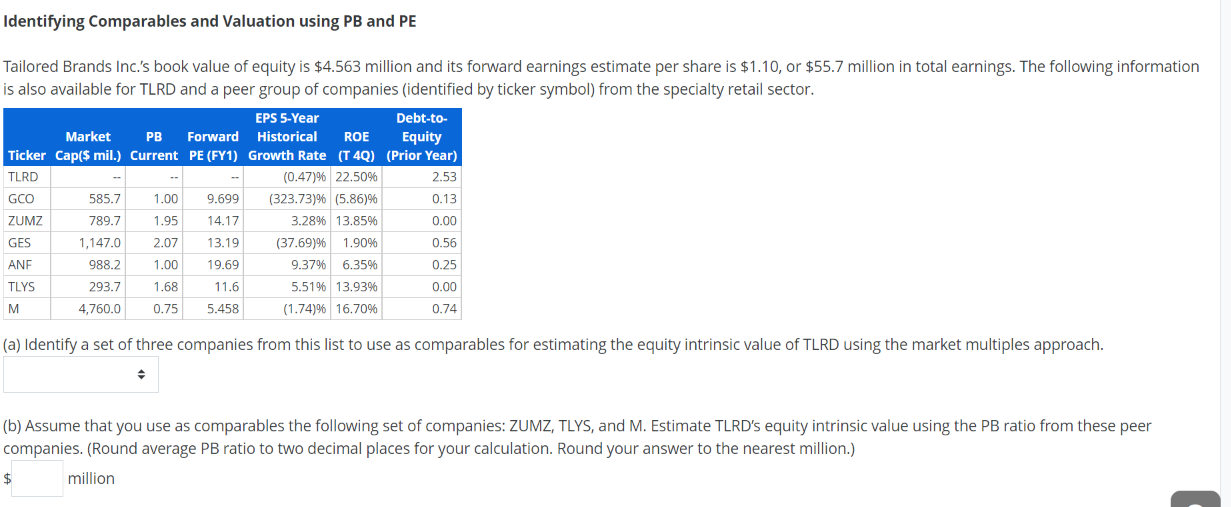

Question: Identifying Comparables and Valuation using PB and PE 2.53 Tailored Brands Inc.'s book value of equity is $4.563 million and its forward earnings estimate per

Identifying Comparables and Valuation using PB and PE 2.53 Tailored Brands Inc.'s book value of equity is $4.563 million and its forward earnings estimate per share is $1.10, or $55.7 million in total earnings. The following information is also available for TLRD and a peer group of companies (identified by ticker symbol) from the specialty retail sector. EPS 5-Year Debt-to- Market PB Forward Historical ROE Equity Ticker Cap($ mil.) Current PE (FY1) Growth Rate (T 4Q) (Prior Year) TLRD (0.47)% 22.50% GCO 585.7 1.00 9.699 (323.73)% (5.86)% 0.13 ZUMZ 789.7 1.95 14.17 3.28% 13.85% 0.00 GES 1,147.0 2.07 13.19 (37.69)% 1.90% 0.56 ANF 988.2 1.00 19.69 9.37% 6.35% 0.25 TLYS 293.7 1.68 11.6 5.51% 13.93% 0.00 M 4,760.0 0.75 5.458 (1.74)% 16.70% 0.74 (a) Identify a set of three companies from this list to use as comparables for estimating the equity intrinsic value of TLRD using the market multiples approach. (b) Assume that you use as comparables the following set of companies: ZUMZ, TLYS, and M. Estimate TLRD's equity intrinsic value using the PB ratio from these peer companies. (Round average PB ratio to two decimal places for your calculation. Round your answer to the nearest million.) million $ (b) Assume that you use as comparables the following set of companies: ZUMZ, TLYS, and M. Estimate TLRD's equity intrinsic value using the PB ratio from these peer companies. (Round average PB ratio to two decimal places for your calculation. Round your answer to the nearest million.) million (c) Use the same comparables as in part band estimate TLRD's equity intrinsic value using the PE ratio from these peer companies. (Round average PE ratio to two decimal places for your calculation. Round your answer to the nearest million.) $ million Check Identifying Comparables and Valuation using PB and PE 2.53 Tailored Brands Inc.'s book value of equity is $4.563 million and its forward earnings estimate per share is $1.10, or $55.7 million in total earnings. The following information is also available for TLRD and a peer group of companies (identified by ticker symbol) from the specialty retail sector. EPS 5-Year Debt-to- Market PB Forward Historical ROE Equity Ticker Cap($ mil.) Current PE (FY1) Growth Rate (T 4Q) (Prior Year) TLRD (0.47)% 22.50% GCO 585.7 1.00 9.699 (323.73)% (5.86)% 0.13 ZUMZ 789.7 1.95 14.17 3.28% 13.85% 0.00 GES 1,147.0 2.07 13.19 (37.69)% 1.90% 0.56 ANF 988.2 1.00 19.69 9.37% 6.35% 0.25 TLYS 293.7 1.68 11.6 5.51% 13.93% 0.00 M 4,760.0 0.75 5.458 (1.74)% 16.70% 0.74 (a) Identify a set of three companies from this list to use as comparables for estimating the equity intrinsic value of TLRD using the market multiples approach. (b) Assume that you use as comparables the following set of companies: ZUMZ, TLYS, and M. Estimate TLRD's equity intrinsic value using the PB ratio from these peer companies. (Round average PB ratio to two decimal places for your calculation. Round your answer to the nearest million.) million $ (b) Assume that you use as comparables the following set of companies: ZUMZ, TLYS, and M. Estimate TLRD's equity intrinsic value using the PB ratio from these peer companies. (Round average PB ratio to two decimal places for your calculation. Round your answer to the nearest million.) million (c) Use the same comparables as in part band estimate TLRD's equity intrinsic value using the PE ratio from these peer companies. (Round average PE ratio to two decimal places for your calculation. Round your answer to the nearest million.) $ million Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts