Question: IE Exercise 13-9: Stock split LO P2 10 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in

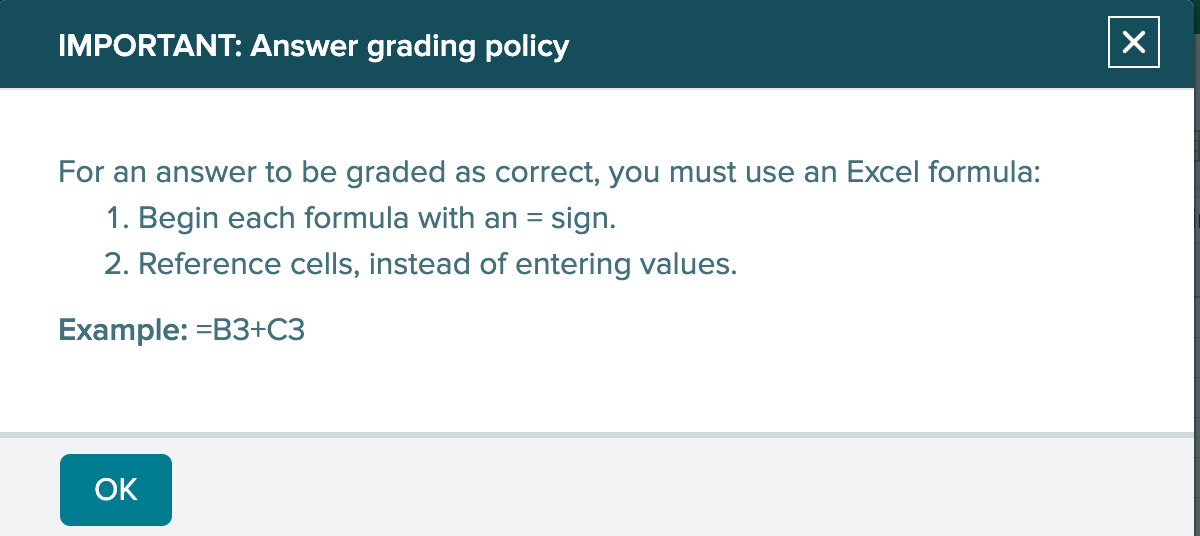

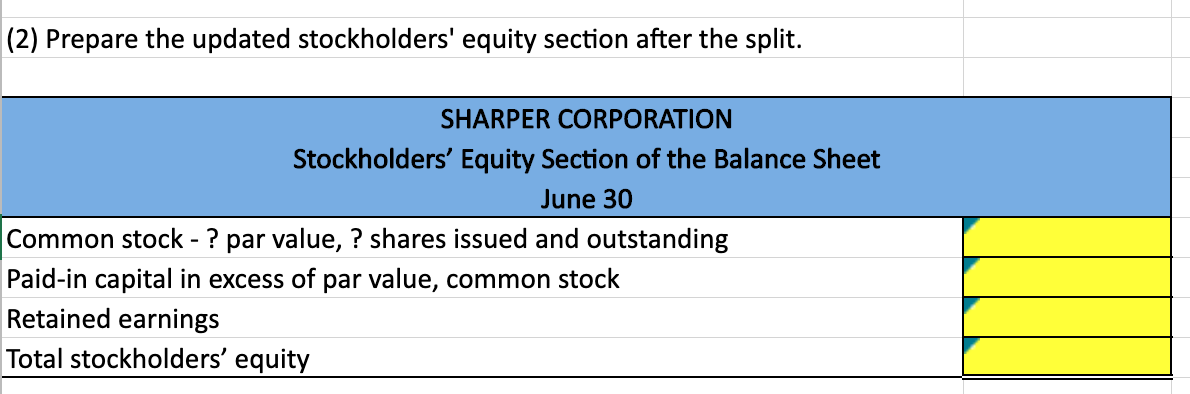

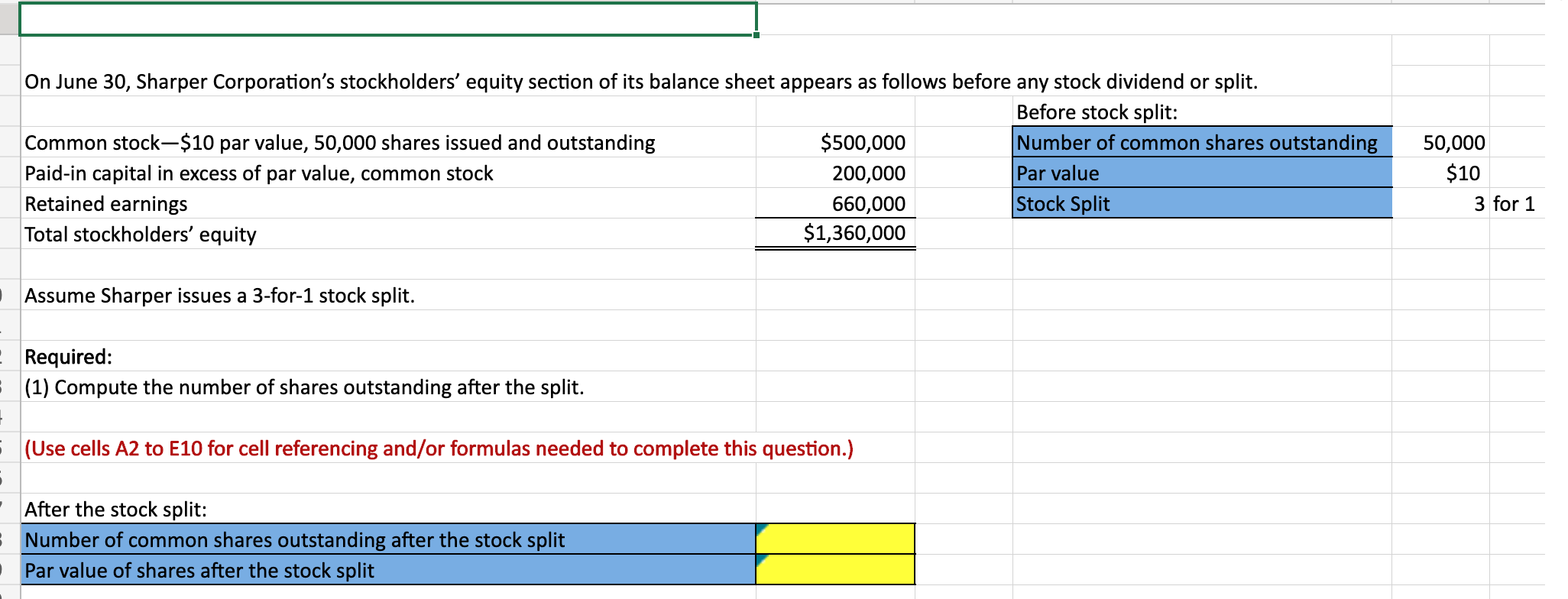

IE Exercise 13-9: Stock split LO P2 10 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect. 3.12 points eBook THITHI Open Excel in new tab Files References IMPORTANT: Answer grading policy For an answer to be graded as correct, you must use an Excel formula: 1. Begin each formula with an = sign. 2. Reference cells, instead of entering values. Example: =B3+C3 OK (2) Prepare the updated stockholders' equity section after the split. SHARPER CORPORATION Stockholders' Equity Section of the Balance Sheet June 30 Common stock - ? par value, ? shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity On June 30, Sharper Corporation's stockholders' equity section of its balance sheet appears as follows before any stock dividend or split. Before stock split: Common stock-$10 par value, 50,000 shares issued and outstanding $500,000 Number of common shares outstanding Paid-in capital in excess of par value, common stock 200,000 Par value Retained earnings 660,000 Stock Split Total stockholders' equity $1,360,000 50,000 $10 3 for 1 Assume Sharper issues a 3-for-1 stock split. - Required: (1) Compute the number of shares outstanding after the split. (Use cells A2 to E10 for cell referencing and/or formulas needed to complete this question.) After the stock split: Number of common shares outstanding after the stock split Par value of shares after the stock split

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts