Question: idk if the inputs are correct at all!! including the worded parts. ANSWER THIS TOO: also part c) prepare the comparative statement of financial position

idk if the inputs are correct at all!! including the worded parts.

ANSWER THIS TOO:

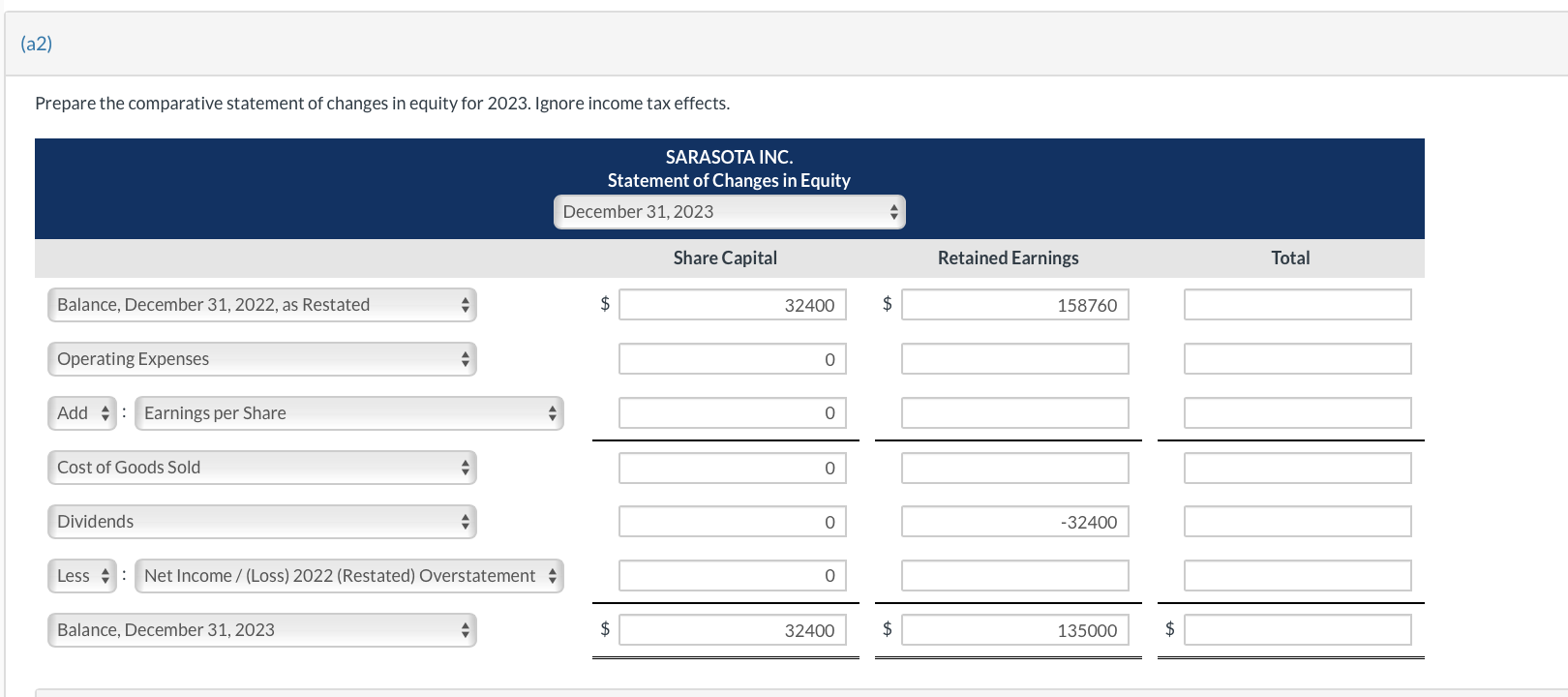

also part c) prepare the comparative statement of financial position as at December 31, 2023

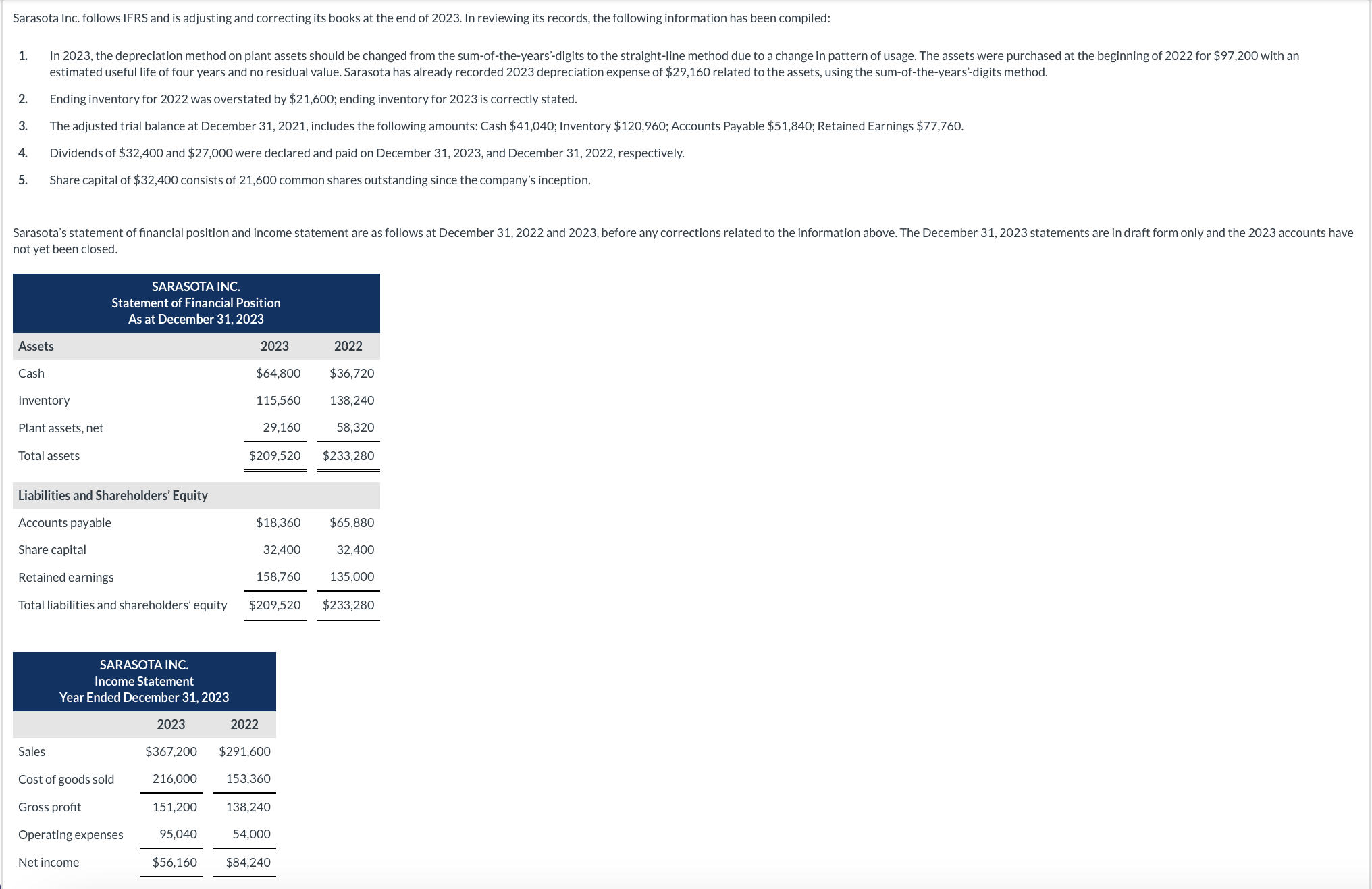

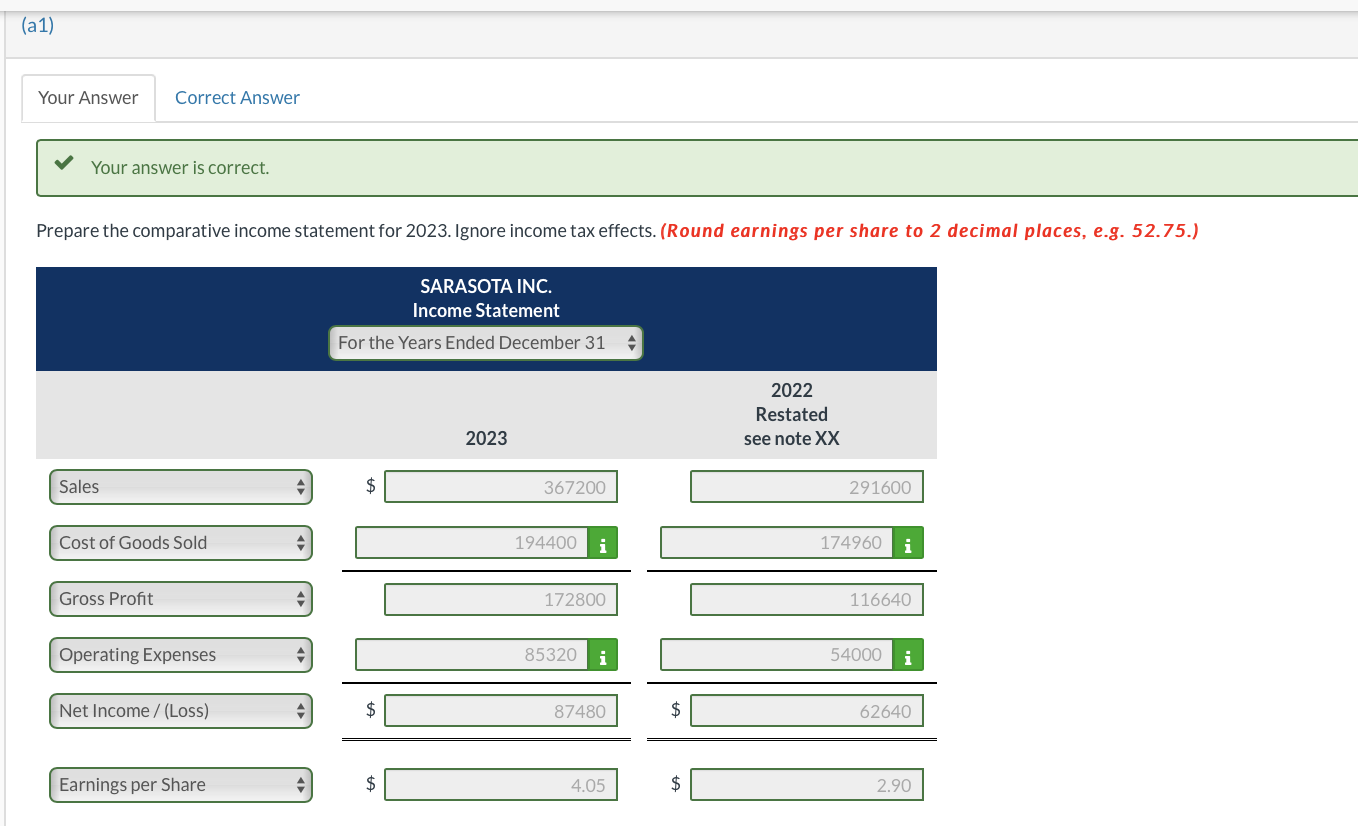

Sarasota Inc. follows IFRS and is adjusting and correcting its books at the end of 2023. In reviewing its records, the following information has been compiled: estimated useful life of four years and no residual value. Sarasota has already recorded 2023 depreciation expense of $29,160 related to the assets, using the sum-of-the-years'-digits method. 2. Ending inventory for 2022 was overstated by $21,600; ending inventory for 2023 is correctly stated. 3. The adjusted trial balance at December 31,2021 , includes the following amounts: Cash $41,040; Inventory $120,960; Accounts Payable $51,840; Retained Earnings $77,760. 4. Dividends of $32,400 and $27,000 were declared and paid on December 31,2023 , and December 31,2022 , respectively. 5. Share capital of $32,400 consists of 21,600 common shares outstanding since the company's inception. Prepare the comparative statement of changes in equity for 2023. Ignore income tax effects. (a1) \begin{tabular}{l|l} Your Answer & Correct Answer \end{tabular} Your answer is correct. Prepare the comparative income statement for 2023. Ignore income tax effects. (Round earnings per share to 2 decimal places, e.g. 52.75.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts