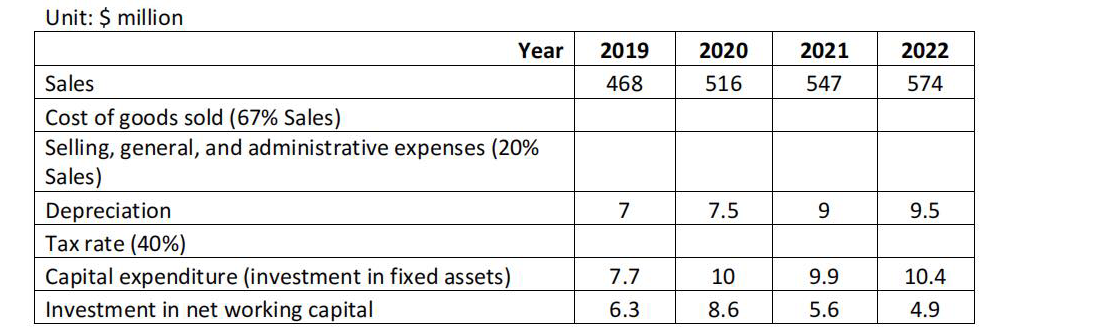

Question: IDX Technologies is a privately held developer of advanced security systems based in Chicago. As part of your business development strategy, in late 2008 you

IDX Technologies is a privately held developer of advanced security systems based in Chicago. As

part of your business development strategy, in late 2008 you initiate discussions with IDXs

founder about the possibility of acquiring the business at the end of 2008. Given the following

data:

After 2022, free cash flow (FCF) is expected to grow at 5% per year, indefinitely.

Weighted-average cost of capital: 13.4654

Estimate the intrinsic value of IDX using the discounted free cash flow approach.

Unit: $ million Year 2019 2020 2021 2022 468 516 547 574 Sales Cost of goods sold (67% Sales) Selling, general, and administrative expenses (20% Sales) Depreciation Tax rate (40%) Capital expenditure (investment in fixed assets) Investment in net working capital 7 7.5 9 9.5 7.7 10 9.9 10.4 6.3 8.6 5.6 4.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts