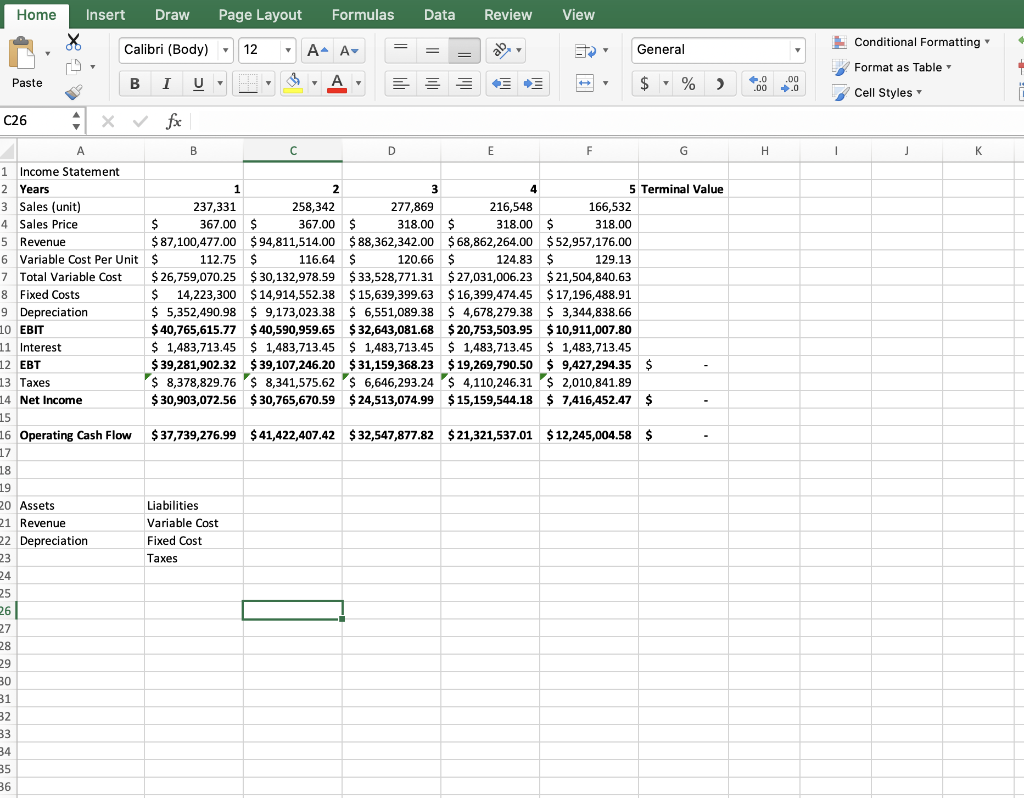

Question: Identify the current assets and current liabilities in the given Income Statement. Home Insert Draw Page Layout Formulas Data Review View Conditional Formatting Calibri (Body)

Identify the current assets and current liabilities in the given Income Statement.

Home Insert Draw Page Layout Formulas Data Review View Conditional Formatting Calibri (Body) 12 A- A = = - General Format as Table Paste BIU A $ % ) 4.0 .00 .00 0 Cell Styles C26 4 X fx G H 1 1 J K B B D E F 1 Income Statement 2 Years 1 2 3 4 5 Terminal Value 3 Sales (unit) 237,331 258,342 277,869 216,548 166,532 4 Sales Price $ $ 367.00 $ 367.00 $ 318.00 $ 318.00 $ 318.00 5 Revenue $ 87,100,477.00 $ 94,811,514.00 $88,362,342.00 $68,862,264.00 $52,957,176.00 6 Variable Cost Per Unit $ 112.75 $ 116.64 $ 120.66 $ 124.83 $ 129.13 7 Total Variable Cost $ 26,759,070.25 $ 30,132,978.59 $ 33,528,771.31 $ 27,031,006.23 $ 21,504,840.63 8 Fixed Costs $ 14,223,300 $14,914,552.38 $ 15,639,399.63 $ 16,399,474.45 $17,196,488.91 9 Depreciation $ 5,352,490.98 $ 9,173,023.38 $ 6,551,089.38 $ 4,678,279.38 $ 3,344,838.66 10 EBIT $ 40,765,615.77 $ 40,590,959.65 $32,643,081.68 $ 20,753,503.95 $10,911,007.80 11 Interest $ 1,483,713.45 $ 1,483,713.45 $ 1,483,713.45 $ 1,483,713.45 $ 1,483,713.45 12 EBT $ 39,281,902.32 $ 39,107,246.20 $ 31,159,368.23 $ 19,269,790.50 $ 9,427,294.35 $ 13 Taxes $ 8,378,829.76 $ 8,341,575.62' 6,646,293.24$ 4,110,246.31 $ 2,010,841.89 14 Net Income $ 30,903,072.56 $30,765,670.59 $ 24,513,074.99 $ 15,159,544.18 $ 7,416,452.47 $ 15 16 Operating Cash Flow $37,739,276.99 $41,422,407.42 $32,547,877.82 $21,321,537.01 $12,245,004.58 $ 17 18 19 20 Assets Liabilities 21 Revenue Variable Cost 22 Depreciation Fixed Cost 23 Taxes 24 25 26 27 - - 28 29 30 31 32 33 34 35 36 Home Insert Draw Page Layout Formulas Data Review View Conditional Formatting Calibri (Body) 12 A- A = = - General Format as Table Paste BIU A $ % ) 4.0 .00 .00 0 Cell Styles C26 4 X fx G H 1 1 J K B B D E F 1 Income Statement 2 Years 1 2 3 4 5 Terminal Value 3 Sales (unit) 237,331 258,342 277,869 216,548 166,532 4 Sales Price $ $ 367.00 $ 367.00 $ 318.00 $ 318.00 $ 318.00 5 Revenue $ 87,100,477.00 $ 94,811,514.00 $88,362,342.00 $68,862,264.00 $52,957,176.00 6 Variable Cost Per Unit $ 112.75 $ 116.64 $ 120.66 $ 124.83 $ 129.13 7 Total Variable Cost $ 26,759,070.25 $ 30,132,978.59 $ 33,528,771.31 $ 27,031,006.23 $ 21,504,840.63 8 Fixed Costs $ 14,223,300 $14,914,552.38 $ 15,639,399.63 $ 16,399,474.45 $17,196,488.91 9 Depreciation $ 5,352,490.98 $ 9,173,023.38 $ 6,551,089.38 $ 4,678,279.38 $ 3,344,838.66 10 EBIT $ 40,765,615.77 $ 40,590,959.65 $32,643,081.68 $ 20,753,503.95 $10,911,007.80 11 Interest $ 1,483,713.45 $ 1,483,713.45 $ 1,483,713.45 $ 1,483,713.45 $ 1,483,713.45 12 EBT $ 39,281,902.32 $ 39,107,246.20 $ 31,159,368.23 $ 19,269,790.50 $ 9,427,294.35 $ 13 Taxes $ 8,378,829.76 $ 8,341,575.62' 6,646,293.24$ 4,110,246.31 $ 2,010,841.89 14 Net Income $ 30,903,072.56 $30,765,670.59 $ 24,513,074.99 $ 15,159,544.18 $ 7,416,452.47 $ 15 16 Operating Cash Flow $37,739,276.99 $41,422,407.42 $32,547,877.82 $21,321,537.01 $12,245,004.58 $ 17 18 19 20 Assets Liabilities 21 Revenue Variable Cost 22 Depreciation Fixed Cost 23 Taxes 24 25 26 27 - - 28 29 30 31 32 33 34 35 36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts