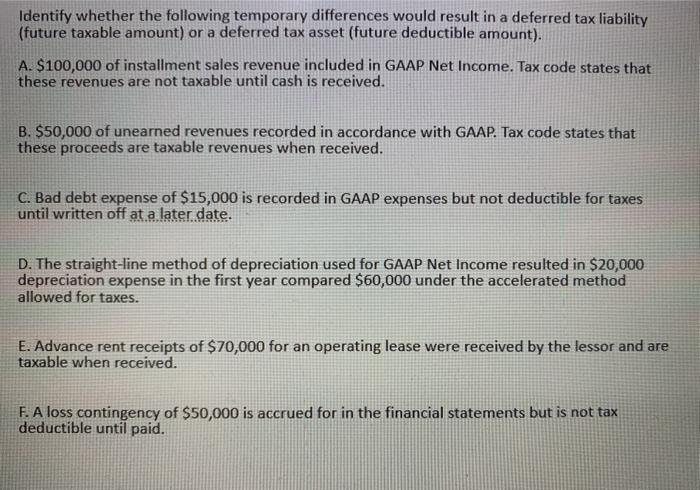

Question: Identify whether the following temporary differences would result in a deferred tax liability (future taxable amount) or a deferred tax asset (future deductible amount). A.

Identify whether the following temporary differences would result in a deferred tax liability (future taxable amount) or a deferred tax asset (future deductible amount). A. $100,000 of installment sales revenue included in GAAP Net Income. Tax code states that these revenues are not taxable until cash is received. B. $50,000 of unearned revenues recorded in accordance with GAAP. Tax code states that these proceeds are taxable revenues when received. C. Bad debt expense of $15,000 is recorded in GAAP expenses but not deductible for taxes until written off at a later date. D. The straight-line method of depreciation used for GAAP Net Income resulted in $20,000 depreciation expense in the first year compared $60,000 under the accelerated method allowed for taxes. E. Advance rent receipts of $70,000 for an operating lease were received by the lessor and are taxable when received. F. A loss contingency of $50,000 is accrued for in the financial statements but is not tax deductible until paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts