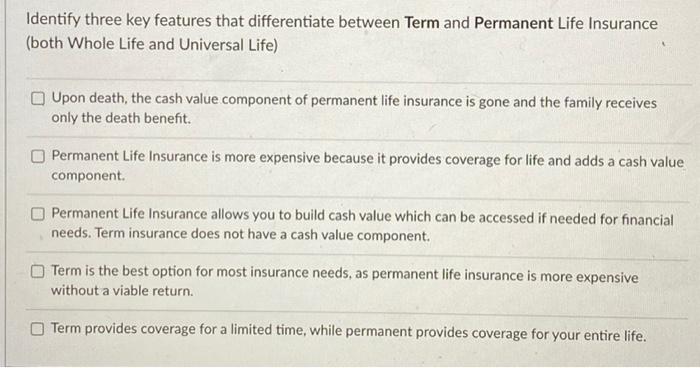

Question: Identify three key features that differentiate between Term and Permanent Life Insurance (both Whole Life and Universal Life) Upon death, the cash value component of

Identify three key features that differentiate between Term and Permanent Life Insurance (both Whole Life and Universal Life) Upon death, the cash value component of permanent life insurance is gone and the family receives only the death benefit. Permanent Life Insurance is more expensive because it provides coverage for life and adds a cash value component. Permanent Life Insurance allows you to build cash value which can be accessed if needed for financial needs. Term insurance does not have a cash value component. Term is the best option for most insurance needs, as permanent life insurance is more expensive without a viable return Term provides coverage for a limited time, while permanent provides coverage for your entire life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts