Question: Identify future taxable amounts and future deductible amounts A difference of when a revenue (or gain)/expense (or loss) is included in financial income and when

Identify future taxable amounts and future deductible amounts

A difference of when a revenue (or gain)/expense (or loss) is included in financial income and when it is included in taxable income is referred to as a temporary difference. A temporary difference originates in one period and reverses in a subsequent period. Temporary differences will result in taxable or deductible amounts in future periods. A future taxable amount means future taxable income will be increased relative to pretax accounting income, whereas a future deductible amount means taxable income will be decreased relative to accounting income, when that temporary difference reverses. Deferred tax liabilities are recognized for all taxable temporary differences. Deferred tax assets are recognized for all deductible temporary differences (and operating loss carryforwards).

write the journal entry and highlight balance sheet account, 2) highlight or circle the items in the shaded parts of the statement.

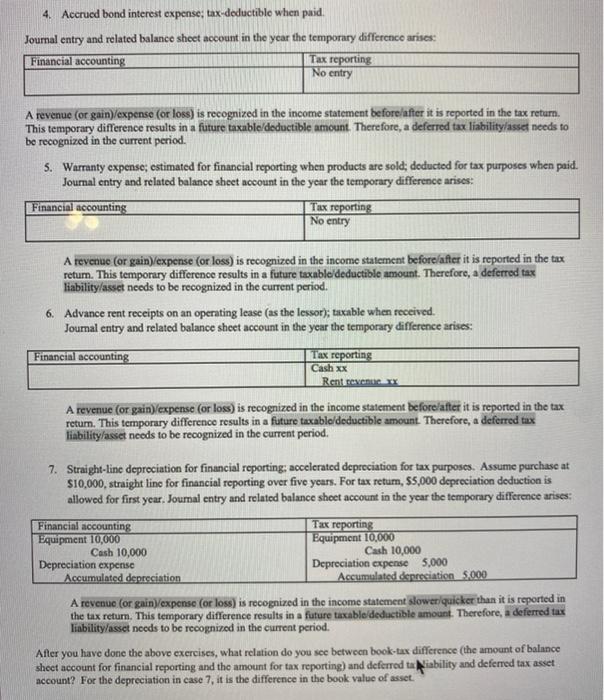

4. Accrued bond interest expense; tax-deductible when paid. Journal entry and related balance sheet account in the year the temporary difference arises: Financial accounting A revenue (or gain)/expense (or loss) is recognized in the income statement before/after it is reported in the tax return. This temporary difference results in a future taxable/deductible amount. Therefore, a deferred tax liability/asset needs to be recognized in the current period. 5. Warranty expense; estimated for financial reporting when products are sold; deducted for tax purposes when paid. Journal entry and related balance sheet account in the year the temporary difference arises: Financial accounting Tax reporting No entry A revenue (or gain)/expense (or loss) is recognized in the income statement before/after it is reported in the tax return. This temporary difference results in a future taxable/deductible amount. Therefore, a deferred tax liability/asset needs to be recognized in the current period. 6. Advance rent receipts on an operating lease (as the lessor); taxable when received. Journal entry and related balance sheet account in the year the temporary difference arises: Financial accounting Tax reporting No entry Financial accounting Equipment 10,000 Cash 10,000 A revenue (or gain)/expense (or loss) is recognized in the income statement before/after it is reported in the tax return. This temporary difference results in a future taxable/deductible amount. Therefore, a deferred tax liability/asset needs to be recognized in the current period. Depreciation expense Tax reporting Cash xx 7. Straight-line depreciation for financial reporting; accelerated depreciation for tax purposes. Assume purchase at $10,000, straight line for financial reporting over five years. For tax return, $5,000 depreciation deduction is allowed for first year. Journal entry and related balance sheet account in the year the temporary difference arises: Rent revenue XX Tax reporting Equipment 10,000 Cash 10,000 Depreciation expense 5,000 Accumulated depreciation 5.000 Accumulated depreciation A revenue (or gain)/expense (or loss) is recognized in the income statement slower/quicker than it is reported in the tax return. This temporary difference results in a future taxable/deductible amount. Therefore, a deferred tax liability/asset needs to be recognized in the current period. After you have done the above exercises, what relation do you see between book-tax difference (the amount of balance sheet account for financial reporting and the amount for tax reporting) and deferred ta Niability and deferred tax asset account? For the depreciation in case 7, it is the difference in the book value of asset.

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

The journal entry to record a deferred tax liability for a future taxable amount would be Debit Defe... View full answer

Get step-by-step solutions from verified subject matter experts