Question: Identify the CORRECT explanation about marketable instruments in the * 1 point money market: A. Eumodollars is a non-tradable instrument where international investor deposited the

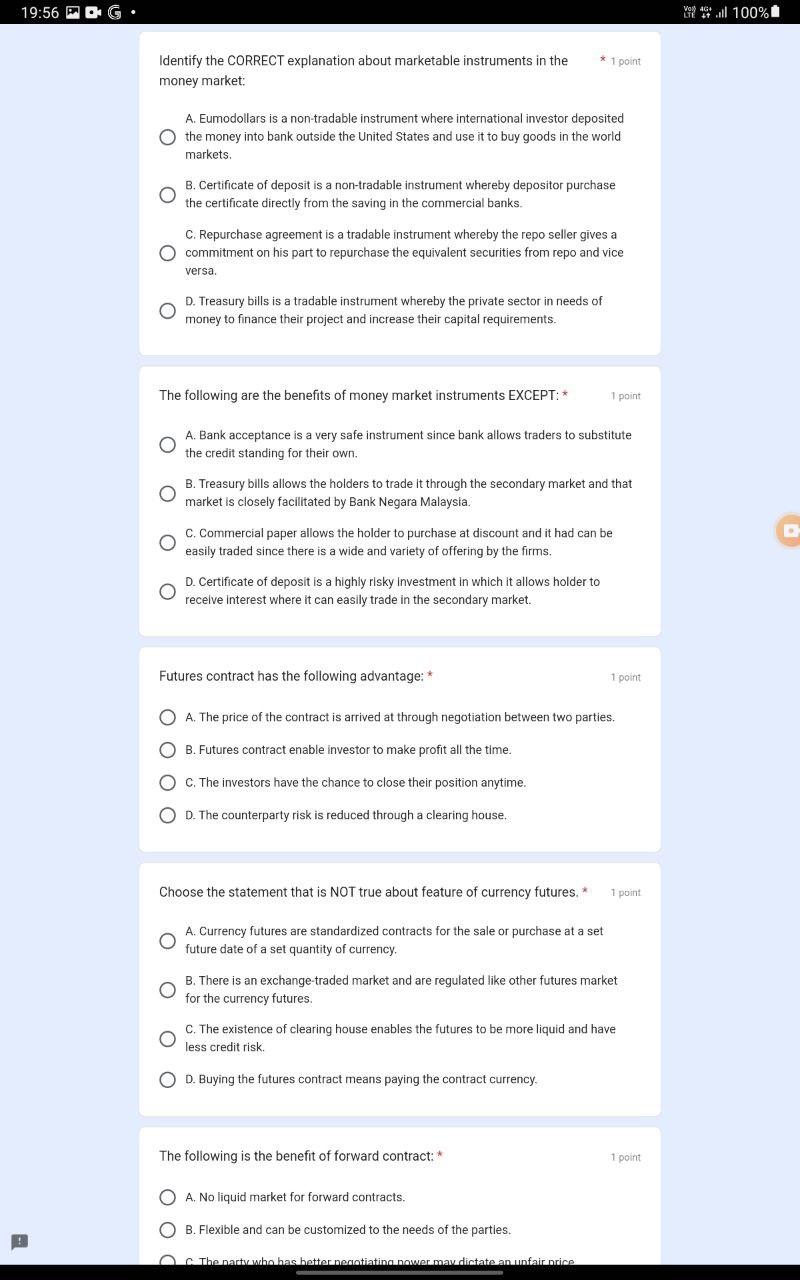

Identify the CORRECT explanation about marketable instruments in the * 1 point money market: A. Eumodollars is a non-tradable instrument where international investor deposited the money into bank outside the United States and use it to buy goods in the world markets. B. Certificate of deposit is a non-tradable instrument whereby depositor purchase the certificate directly from the saving in the commercial banks. C. Repurchase agreement is a tradable instrument whereby the repo seller gives a commitment on his part to repurchase the equivalent securities from repo and vice versa. D. Treasury bills is a tradable instrument whereby the private sector in needs of money to finance their project and increase their capital requirements. The following are the benefits of money market instruments EXCEPT: * 1.point A. Bank acceptance is a very safe instrument since bank allows traders to substitute the credit standing for their own. B. Treasury bills allows the holders to trade it through the secondary market and that market is closely facilitated by Bank Negara Malaysia. C. Commercial paper allows the holder to purchase at discount and it had can be easily traded since there is a wide and variety of offering by the firms. D. Certificate of deposit is a highly risky investment in which it allows holder to recelve interest where it can easily trade in the secondary market. Futures contract has the following advantage: * 1 point A. The price of the contract is arrived at through negotiation between two parties. B. Futures contract enable investor to make profit all the time. c. The investors have the chance to close their position anytime. D. The counterparty risk is reduced through a clearing house. Choose the statement that is NOT true about feature of currency futures, * 1 point. A. Currency futures are standardized contracts for the sale or purchase at a set future date of a set quantity of currency. B. There is an exchange-traded market and are regulated like other futures market for the currency futures. C. The existence of clearing house enables the futures to be more liquid and have less credit risk. D. Buying the futures contract means paying the contract currency, The following is the benefit of forward contract: * 1 point A. No liquid market for forward contracts. B. Flexible and can be customized to the needs of the partles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts