Question: Identify the Internal and External Environments Amazon, the credit card company (Chase Bank), and the consumer. Amazon benefit cause it received money from the credit

Identify the Internal and External Environments

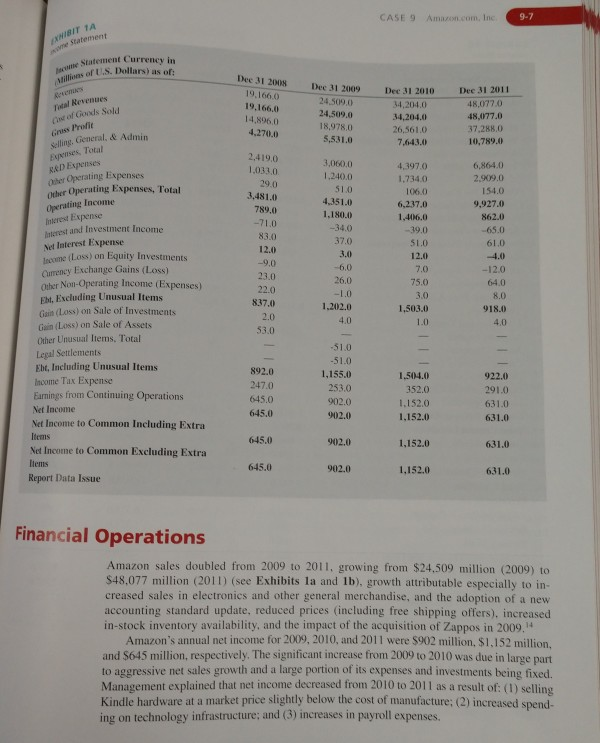

Amazon, the credit card company (Chase Bank), and the consumer. Amazon benefit cause it received money from the credit card company both directly from Amazon and indirectly from fees generated from non-Amazon purchases. In addition, Am efited from the company loyalty generated by having its own credit card the consum and uses every day. The credit card company gained from Amazon's high visibility in its potential customer base and transactions. And the consumer camned credit towards tificates with each use of the card. Partnerships Amazon leveraged its expertise in online order taking and order fulfillment and devel partnerships with many retailers whose websites it hosted and managed, including rently or in the past) Target, Sears Canada. Bebe Stores, Timex Corporation, and Marks Spencer. Amazon offered services comparable to those it offered customers on its websites, thus freeing those retailers to focus on the non-website, non-technological ac of their operations." In addition, Amazon Marketplace allowed independent retailers and third-party selle to sell their products on Amazon by placing links on their websites to Amazon.com specific Amazon products. Amazon was not the seller of record in these transactions, bu instead earned fixed fees, revenue share fees, per unit activity fees, or some combinati thereof. Linking to Amazon created visibility for these retailers and individual sellers adding value to their websites, increasing their sales, and enabling them to take advanta of Amazon's convenience and fast delivery. Sellers shipped their products to an Amaron warehouse or fulfillment center, where the company stored it for a fee, and when an order was placed, shipped out the product on the seller's behalf. This form of affiliate mark ing came at nearly no cost to Amazon. Affiliates used straight text links leading direct to a product page and they also offered a range of dynamic banners that featured different content. Web Services As a major tech player, Amazon developed a number of web services, including ecommerce database, payment and billing, web traffic, and computing. These web services provided access to technology infrastructure that developers were able to utilize to enable various types of virtual businesses. The web services (many of which were free) created a reliable, scalable and inexpensive computing platform that revolutionized the online presence of small bus nesses. For instance, Amazon's e-commerce Fulfillment By Amazon (FBA) program allowed merchants to direct inventory to Amazon's fulfillment centers, after products were purchased Amazon packed and shipped. This freed merchants from a complex ordering process while ed PHA capabilities straight into their own sites, Worage solution (Amazon Glacier) from Amazon allowing them control over their inventory Amazon's Pointment FHA program. FWS letter Inventory. Amaron's Eument Wich Service (FWS) added vastly enhancing their business capabilities a bilities strah In 2012, Amaron announced ase t Amaro Web Services (AWSi Hution for data archivine backum, and other long-term backup storage projects where data e frequently could be retained for future reference de heren Companies often incurred signifi e d ant costs for data archiving in anticipation of growing backup demand, which led to er utilized capacity and wasted money With Amaro wasted me Glacier, companies were able to e i thal emana how the exact cost of their storage system with Amazon Glacier. Ama continued to dominate the space of old Stor h ich had first come into prominen 2009, amidst competitors such as Rack Mirroft (MSF offering the own solutions. By 2012. Amazon Web Services were a sucial facet of Amazon's profit base Amazon was one of the lead players in the fastesine retail commerce market ce huge growth potential, Amaron made the decision and Amazon Web Services LAWS internationally and invested heavily in technology infrastructure to support the rapid grow in AWS. Though its investments in ecommerce threatened to suppress its near-term margin growth, Amazon expected to benefit in the long term, given the significant growth potential in domestic and even more so. in international ecommerce. Amazon's Acquisition of Zappos, Quidsi, Living Social, and Lovefilm On July 22, 2009, Amazon acquired Zappos, the online shoe and clothing retailer, for $1.2 billion. At that time, Zappos was reporting over S1 billion in annual sales without any marketing or advertising. According to founder Tony Hsieh, the secret to Zappos' success was superior customer service, from its 365-day return guarantee to the company tours with which it regaled visitors, picking them up at the airport, then returning them to the airport afterward. Zappos' employees were also very well treated, eaming it a place at the top of the list of the best companies to work for." Tony Hsieh felt that Amazon was the perfect partner to fuel Zappo's sales growth going forward. On November 8, 2010, Amazon announced the acquisition of Quidsi, the parent company of Diapers.com, an online baby care specialty site, and Soap.com, an online site for everyday essentials. Amazon paid $500 million in cash, and assumed $45 million in debt and other ob ligations. As Jeff Bezos explained, "This acquisition brings together two companies who are committed to providing great prices and fast delivery to parents, making one of the chores of being a parent a little easier and less expensive. On December 2, 2010, Amazon announced that it had invested S175 million in Groupon competitor Living Social, a site whose up-to-the-minute research offered users immediate docess to the hottest restaurants, shops, activities, and services in a given area, while saving them 50 to 70% through special site deals On January 20, 2011, Amazon acquired Lovefilm for 200 million, a 1.6-million- subscribers strong European Web-based DVD rental service based in London Lovefilm had followed Netflix's business model, offering unlimited DVD rentals by mail for a monthly subscription fee of 9.99, but planned to challenge Netflix and expand its digital media busi- ness by entering the live-streaming subscription business CASE 9 Amaron con loc EXH incon ail order houses ctronics, houvefur ded with Apple's iPad Ace sector included competition from dia Bay, Price with companies that content such as any of the com s & Noble). more Competitors Competition was fierce for Amazon on all fronts, from catalogue and mail to retail stores from book, music, and video stores to retailers of electronics nishings, auto parts, and sporting goods. Amazon's Kindle contended with among many lesser competitors. And Amazon's competitors in the service sech other e-commerce and Web service providers. The company faced direct come companies such as eBay, Apple, Barnes & Noble, Overstock.com, Media com, PCMall.com, and Red Envelope.com. Amazon had to compete with com provided their own products or services, sites that sold or distributed digital conte iTunes and Netflix, and media companies such as The New York Times. Many of pany's competitors had greater resources (eBay), longer histories (Barnes & Nobl. customers (Apple), or greater brand recognition (iTunes). The companies offering the most direct threat to Amazon were eBay and Me Pierre Omidyar founded eBay in 1995, a website that connected individual buyers and including small businesses to buy and sell virtually anything. In 2010, the total value of sold on eBay was $62 billion, making eBay the world's largest online marketplace 39 markets with more than 97 million active users worldwide. eBay and Amazon sulik to similar growth strategies: each acquired a broad spectrum of companies. Over the IS from 1995-2010 eBay acquired PayPal, Shopping.com, StubHub, and Bill Me Later, which have brought new e-commerce efficiencies to eBay Metro AG, headquartered in Dusseldorf, Germany, one of the world's leading intem tional retail and wholesale companies, was formed through the merger of retail companies Asko Deutsche Kaufhaus AG, Kaufhof Holding AG and Deutsche SB-Kauf AG, In 2010, the total value of goods sold by Metro AG was 67 billion. Serving 33 countries, Metro AG offered a comprehensive range of products and services designed to meet the specific shopping needs of private and professional customers. Metro AG, like Amazon, focused on customer orientation, efficiency, sustainability, and innovation Amazon had to be vigilant, negotiating more favorable terms from suppliers, adopting more aggressive pricing and devoting more resources to technology, infrastructure, fulfillment. and marketing. To maintain competitiveness, Amazon also strengthened its edge by entering into alliances with other businesses (ie.. Amazon Marketplace). Nevertheless, growing com petition from global and domestic players continually threatened to erode Amazon's desired share of the market. Across the industries in which it competed, however. Amazon fought to maintain its edge based on its core principles of selection, price, availability convenience, in formation, discovery, brand recognition, personalized services, accessibility, customer ser reliability, speed of fulfillment, ease of use, and ability to adapt to changing conditions, as well as ... customers' overall experience and trust."12 Frustration-Free Packaging To stay current, Amazon took the initiative to reduce its carbon footprint by implemens "Frustration Free Packaging" program. Recyclable Frustration Free Packaging came wi excess packaging materials such as hard plastic enclosures or wire twists and was design be opened by hand without a scissors or a knife. Amazon then went one further and war with the original manufacturers to package products in Frustration Free Packaging ng the assembly line, further reducing the use of plastic and paper. Units shipped that Frustration Free Packaging has increased very rapidly, from 1.3 million in 2009 to 4,0 in 2010. Amazon also utilized software to determine the right size box for any prou company shipped, achieving a dramatic reduction in the number of packages shipped in sized boxes and significantly reducing waste. ging night off that utilized 2009 to 4.0 million any product the Shipped in over CASE 9 Amazon.com, Inc SIT TA Statement Statement Currency in is of US Dollars) as of Dec 31 2009 Total Revenues our of Goods Sold Dec 31 2008 19.166,0 19.166.0 14,8960 4,270.0 2015090 24,509.0 18,978,0 5,531.0 Dec 31 2010 34,204.0 34,204.0 26,561.0 7.643.0 Dec 31 2011 48,077.0 48,077.0 37,2880 10,789.0 Gres Prolle General Admin Eymes Teal & Expenses Other Operating Expenses Other Operating Expenses, Total 2.419.0 1.033.0 29.0 3.481.0 789.0 - 71.0 83.0 12.0 3,060,0 1.240.0 51.0 4,351.0 1,180. Operating Income Interest Expense 4,3970 1.734.0 106.0 6,237.0 1,406.0 19.0 SLO 12.0 6,864.0 2.679.0 154.0 9,927.0 862.0 65.0 61.0 -9.0 37.0 3.0 6.0 26.0 -10 1.202.0 7,0 75.0 -12.0 64.0 23.0 22.0 837.0 8.0 3.0 1,503.0 918.0 4.0 2.0 53.0 Interest and Investment Income Net Interest Expense Income (Loss) on Equity Investments Cumency Exchange Gains (Loss) Other Non-Operating Income (Expenses) Eh, Excluding Unusual Items Gein (Loss) on Sale of Investments Gain (Loss) on Sale of Assets Other Unusual liems. Total Legal Settlements Ebe, Including Unusual Items Income Tax Expense Earnings from Continuing Operations Net Income Net Income to Common Including Extra Items 1.0 892.0 247.0 645.0 645.0 -51.0 -51.0 1,155.0 253.0 902.0 902.0 1,504.0 352.0 1.152.0 1.152.0 922.0 291.0 631.0 631.0 645.0 902.0 1,152.0 631.0 Net Income to Common Excluding Extra Items Report Data Issue 645.0 902.0 1.152.0 631.0 Financial Operations Amazon sales doubled from 2009 to 2011. growing from $24.509 million (2009) to $48.077 million (2011) (see Exhibits la and lb), growth attributable especially to in creased sales in electronics and other general merchandise, and the adoption of a new accounting standard update, reduced prices (including free shipping offers), increased in-stock inventory availability, and the impact of the acquisition of Zappos in 2009, Amazon's annual net income for 2009, 2010, and 2011 were $902 million, $1,152 million. and 5645 million, respectively. The significant increase from 2009 to 2010 was due in large part to aggressive net sales growth and a large portion of its expenses and investments being fixed Management explained that net income decreased from 2010 10 2011 as a result of: (1) selling Kindle hardware at a market price slightly below the cost of manufacture; (2) increased spend ing on technology infrastructure; and (3) increases in vollex CASE 9 Amazon.com, Inc. hallenges for Amazon Amazon developed very quickly into a maior player in the online la remained: major player in the online retail market, yet challenges 1. From its inception, Amazon was not required to collect state azon was not required to collect state or local sales or use taxes. an exemption upheld by the US Supreme Court However, in 2012. states De sider superseding the Supreme Court decision 15 If the states were to pre 5. Supreme Court. However, in 2012, states began to con- would be forced to collect sales and use tax creating administrative burde reme Court decision. If the states were to prevail, Amazon putting it at a competitive disadvantage if similar obligations are not impos Sales and use tax, creating administrative burdens for it, and Its online competitors, potentially decreasing its future sales, tage if similar obligations are not imposed on all of Massachusetts and states were motivated both by the desire to an into new sources of revenues for the state budgets and to protect local retailers. In 2012, reports had it that Amazon was making deals to collect sales tax in all 50 states so that they could open warehouses near population centers and provide same-day del cry, il major shift in its business model that would ratchet up competition with big box stores like Best Buy and Target as well as local retailers. However, there were no guar antees of the profitability of same-day delivery, given the added warehouse and delivery costs. 2. With the new social trend of "buying local." Amazon faced the threat of some regular consumers preferring to buy from their local stores rather than from an online retailer 3. Amazon always had to grapple with the threat of customer preference for instant gratifi- cation, the customer's desire to get a product immediately in the store, rather than waiting several days for the product to be shipped to them. 4. Breaches of security from outside parties trying to gain access to its information or data were a continual threat for Amazon." As of 2012. Amazon had systems and processes in place that were designed to counter such attempts: however, failure to maintain these systems or processes could be detrimental to the operations of the company 5. As more media products were sold in digital formats, Amazon's relatively low-cost phys- ical warehouses and distribution capabilities no longer provided the same competitive advantages. In addition, Amazon had felt that its worldwide free shipping offers and Amazon Prime were effective worldwide marketing tools, and intended to offer them indefinitely, yet it began to suffer from soaring shipping expenses cutting into profits. In quarter three of 2011, Amazon's shipping fees generated $360 million in revenue, which was dwarfed by $918 million in shipping expenses. 6. Amazon had to contend with absorbing losses from its unsuccessful ventures such as its A9 search engine, Amazon Auctions, and Unbox, Amazon's original video-on-demand service. 7. Recent hires from Microsoft, Robert Williams, former senior program manager, and Brandon Watson, head of Windows Phone development prompted speculation that Amazon was developing a smartphone, possibly a Kindle-branded device. Bloomberg renorted that Amazon had gone so far as to strike a manufacturing deal with Foxconn. the controversial Taiwanese company responsible for assembling Apple's iPhone and Google Android devices. Amazon has not commented on the reports. A smartphone would have given Amazon another mobile device to sell, but some analysts felt it wouldn't have made sense for Amazon to enter into the already crowded smartphone arena "Since tablets skew more heavily toward media consumption than smartphones they are a natural fit for Amazon's commerce and media platform," said Baird & Co analyst Colin Sebastian, in a research note. In contrast, smartphones require specialized 9-10 CASE 9 Amazon.com, Inc native apps (e.g.. maps, voice, search, e-mail) that would be costly replicate." Sebastian also noted that hardware is a low-margin bu Kindle Fire sold for $199, a price that some analysts believed was belo ing Amazon hoped the Kindle Fire would more than pay for itself by e-books and other digital content. Thus, by 2012 Amazon had proved i giant, yet as with any vibrant company, faced continual challenges, parti ing the overarching questions of whether to spend its money developing such as the Kindle Smartphone, or to stick with its strengths as an online reta acquiring more holdings such as Zappos, and pushing for same-day deliver added cost to compete with other online retailers, and with the big box stores In 2012, Amazon was at a crossroads. It needed to decide if it should invest in the structure for same-day delivery, and take on local retailers, or invest in high-technology compete at a deeper level with Sony. Apple, and Samsung. costly for Amazon egin business. Amaz below cost, suggest itself by boosting sales proved itself as a real ges, particularly regard developing media produs line retailer, perhaps day delivery despite the EFERENCES exa.com. Amazon.com. 2011 hpwww.alexa.com/siteinfo/ amazon.com azon.com. 2005 Annual Report. April 2006 azon.com. 2007 Annual Report. April 2008 zon.com. 2008 Annual Report. April 2009 azon.com. 2009 Annual Report. April 2010 zon.com. 2010 Annual Report. April 2011 zon.com. 2011 Corporate Governance: A Message to Shareowners. 2011. http://phur.corporate-ir.net/phoenix html?c=97664&p=irol-gow Highlights on.com. Amazon Leadership Principles. 2011. http:// www.amazon.com/Values-Careers Homepage/b?ie=UT F8&node=239365011 Bange. V. Online Security: Legal Issues. Page 10. New Media Age. Jan. 2007. Bezos, J. Earth's Most Customer-Centric Company: Differen tiating with Technology. MIT, Interviewer. Nov. 2000 http://mitworld.mit.edu/video/ Bofah, Kofi. What is the Meaning of Foreign Exchange Risk eHow Money. http://www.ehow.com/about 66124 meaning-foreign-exchange-risk_.html Chaffey. D. Amazon.com Case Study. http://www.davecm .com/E-commerce-Internet-marketing-case-studies Amazon-case-study/ CrunchBase com nam

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock