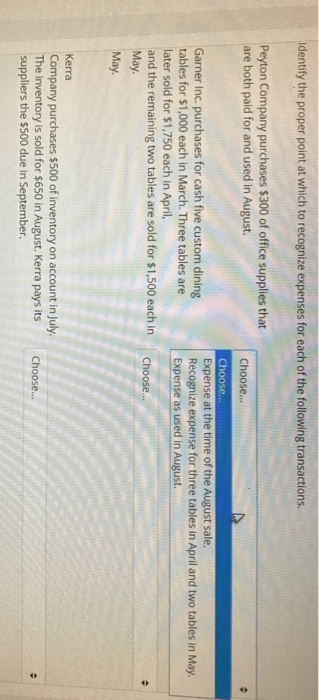

Question: Identify the proper point at which to recognize expenses for each of the following transactions Peyton Company purchases $300 of office supplies that are both

Identify the proper point at which to recognize expenses for each of the following transactions Peyton Company purchases $300 of office supplies that are both pald for and used in August. Choose... Expense at the time of the August sale Recognize expense for three tables in April and two tables in May. Expense as used in August. Garner Inc. purchases for cash five custom dining tables for $1,000 each in March. Three tables are later sold for $1,750 each in April, and the remaining two tables are sold for $1,500 each in c May May Kerra Company purchases $500 of inventory on account in July. The inventory is sold for $650 in August. Kerra pays its Choose... suppliers the $500 due in September. Identify the proper point at which to recognize expenses for each of the following transactions Peyton Company purchases $300 of office supplies that are both pald for and used in August. Choose... Expense at the time of the August sale Recognize expense for three tables in April and two tables in May. Expense as used in August. Garner Inc. purchases for cash five custom dining tables for $1,000 each in March. Three tables are later sold for $1,750 each in April, and the remaining two tables are sold for $1,500 each in c May May Kerra Company purchases $500 of inventory on account in July. The inventory is sold for $650 in August. Kerra pays its Choose... suppliers the $500 due in September

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts