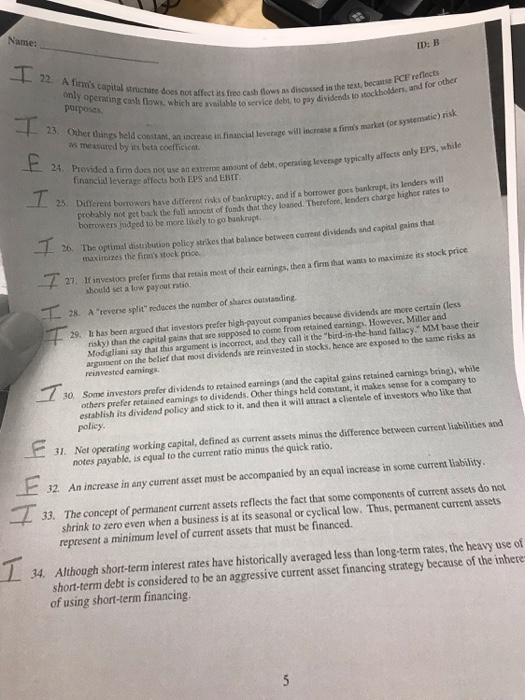

Question: ID: B 22. A firm's capital structute does not affect its freo cash flows as discussed in the text, because reflects its free dre available

ID: B 22. A firm's capital structute does not affect its freo cash flows as discussed in the text, because reflects its free dre available to service debi, to pay divideeds to stockbolders, and for es held constant, an increase in financial leversge will increase a firm's market (or sy as measured by its beta coefficient. (or systematic) risk 24. Provided a firm does not use an extreme asmount typically affects only EPS, while financial leverage affects both EPS and EBIr. 25. Different borowen have differest risks of bankruptcy, aod if a borrower goes bunkmupt probably not get back the fall lenders w mount of funds that they loaned. Therefore, lenders charge highcr rates to wers judged to be more likely to go buakrupt. optimal distribution policy strikes that balance betweea current dividends and capital gains that maximizes the firm's stock price. 27. If investoes prefer firms that retaia most of their earnings, then a firms that wants to maximize its stock price 28. A "reverse split reduces the number of shares outstanding 29, 11 has been argued that investors prefer high-payout companies because dividends are more certain should set a low payout rnatio. less risky) than the capital gains that are supposed to come from retained earnings. However, Miller and Modigliani say that this argument is incorrect, and they call it the "bird-in-the hand fallacy. MM base their argument on the belief that most dividends are reinvested in stocks, hence are exposed to the same risks as reinvested carnings. investors prefer dividends to retained earnings (and the capital gains retained carnings bring), while company to others prefer retained eamings to dividends. Other things held constant, it makes sense for a policy establish its dividend policy and stick to it, and then it will attract a clientele of investors who like that Ne curimt scts minus the difece betven carens lasilites n notes payable, is equal to the current ratio minus the quick ratio. 32. An increase in any current asset must be accompanied by an equal increase in some current liability 33. The concept of permanent current assets reflects the fact that some components of current assets do not shrink to zero even when a business is at its seasonal or cyclical low. Thus, permanent current assets represent a minimum level of current assets that must be financed. 34. Although short-term interest rates have historically averaged less than long-term rates, the heavy use of short-term debt is considered to be an aggressive current asset financing strategy because of the inhere of using short-term financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts