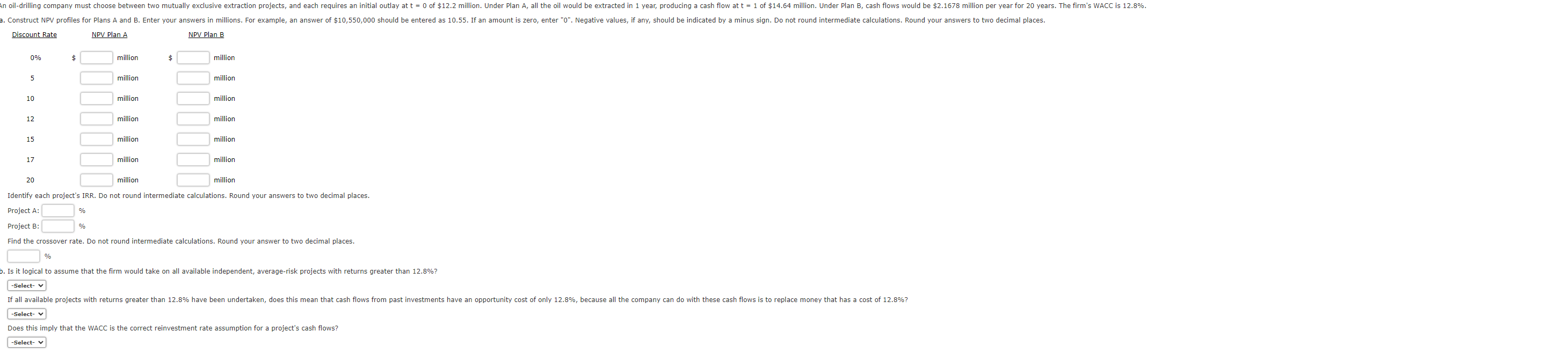

Question: Identify each project's IRR. Do not round intermediate calculations. Round your answers to two decimal places. Project A: Project B Find the crossover rate. Do

Identify each project's IRR. Do not round intermediate calculations. Round your answers to two decimal places. Project A: Project B Find the crossover rate. Do not round intermediate calculations. Round your answer to two decimal places. Is it logical to assume that the firm would take on all available independent, average-risk projects with returns greater than 12.8% ? Does this imply that the WACC is the correct reinvestment rate assumption for a project's cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts