Question: Identify the choice that best completes the statement or answers the question. 1. According to Modigliani and Miller's Proposition I without taxes: A. bankruptcy risk

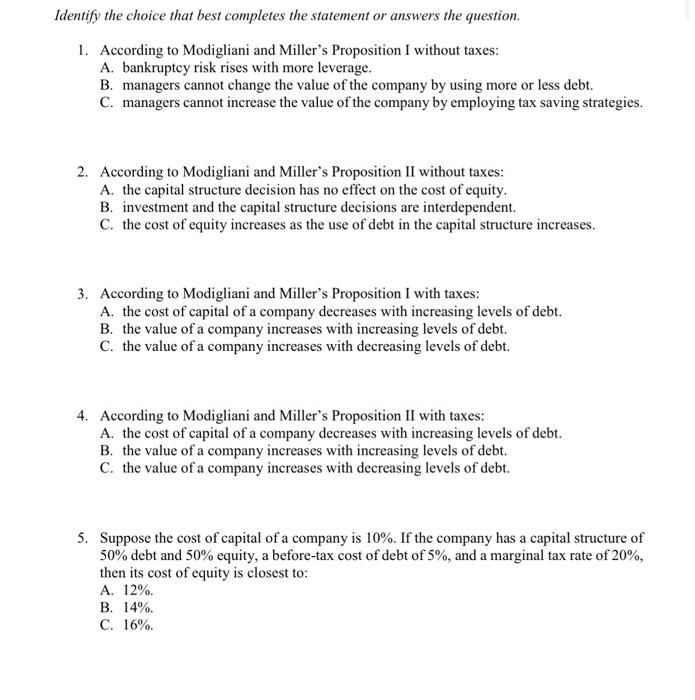

Identify the choice that best completes the statement or answers the question. 1. According to Modigliani and Miller's Proposition I without taxes: A. bankruptcy risk rises with more leverage. B. managers cannot change the value of the company by using more or less debt. C. managers cannot increase the value of the company by employing tax saving strategies. 2. According to Modigliani and Miller's Proposition II without taxes: A. the capital structure decision has no effect on the cost of equity. B. investment and the capital structure decisions are interdependent. C. the cost of equity increases as the use of debt in the capital structure increases. 3. According to Modigliani and Miller's Proposition I with taxes: A. the cost of capital of a company decreases with increasing levels of debt. B. the value of a company increases with increasing levels of debt. C. the value of a company increases with decreasing levels of debt. 4. According to Modigliani and Miller's Proposition II with taxes: A. the cost of capital of a company decreases with increasing levels of debt. B. the value of a company increases with increasing levels of debt. C. the value of a company increases with decreasing levels of debt. 5. Suppose the cost of capital of a company is 10%. If the company has a capital structure of 50% debt and 50% equity, a before-tax cost of debt of 5%, and a marginal tax rate of 20%, then its cost of equity is closest to: A. 12%. B. 14%. C. 16%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts