Question: ID The next two (2) questions are based on the following information: An investor purchases a bond with a 10% annual coupon rate paid semi-annually

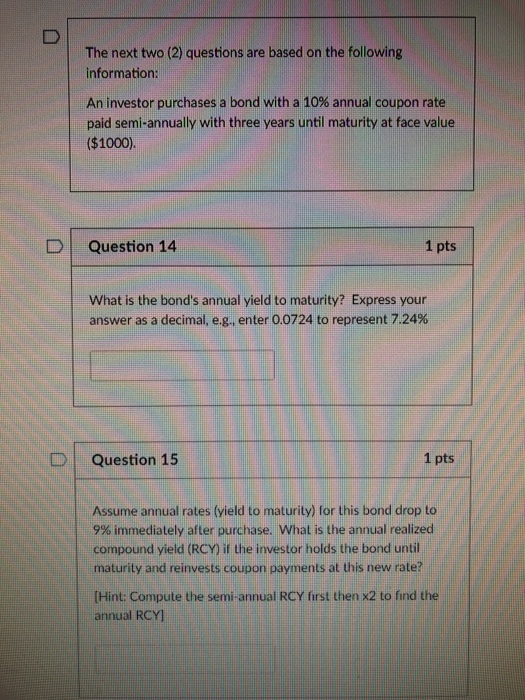

ID The next two (2) questions are based on the following information: An investor purchases a bond with a 10% annual coupon rate paid semi-annually with three years until maturity at face value ($1000). D | Question 14 1 pts What is the bond's annual yield to maturity? Express your answer as a decimal, eg., enter 0.0724 to represent 7.24% D | Question 15 1 pts Assume annual rates (yield to maturity) for this bond drop to 9% immediately after purchase. What is the annual realized compound yield (RCY) if the investor holds the bond until maturity and reinvests coupon payments at this new rate? Hint: Compute the semi-annual RCY first then x2 to find the annual RCY] ID The next two (2) questions are based on the following information: An investor purchases a bond with a 10% annual coupon rate paid semi-annually with three years until maturity at face value ($1000). D | Question 14 1 pts What is the bond's annual yield to maturity? Express your answer as a decimal, eg., enter 0.0724 to represent 7.24% D | Question 15 1 pts Assume annual rates (yield to maturity) for this bond drop to 9% immediately after purchase. What is the annual realized compound yield (RCY) if the investor holds the bond until maturity and reinvests coupon payments at this new rate? Hint: Compute the semi-annual RCY first then x2 to find the annual RCY]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts