Question: ID Module 2 - Working Capital Management Cont'l. (Answer Owes 8 OR) You are asked to make a decision to invest in one of two

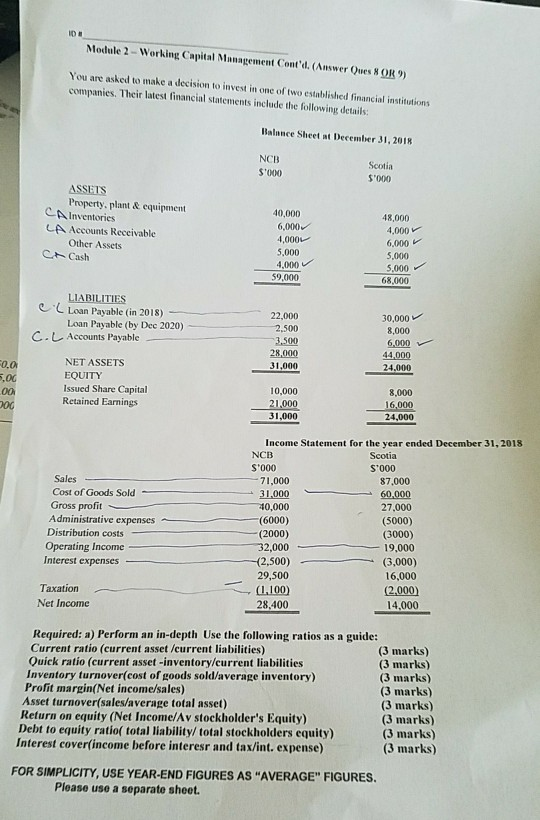

ID Module 2 - Working Capital Management Cont'l. (Answer Owes 8 OR) You are asked to make a decision to invest in one of two established financial institutions companies. Their latest financial statements include the following details: Balance Sheet at December 31, 2018 NCB $000 Scotia $'000 ASSETS Property, plant & equipment CAInventories LA Accounts Receivable Other Assets C Cash 40,000 6,000 4,000 5.000 48,000 4,000 6.000 4.000 5.000 5.000 68,000 59,000 LIABILITIES CL Loan Payable in 2018) Loan Payable (by Dec 2020) c. Accounts Payable NET ASSETS EQUITY Issued Share Capital Retained Earnings 22,000 2.500 3.500 28.000 31,000 30,000 8,000 6.000 44,000 24.000 0.0 5.00 00 DOC 10,000 21,000 31,000 8,000 16,000 24,000 Sales Cost of Goods Sold Gross profit Administrative expenses Distribution costs Operating Income Interest expenses Income Statement for the year ended December 31, 2018 NCB Scotia S'000 S'000 71,000 87.000 31,000 60,000 40,000 27,000 (6000) (5000) (2000) (3000) 32,000 19,000 -(2,500) (3.000) 29,500 16,000 (1.100) (2.000) 28.400 14,000 Taxation Net Income Required: a) Perform an in-depth Use the following ratios as a guide: Current ratio (current asset /current liabilities) (3 marks) Quick ratio (current asset - inventory/current liabilities (3 marks) Inventory turnover(cost of goods sold/average inventory) (3 marks) Profit margin(Net income/sales) (3 marks) Asset turnover(sales/average total asset) (3 marks) Return on equity (Net Income/Av stockholder's Equity) (3 marks) Debt to equity ratio total liability/total stockholders equity) (3 marks) Interest cover(income before interesr and tax/int. expense) (3 marks) FOR SIMPLICITY, USE YEAR-END FIGURES AS "AVERAGE" FIGURES. Please use a separate sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts