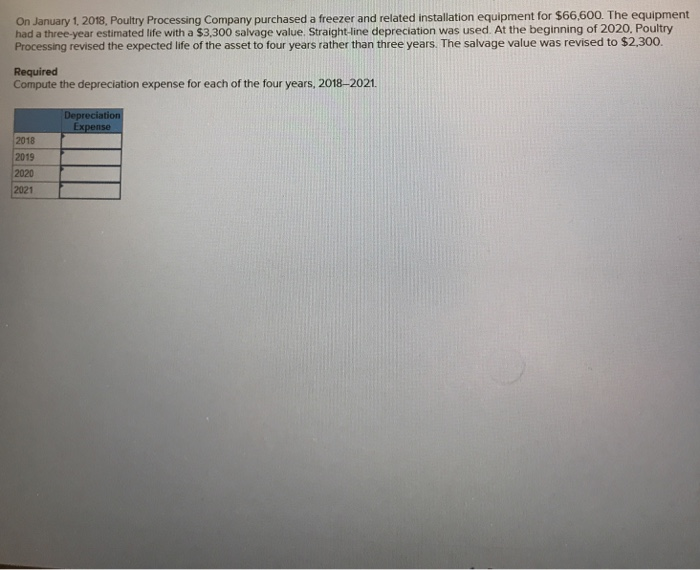

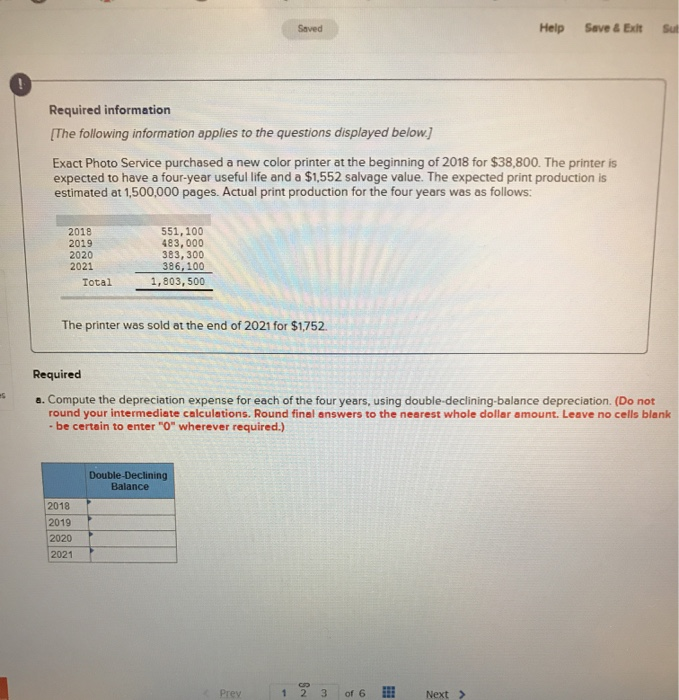

Save & Exit Help Su Saved Required information [The following information applies to the questions displayed below Exact Photo Service purchased a new color printer at the beginning of 2018 for $38,800. The printer is expected to have a four-year useful life and a $1,552 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: 2018 551,100 483,000 383, 300 386,100 2019 2020 2021 1,803, 500 Iotal The printer was sold at the end of 2021 for $1,752 Required a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. (Do not round your intermediate calculations. Round final answers to the nearest whole dollar amount. Leave no cells blank - be certain to enter "O" wherever required.) Double-Declining Balance 2018 2019 2020 2021 Prev 1 of 6 Next Help Save &Exit Saved Required information The following information applies to the questions displayed below] Exact Photo Service purchased a new color printer at the beginning of 2018 for $38,800. The printer is expected to have a four-year useful life and a $1,552 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: 551,100 483,000 383,300 386,100 2018 2019 2020 2021 1,803,500 Total The printer was sold at the end of 2021 for $1,752 Required b. Compute the depreciation expense for each of the four years, using units-of-production depreciation. (Round cost per unit to three decimal places. Round your finel answers to nearest dollar amount.) Units-of Production 2018 2019 2020 2021 Saved Help Save&Exit Required information [The following information applies to the questions displayed below. Exact Photo Service purchased a new color printer at the beginning of 2018 for $38,800. The printer is expected to have a four-year useful life and a $1,552 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: 2018 2019 2020 551,100 483, 000 383,300 386,100 2021 1,803, 500 Total The printer was sold at the end of 2021 for $1,752 c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation methods. (Amounts to be deducted should be indicated with minus sign.) Depreciation Methods Double-Declining Amount Effect Balance Units-of-Production City Taxi Service purchased a new auto to use as a taxi on January 1, 2018, for $28,700. In addition, City paid sales tax and title fees of $550 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $6,950 Required a. Using the straight-line method, compute the depreciation expense for 2018 and 2019. (Round your answers to the nearest whole dollar amount.) b. Assume the van was sold on January 1, 2020, for $23,380. Determine the amount of gain or loss that would be recognized on the asset disposal. (Amounts to be deducted should be indicated with minus sign. Round the intermediate calculations to nearest whole dollar amount.) a. 2018 Depreciation 2019 Depreciation per year per year b. on sale Un Company sold office equipment with a cost of $37,770 and accumulated depreciation of $33,163 for $6,410 Required a. What is the book value of the asset at the time of sale? Book value b. What is the amount of gain or loss on the disposal? c. How would the sale affect net income (increase, decrease, no effect) and by how much? Amount Effect Net income d. How would the sale affect the amount of total assets shown on the balance sheet (increase, decrease, no effect) and by how much? Effect Amount Amount of total asset e. How would the event affect the statement of cash flows (inflow, outflow, no effect) and in what section? Amount Effect Section Cash fow On January 1, 2018, Poultry Processing Company purchased a freezer and related installation equipment for $66,600. The equipment had a three-year estimated life with a $3,300 salvage value. Straight-line depreciation was used. At the beginning of 2020, Poultry Processing revised the expected life of the asset to four years rather than three years. The salvage value was revised to $2,300. Required Compute the depreciation expense for each of the four years, 2018-2021. Depreciation Expense 2018 2019 2020 2021