Question: identify several risks that you are exposed to (minimum 10), evaluate the probability and severity of the loss from each of these risks and identify

identify several risks that you are exposed to (minimum 10), evaluate the probability and severity of the loss from each of these risks and identify ways you can manage these risks. Then determine your appropriate risk management alternative for each of these identified risks and explain why you chose this management alternative.

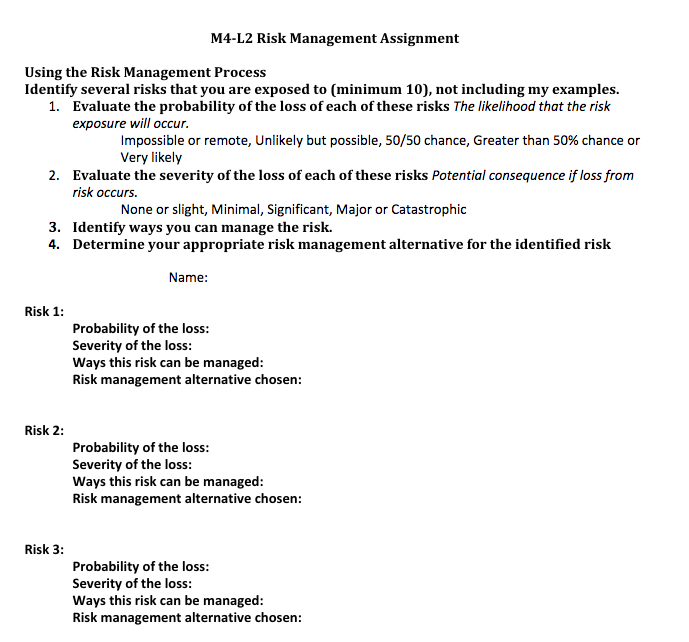

Using the Risk Management Process Identify several risks that you are exposed to (minimum 10), not including my examples. 1. Evaluate the probability of the loss of each of these risks The likelihood that the risk exposure will occur. Impossible or remote, Unlikely but possible, 50/50 chance, Greater than 50% chance or Very likely 2. Evaluate the severity of the loss of each of these risks Potential consequence if loss from risk occurs. None or slight, Minimal, Significant, Major or Catastrophic 3. Identify ways you can manage the risk. 4. Determine your appropriate risk management alternative for the identified risk Name: Risk 1: Probability of the loss: Severity of the loss: Ways this risk can be managed: Risk management alternative chosen: Risk 2: Probability of the loss: Severity of the loss: Ways this risk can be managed: Risk management alternative chosen: Risk 3: Probability of the loss: Severity of the loss: Ways this risk can be managed: Risk management alternative chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts