Question: Identify situations when implementing a nonqualified plan is appropriate for an employer. I. When an employer wants to provide a deferred compensation benefit for all

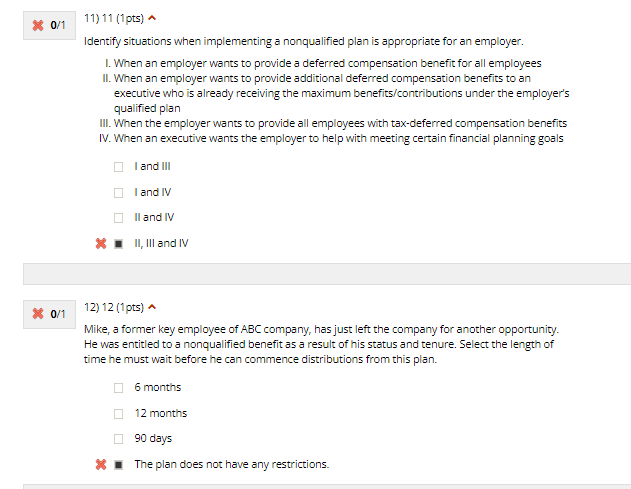

Identify situations when implementing a nonqualified plan is appropriate for an employer. I. When an employer wants to provide a deferred compensation benefit for all employees II. When an employer wants to provide additional deferred compensation benefits to an executive who is already receiving the maximum benefits/contributions under the employer's qualified plan III. When the employer wants to provide all employees with tax-deferred compensation benefits IV. When an executive wants the employer to help with meeting certain financial planning goals | and III I and IV II and IV * II, III and IV 12) 12 (1pts) ^ Mike, a former key employee of ABC company, has just left the company for another opportunity. He was entitled to a nonqualified benefit as a result of his status and tenure. Select the length of time he must wait before he can commence distributions from this plan. 6 months 12 months 90 days * The plan does not have any restrictions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts