Question: Identify some common forms of long - term liabilities. Explain how the repayment pattern of an installment note differs from that of a bond. For

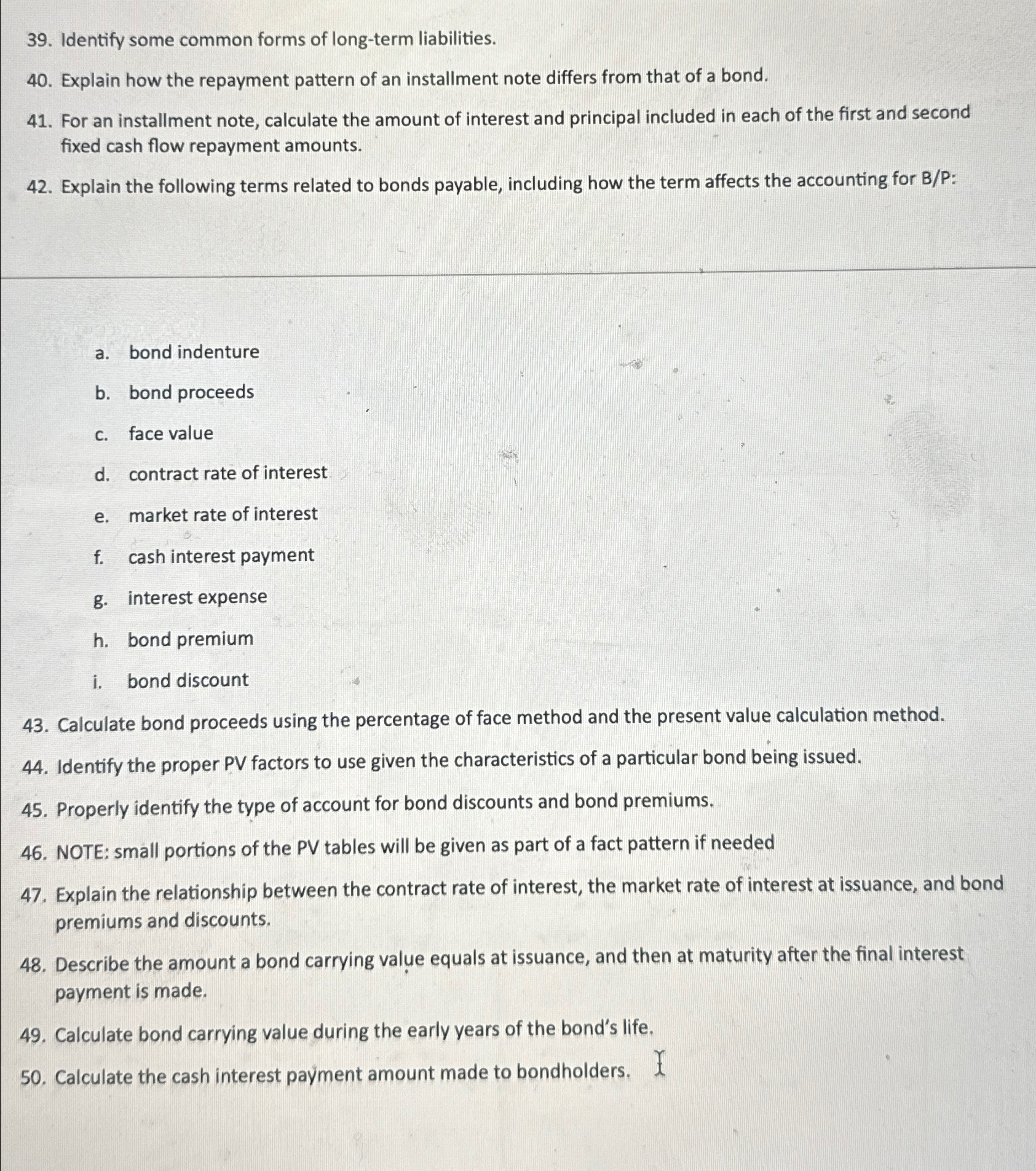

Identify some common forms of longterm liabilities.

Explain how the repayment pattern of an installment note differs from that of a bond.

For an installment note, calculate the amount of interest and principal included in each of the first and second fixed cash flow repayment amounts.

Explain the following terms related to bonds payable, including how the term affects the accounting for :

a bond indenture

b bond proceeds

c face value

d contract rate of interest

e market rate of interest

f cash interest payment

g interest expense

h bond premium

i bond discount

Calculate bond proceeds using the percentage of face method and the present value calculation method.

Identify the proper PV factors to use given the characteristics of a particular bond being issued.

Properly identify the type of account for bond discounts and bond premiums.

NOTE: small portions of the PV tables will be given as part of a fact pattern if needed

Explain the relationship between the contract rate of interest, the market rate of interest at issuance, and bond premiums and discounts.

Describe the amount a bond carrying value equals at issuance, and then at maturity after the final interest payment is made.

Calculate bond carrying value during the early years of the bond's life.

Calculate the cash interest payment amount made to bondholders.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock