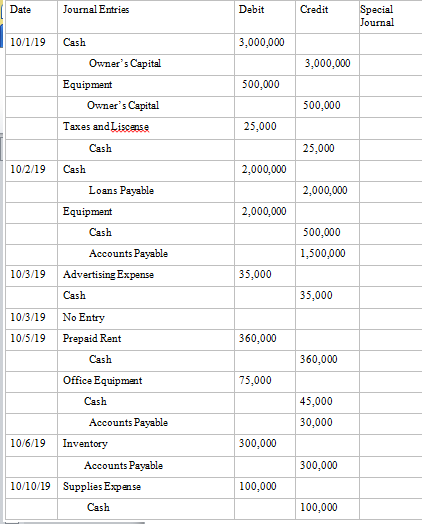

Question: Identify where journals will put the journal entry. Write (SJ) if sales journal, (PJ) purchase journal, (CRJ) Cash Receipt Journal, (CDJ) Cash Disbursement Journal, and

Identify where journals will put the journal entry.

Write (SJ) if sales journal, (PJ) purchase journal, (CRJ) Cash Receipt Journal, (CDJ) Cash Disbursement Journal, and (GJ) General Journal.

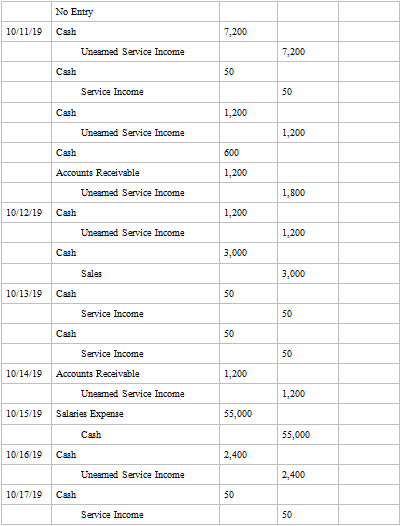

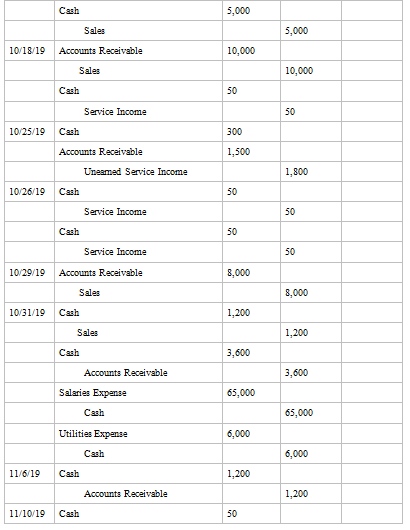

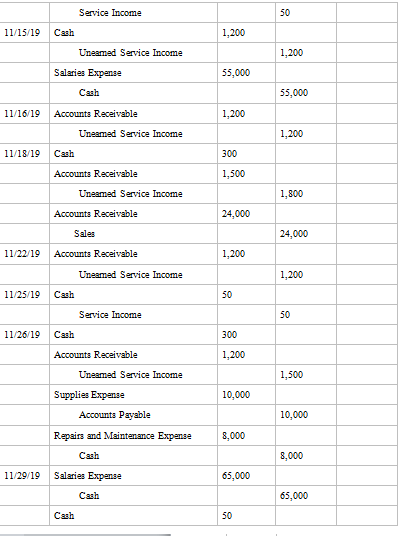

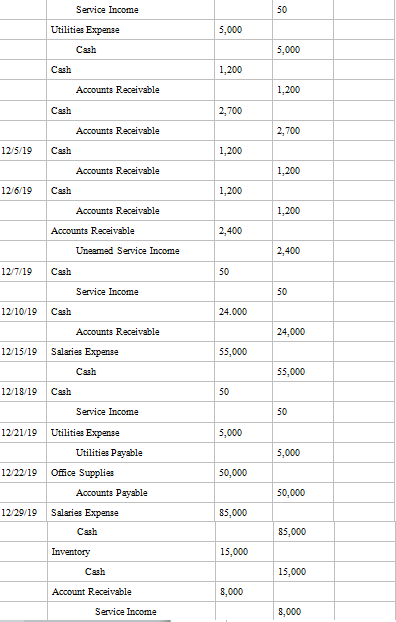

Date Journal Entries Debit Credit Special Journal 10/1/19 Cash 3.000.000 Owner's Capital 3,000,000 Equipment 500,000 Owner's Capital 500,000 Taxes and Liscense 25,000 Cash 25,000 10/2/19 Cash 2,000,000 Loans Payable 2,000,000 Equipment 2,000,000 Cash 500,000 Accounts Payable 1,500.000 10/3/19 Advertising Expense 35,000 Cash 35,000 10/3/19 No Entry 10/5/19 Prepaid Rent 360.000 Cash 360,000 Office Equipment 75,000 Cash 45.000 Accounts Payable 30,000 10/6/19 Inventory 300,000 Accounts Payable 300,000 10/10/19 Supplies Expense 100,000 Cash 100,000No Entry 10/11/19 Cash 7,200 Uneamed Service Income 7,200 Cash 50 Service Income 50 Cash 1,200 Unearned Service Income 1,200 Cash 600 Accounts Receivable 1,200 Uneamed Service Income 1,200 10/12/19 Cash 1,200 Unearned Service Income 1,200 Cash 3,000 Sale: 3,000 10/13/19 Cash 50 Service Income 50 Cash 50 Service Income 50 10/14/19 Accounts Receivable 1,200 Uneamed Service Income 1,200 10/15/19 Salaries Expense 55,000 Cash 55,000 10/16/19 Cash 2,400 Uneamed Service Income 2,400 10/17/19 Cash 50 Service Income 50Cash 5,000 Sale: 5,000 10/18/19 Accounts Receivable 10,000 Sale: 10,000 Cash 50 Service Income 50 10/25/19 Cash 300 Accounts Receivable 1,500 Uneared Service Income 1,800 10/26/19 Cash 50 Service Income 50 Cash 50 Service Income 50 10/29/19 Accounts Receivable 8,000 Sale: 2,000 10/31/19 Cash 1,200 Sales 1,200 Cash 3,600 Accounts Receivable 3,600 Salaries Expense 65,000 Cash 65,000 Utilities Expense 6,000 Cash 6,000 11/6/19 Cash 1,200 Accounts Receivable 1,200 11/10/19 Cash 50Service Income 50 11/15/19 Cash 1,200 Uneamed Service Income 1,200 Salaries Expense 55,000 Cash 55,000 11/16/19 Accounts Receivable 1,200 Uneamed Service Income 1,200 11/18/19 Cash 300 Accounts Receivable 1,500 Umeamed Service Income 1,800 Accounts Receivable 24,000 Sale: 24,000 11/22/19 Accounts Receivable 1,200 Uneared Service Income 1,200 11/25/19 Cash 50 Service Income 50 11/26/19 Cash 300 Accounts Receivable 1,200 Uneamed Service Income 1,500 Supplies Expense 10,000 Accounts Payable 10,000 Repairs and Maintenance Expense 8,000 Cash 8,000 11/29/19 Salaries Expense 65,000 Cash 65,000 Cash 50Service Income 50 Utilities Expense 5,000 Cash 5,000 Cash 1,200 Accounts Receivable 1,200 Cash 2,700 Accounts Receivable 2,700 12/5/19 Cash 1,200 Accounts Receivable 1,200 12/6/19 Cash 1,200 Accounts Receivable 1,200 Accounts Receivable 2,400 Uneamed Service Income 2,400 12/7/19 Cash 50 Service Income 50 12/10/19 Cash 24.000 Accounts Receivable 24,000 12/15/19 Salaries Expense 55,000 Cash 55,000 12/18/19 Cash 50 Service Income 50 12/21/19 Utilities Expense 5,000 Utilities Payable 5,000 12/22/19 Office Supplies 50,000 Accounts Payable 50,000 12/29/19 Salaries Expense 25,000 Cash 25,000 Inventory 15,000 Cash 15,000 Account Receivable 8,000 Service Income 8,000