Question: Identify the choice that best completes the statement or answers the question. 1. Under the Markowitz framework investors: A. are assumed to be risk-seekers. B.

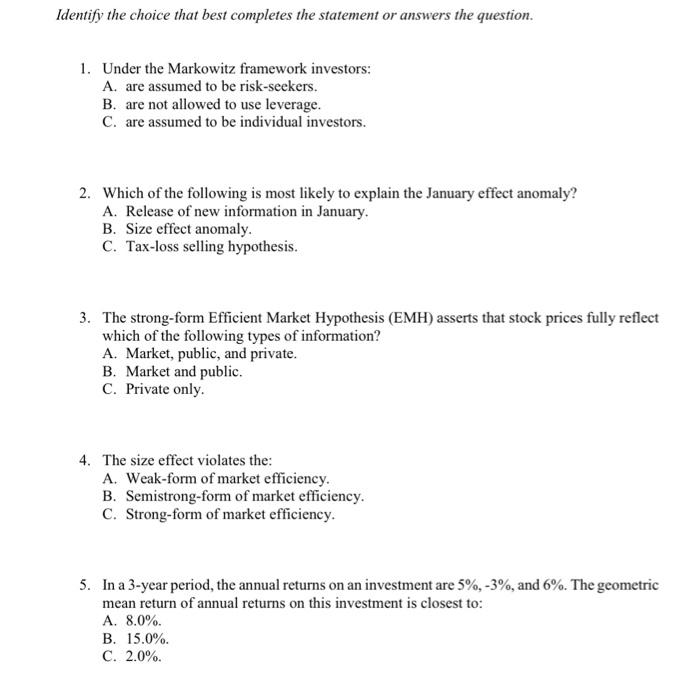

Identify the choice that best completes the statement or answers the question. 1. Under the Markowitz framework investors: A. are assumed to be risk-seekers. B. are not allowed to use leverage. C. are assumed to be individual investors. 2. Which of the following is most likely to explain the January effect anomaly? A. Release of new information in January B. Size effect anomaly. C. Tax-loss selling hypothesis. 3. The strong-form Efficient Market Hypothesis (EMH) asserts that stock prices fully reflect which of the following types of information? A. Market, public, and private. B. Market and public. C. Private only. 4. The size effect violates the: A. Weak-form of market efficiency. B. Semistrong-form of market efficiency. C. Strong-form of market efficiency. 5. In a 3-year period, the annual returns on an investment are 5%, -3%, and 6%. The geometric mean return of annual returns on this investment is closest to: A. 8.0%. B. 15.0%. C. 2.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts